World Soybean Oil Trade

Author

Published

3/25/2024

Major Players

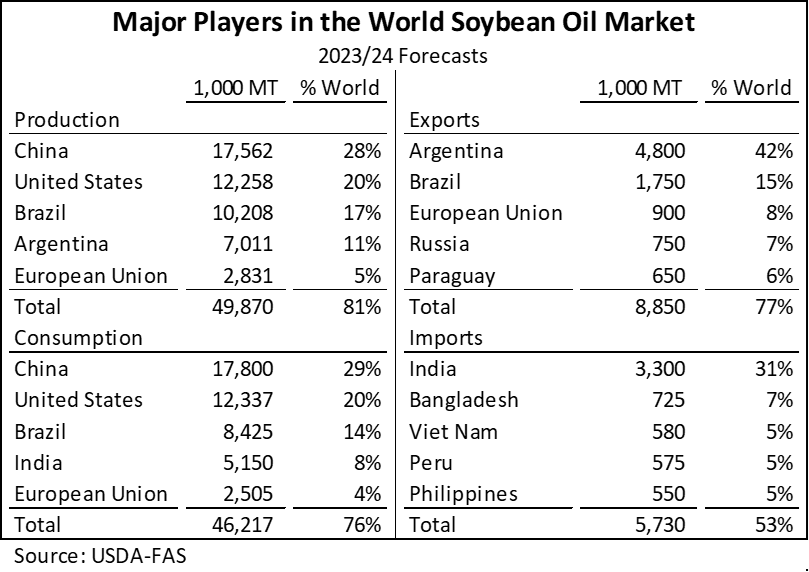

In 2024, the US is expected to be the second largest producer and consumer of soybean oil (Table 1). However, the US is not a major player in the trade market of soybean oil.

Argentina is the largest exporter of soybean oil, and India is the largest importer. China is the largest consumer of soybean oil but is notably absent from the top importer list. China has historically preferred to import soybeans and crush them domestically.

