World Soybean Trade

Author

Published

11/19/2025

Major Players

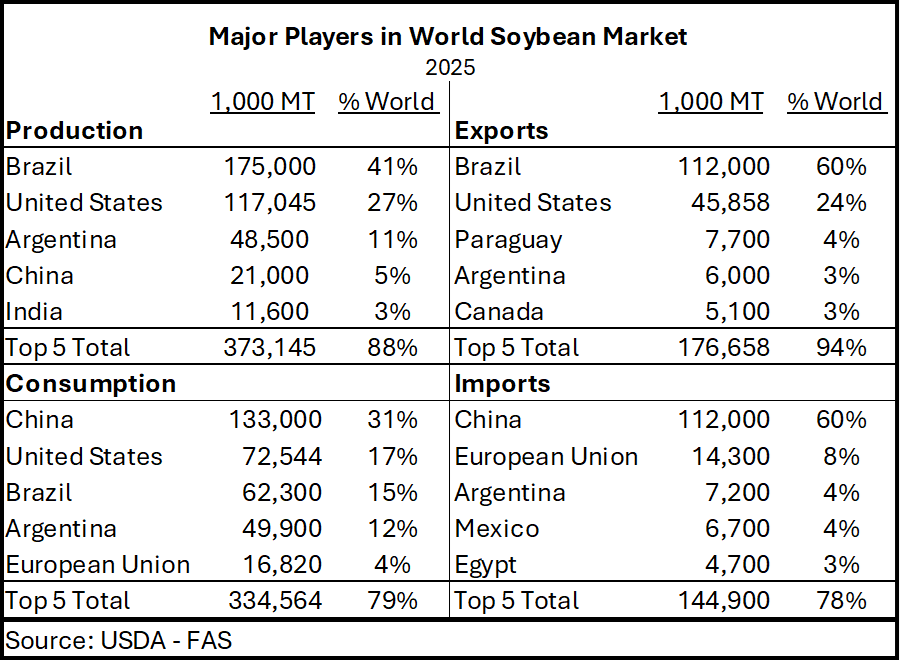

The United States, while shifting its place in the global soybean market, remains a major player given their ranking as the second-largest producer, exporter, and consumer of soybeans. Brazil remains the dominant producer and exporter of soybeans, while China maintains their position as the largest consumer and importer of soybeans, accounting for over half of global soybean imports (Table 1).

Table 1. Major Players in the World Soybean Market

Table 1. Major Players in the World Soybean Market

To get a better glimpse at global soybean trade, the remainder of this article utilizes UN Comtrade Database and is therefore not directly comparable to Table 1 that utilizes USDA Foreign Agriculture Service (FAS) data, but the data tells a similar story. We can expect some major changes to the data as we close out the final quarter of 2025.

