February 2023 Supply and Demand Update

Author

Published

2/9/2023

February is typically a quieter month for news on the US corn and soybean supply and demand outlook. The USDA lowered their forecast for corn ethanol use by 25 million bushels (0.5%) from last month as both USDA and the EIA reported lower than expected ethanol production in December and January. No other changes to corn use left endings stocks 25 million bushels higher.

For soybeans, the crush forecast was lowered 15 million bushels. Endings stocks were adjusted up by the same amount as there were not other changes to soybean use.

Despite higher endings stocks estimated for both commodities, both corn and soybean price projections were not lowered.

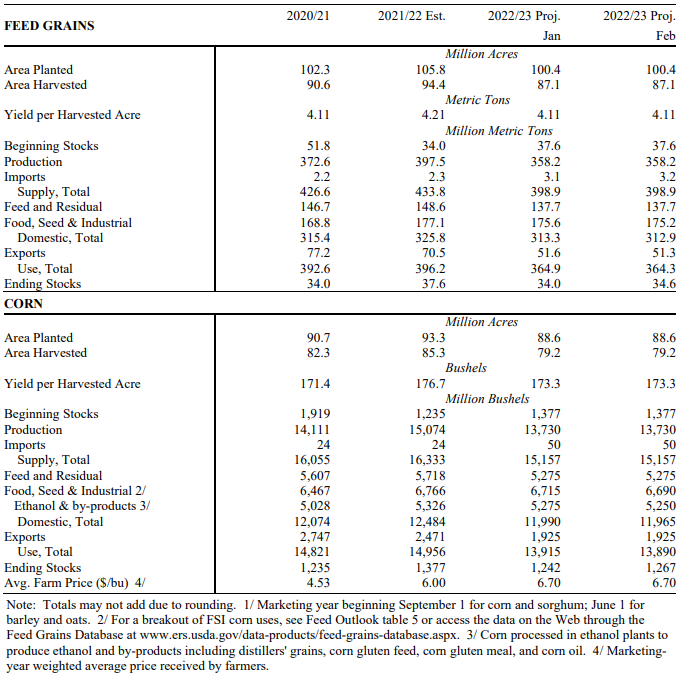

Table 1. WASDE Feed Grain and Corn Estimates – February 2023

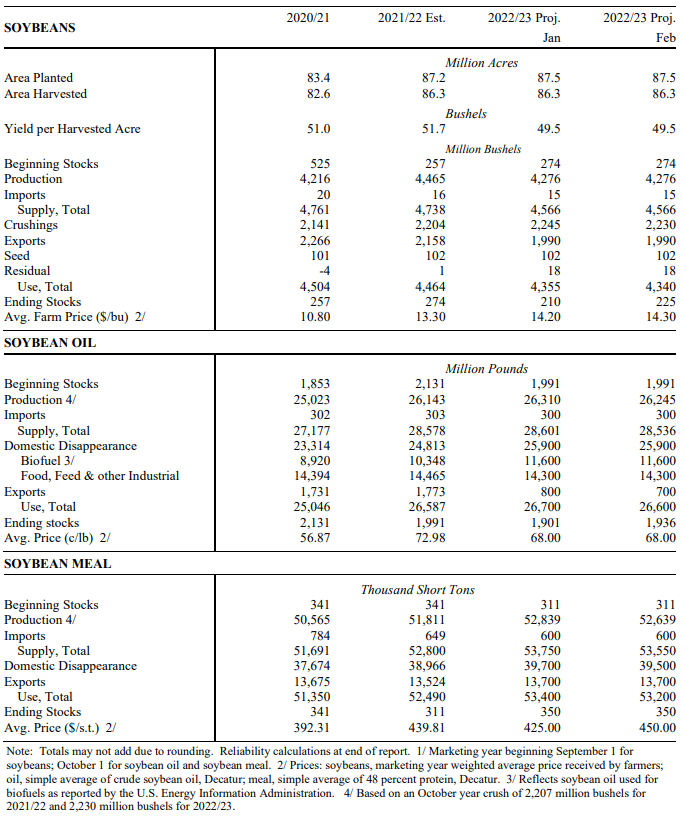

Table 2. WASDE Soybean and Soy Products Estimates – February 2023

Corn Exports Remain Unchanged

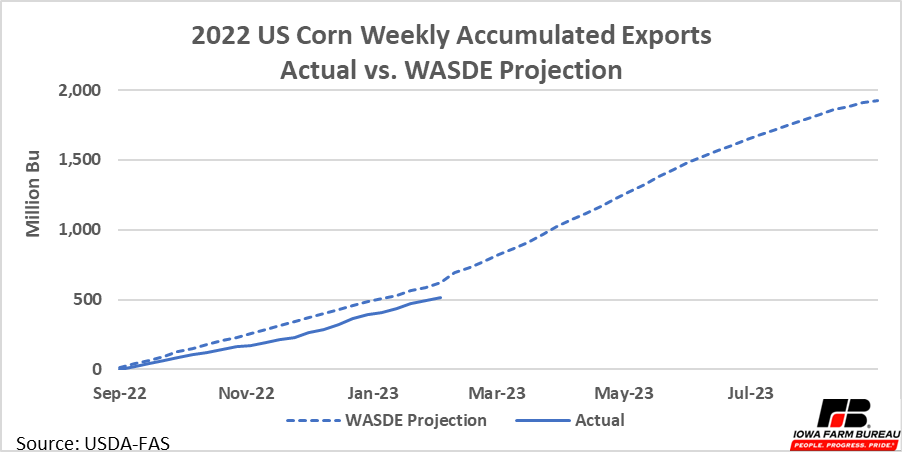

The USDA did not make any adjustments to corn exports. Actual exports continue to sit behind the USDA forecast given the seasonal pattern of buying in previous years (Figure 1).