Table 1. Major Players in the World Soybean Oil Market

Table 1. Major Players in the World Soybean Oil Market

Relative Value of US Soybean Oil Imports and Exports

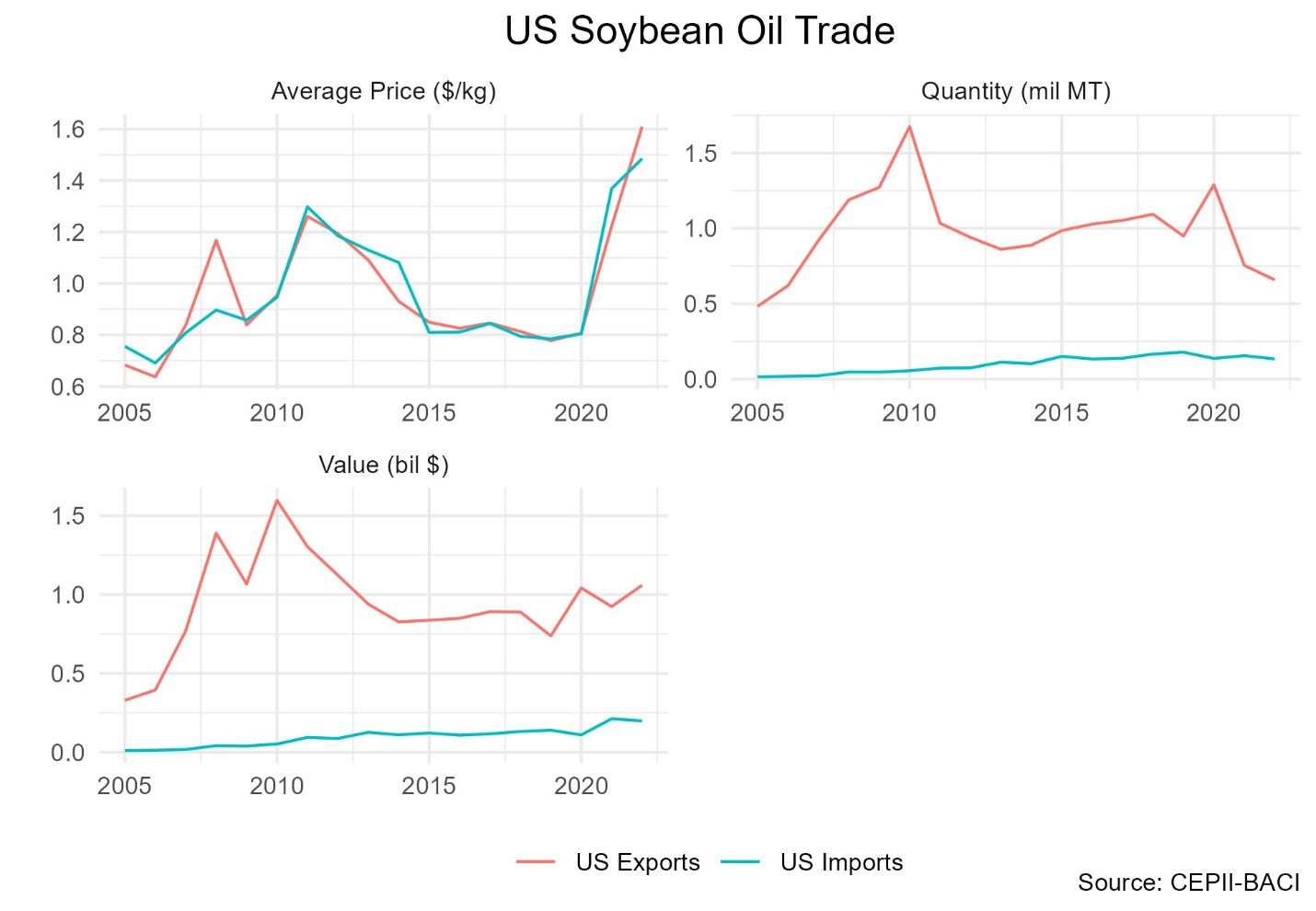

To get a more detailed look at world soybean oil trade the rest of this article will reference BACI data not USDA data. Therefore, the following tables will not be directly comparable to Table 1. BACI is an international trade dataset assembled by CEPII using the United Nation’s Comtrade data that is corrected for inconsistencies.

Figure 1 shows US soybean oil imports and exports in terms of value, quantity, and average price. As mentioned earlier, the US is not a major player in the world soybean oil trade market.

Figure 1. US Soybean Oil Trade

Figure 1. US Soybean Oil Trade

Major Trade Partners for US Soybean Oil

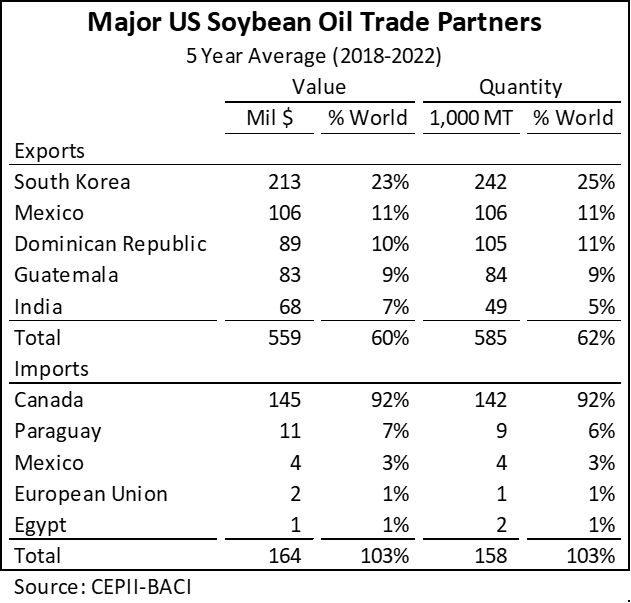

Table 2 shows the trading partners from 2018-2022 for US soybean oil trade South Korea was the largest importer of US soybean oil, making up 23% of US exports. Canada was by far the largest source of soybean oil imports, making up 92% of the imports.