Relative Value of US Soybean Imports and Exports

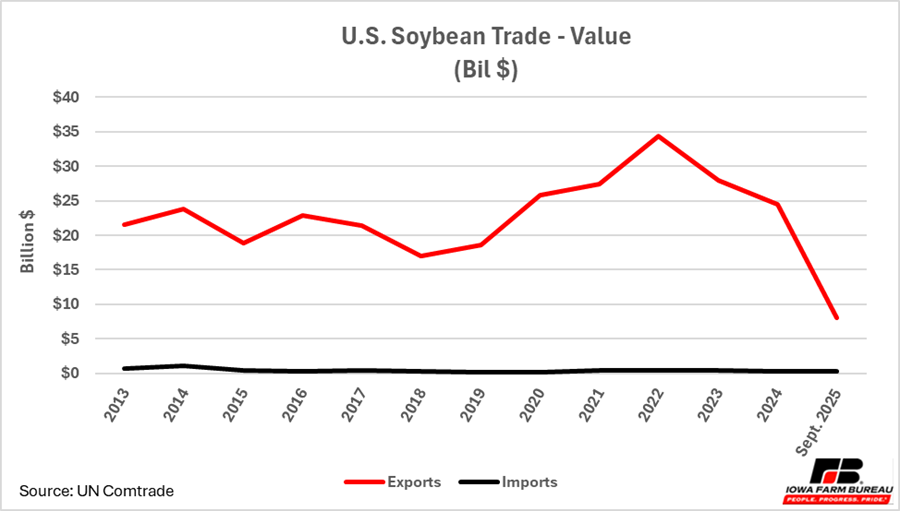

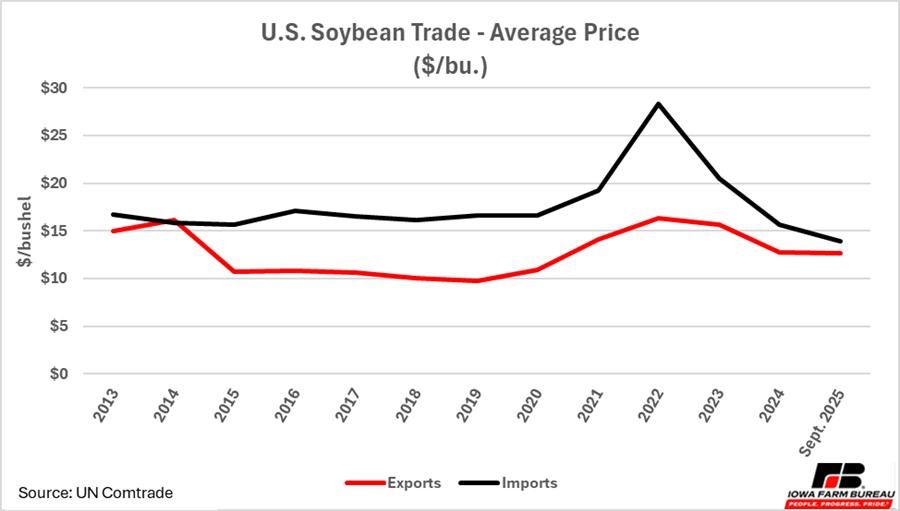

Figure 1 plots U.S. soybean exports and imports in terms of quantity; Figure 2 plots United States soybean exports and imports in terms of value; Figure 3 plots the average price per bushel of U.S. soybean exports and imports. Note that data for 2025 is only representative of the first nine months of the year.

The United States purchases very few soybeans from foreign suppliers. However, the average price per bushel of imported soybeans is much higher than exported soybeans. The gap between average price per bushel of soybeans exported and imported is narrowing following a dramatic spike in average price per bushel of imports in 2022 due to higher prices.

Figure 1. Quantity of U.S. soybean trade 2013 - Sept. 2025

Figure 1. Quantity of U.S. soybean trade 2013 - Sept. 2025

Figure 2. Value of U.S. soybean trade 2013 - Sept. 2025

Figure 2. Value of U.S. soybean trade 2013 - Sept. 2025

Figure 3. Average price of U.S. soybean exports and imports 2013 - Sept. 2025

Figure 3. Average price of U.S. soybean exports and imports 2013 - Sept. 2025

Major Trade Partners for US Soybean

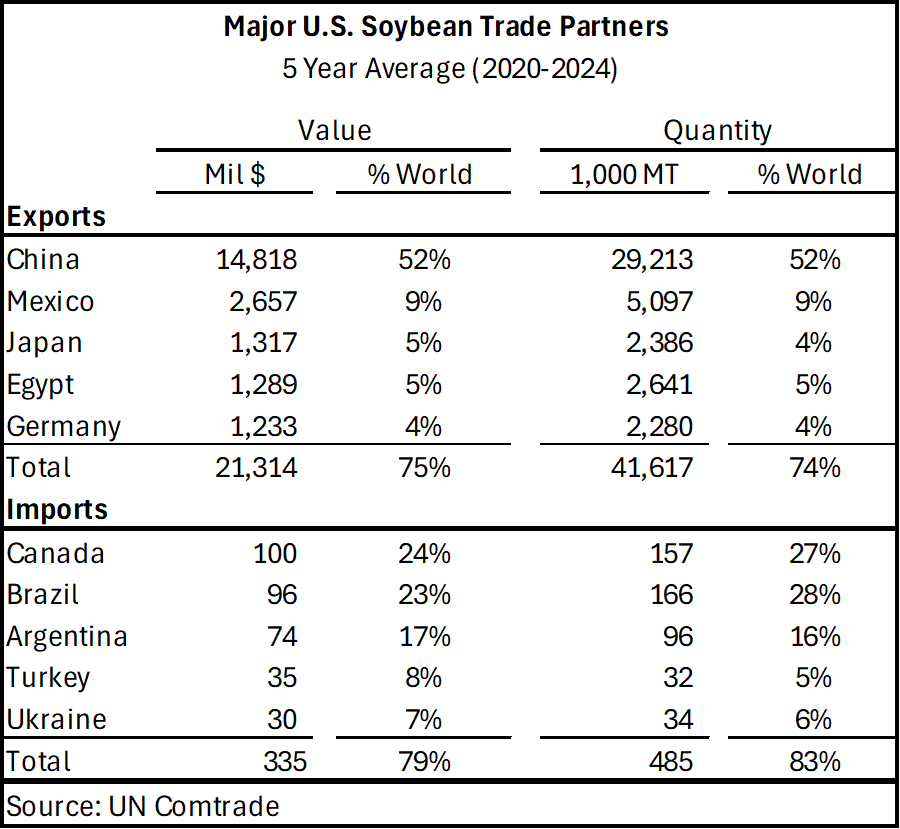

Over the last five years, China has been the largest purchaser of U.S. soybeans, accounting for over half (52%) of all U.S. soybean exports in terms of both volume and value (Table 2). Through October 2025, U.S. exports to China totaled 5.33 million MT (195.5 million bushels). The second largest export destination is Mexico with 2.4 million MT (86.9 million bushels). In 2024, U.S. soybean export to China exceeded 27 million MT (993.1 million bushels).