Figure 1. 2022 US Corn Weekly Accumulated Exports (Actual vs. WASDE Projection)

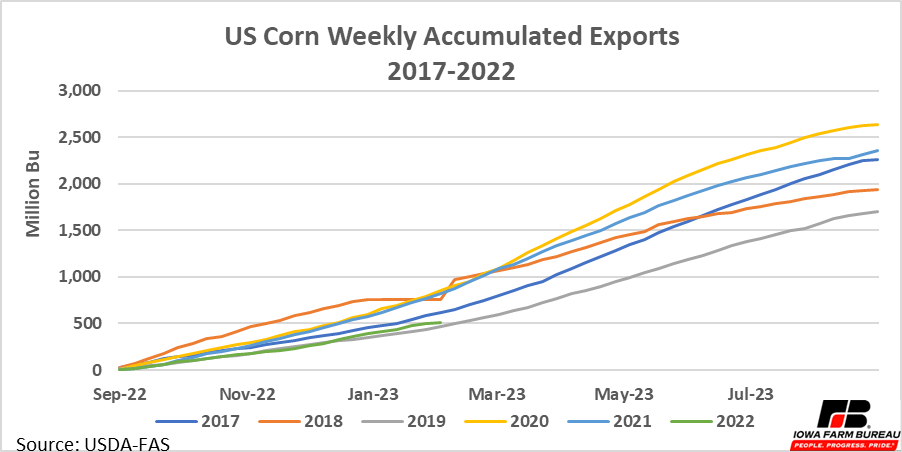

Corn exports this year have been lower than in most recent years except for 2019 (Figure 2). In 2019, corn exports ended around 1,700 million bushels, well below this year’s USDA estimate of 1,925 million bushels.

However, corn exports due typically pick up in the second half of the marketing year. In 2017 for example, exports at this time of the year were only slightly above current levels, but exports ended around 2,260 million bushels. The US has shown it has the capacity to move a large amount of corn out of the country if demand for exports is there.

If that demand will come is still unknown so exports will be important to monitor over the next few months. If exports remain slow USDA likely will lower its export estimates in future reports. Lower exports will mean higher endings stock and downward pressure on corn prices.

Figure 2. US Corn Weekly Accumulated Exports (2017-2022)

Economic analysis provided by Aaron Gerdts, Research Analyst, Decision Innovation Solutions on behalf of Iowa Farm Bureau.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!