Table 2. Major US Soybean Oil Trade Partners

Table 2. Major US Soybean Oil Trade Partners

Markets of Other Major Exporters

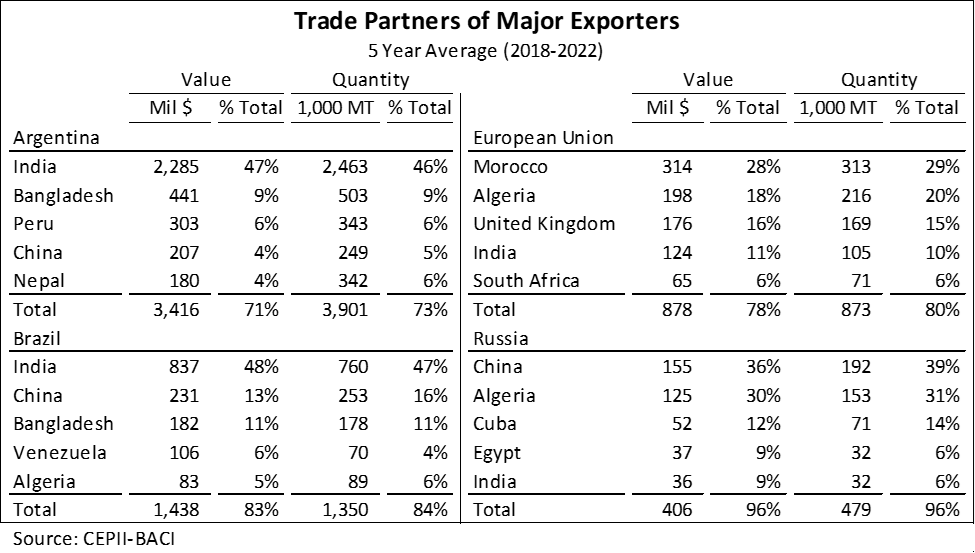

Table 3 outlines trade relationships of the top four largest exporters of soybean oil.

From 2018-2022 Argentina’s largest trading partners was India, who took almost half of its soybean oil exports. After India, the relative share of each partner with Argentina becomes much more uniform.

Brazil’s largest trading partner was also India, who also made up almost half of its exports. China and Bangladesh were Brazil’s next largest partners.

The EU’s largest partner was Morocco; Algeria, the UK and India were also significant partners.

Russia’s largest trading partners were China and Algeria, who together make up over 60% of its soybean oil exports. Russia’s top 5 partners make up over 95% of its soybean oil exports.

Table 3. Trade Partners of Major Soybean Oil Exporters

Table 3. Trade Partners of Major Soybean Oil Exporters

Markets of Major Importers

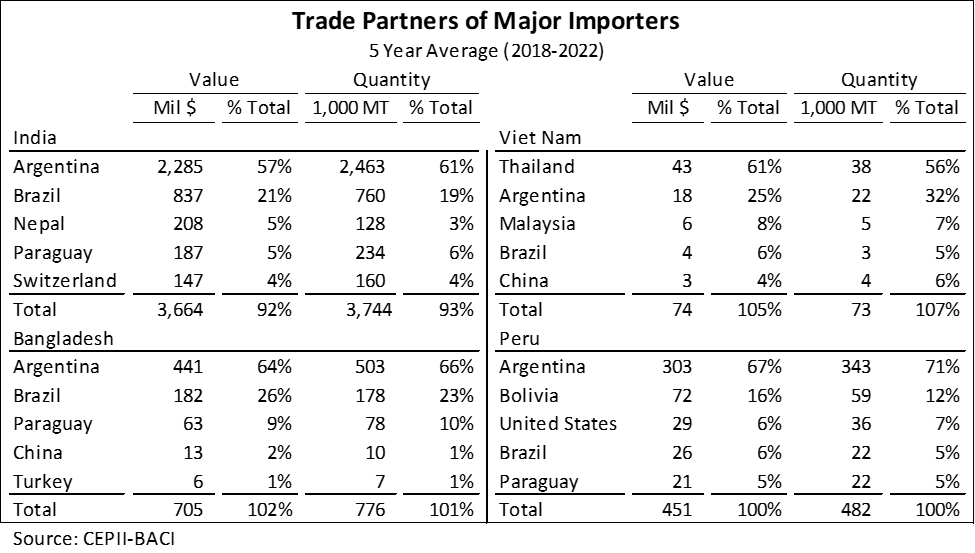

Table 4 outlines the trade relationships of the four largest soybean importers in the world from 2018-2022.

India is by far the largest importer of soybean oil. India’s top trading partners were Argentina and Brazil who made up almost 80% of their soybean oil imports combined.

After India, top importers of soybean oil are relatively evenly dispersed. The rest of the top 4 importers projected by USDA FAS are outlined here.

Bangladesh’s top partners are also Argentina and Brazil. Together these countries made up over 90% of Bangladesh’s imports.

Vietnam’s largest trading partner was Thailand, who provided over 60% of its soybean oil imports. Argentina was also a major trading partner.

Peru’s largest partner was Argentina, who provided almost 70% of its soybean oil imports from 2018-2022.

Table 4. Trade Partners of Other Major Importers

Table 4. Trade Partners of Other Major Importers

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!