The United States imports very little soybeans; however, Canada and Brazil are the top suppliers of soybean to the United States, closely followed by Argentina.

Table 2. Major U.S. Soybean Trade Partners

Table 2. Major U.S. Soybean Trade Partners

Markets of Other Major Soybean Exporters

Table 3 highlights the five-year average trade relationships of major soybean exporters other than the United States. Brazil, as the leading global soybean exporter, exports the majority (65%) of their soybean exports to China. Brazil also exports soybeans to the European Union, Thailand, Turkey, and Iran, collectively accounting for less than 15% of Brazil’s exports. As of September 2025, Brazil has exported 73.2 million MT (2.7 billion bushels) to China, up 13% from the five-year average.

Paraguay, as another major exporter, sends 80% of soybean exports, by volume, to Argentina. Nearly 80% of Argentina’s soybean exports are purhcased by China. At this point in 2025, Argentina has exported over 2 million MT (74.5 million bushles) to China.

Similarly over the last five years, Canada’s top soybean export destination is China, but the European Union, Iran, Algeria, and Japan are other major trading partners for Canada’s soybean exports. For the first nine months of 2025, however, the United States is Canada’s top soybean export destination with over 135.5 million MT (11.6 million bushels), closely followed by Japan and China.

Table 3. Trade Partners of Other Major Soybean Exporters (Excluding US)

Table 3. Trade Partners of Other Major Soybean Exporters (Excluding US)

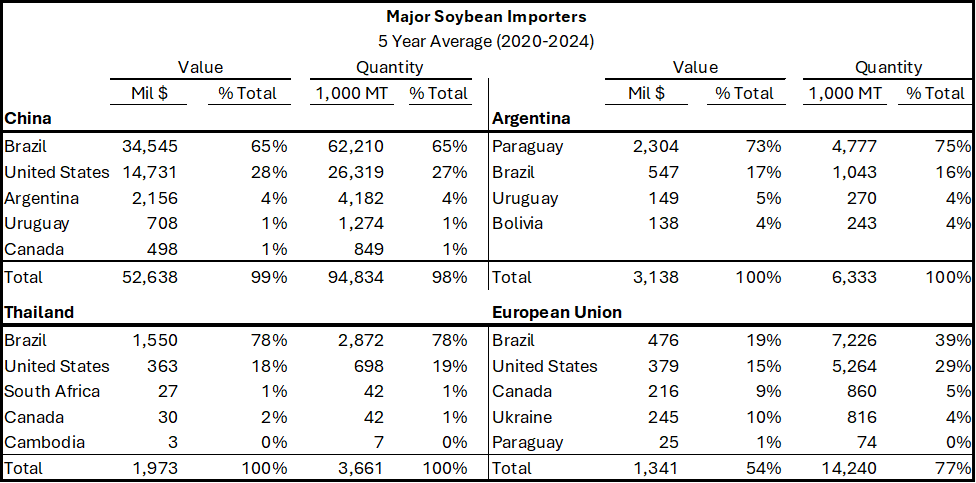

Table 4 outlines the five-year average of trade relationships of major soybean importers. China maintains its position as the world’s largest importer of soybeans. Brazil is their largest supplier in terms of both volume and value (65%), followed by the United States (27%).

Argentina imports 75% of their soybeans from Paraguay, but also imports from Brazil, Uruguay, and Bolivia, although much smaller volumes. For the first nine months of 2025, Argentina has imported nearly 3.3 million MT (122.8 million bushels) from Paraguay, right on pace with the five-year average when taking into considering what will be imported throughout the remaining quarter of the year.

Thailand and the European Union both import the majority of their soybeans from Brazil, but the United States is also a major supplier of soybeans to both. Brazil accounts for 78% of Thailand’s and 39% of the European Union’s soybean import volume.

Table 4. Trade Partners of Other Major Soybean Importers (Excluding US)

Table 4. Trade Partners of Other Major Soybean Importers (Excluding US)

Economic analysis provided by Paige Klipstein, Research Analyst, Decision Innovation Solutions on behalf of Iowa Farm Bureau

Find more information about alternative soybean products:

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!