U.S. Corn Exports During the First Four Months Of 2023/24 Rebounded from The Previous Year

Author

Published

1/17/2024

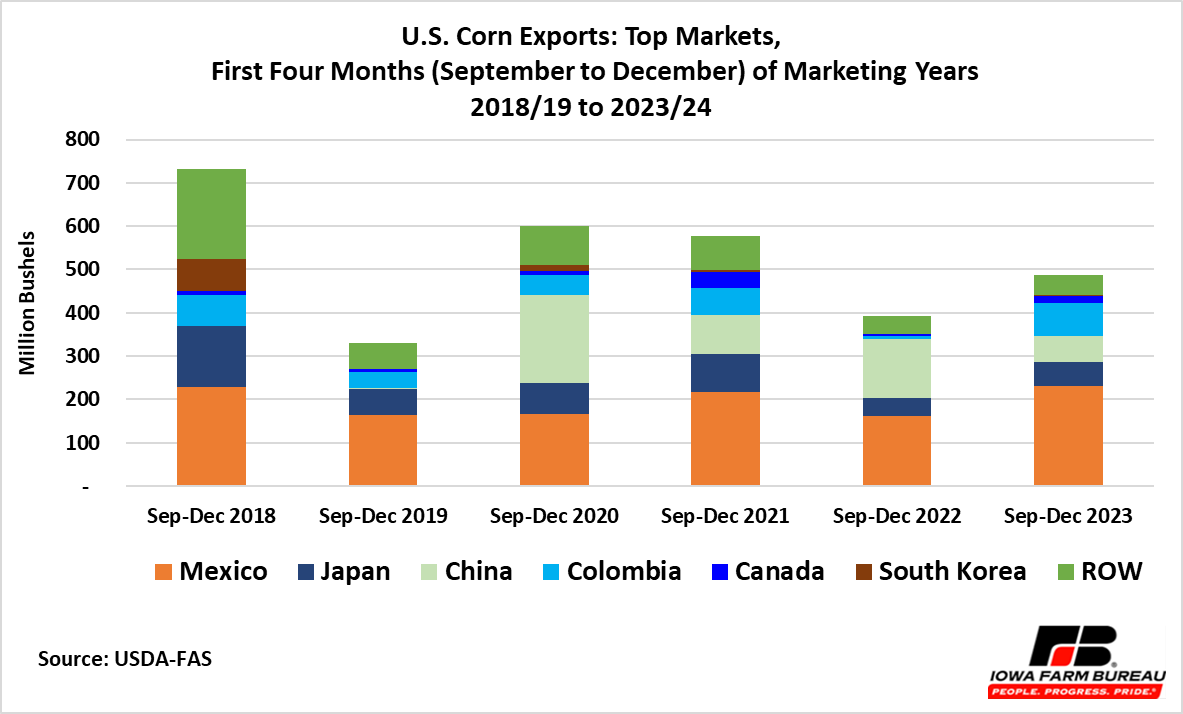

According to the USDA-FAS weekly sale data, corn exports from September to December 2023 totaled 487.8 million bushels, ahead of the previous year’s pace of 393.6 million bushels; however, exports were down 15.4% from the first four months of 2021/22 marketing year (576.9 million bushels) (see Figure 1).

Figure 1. U.S. Corn Exports: Top Markets, First Four Months (September to December) of Marketing Years 2018/19 to 2023/24

Mexico was the top market for U.S. corn exports during the first four months of 2023/24 and accounted for 47% of total U.S. corn exports during that period. Exports to Mexico were estimated at 231.5 million bushels and were up 43% from last year. Although sales during the last week of December 2023 were down from the preceding week, they were ahead of the previous two years.

In addition, U.S. corn exports to Colombia experienced a substantial increase of 68.1 million bushels to 74.4 million bushels during the first four months of the 2023/24 marketing year relative to the same period in 2022/23. As indicated by USDA in a Grain and Feed Update report on Colombia (November 2023)[1], U.S. corn exports could regain the Colombian market share to nearly 70 percent subject to Mercosur duties continued application as per the downward trend of international corn prices.

From September to December 2023, shipment to Japan were estimated at 54.7 million bushels, up 29% from the first four months of the 2022/23 marketing year (see Figure 1). U.S. corn export to Japan accounted for 11% of U.S. total export sales in 2023/24 (September-December).

According to USDA[2], in the 2022/23 trade year (Oct-Sept), U.S. market share in Japan dropped to about 46% from the previous nine-year average of 75%. This change could be mostly attributed to competition from Brazil, the other large corn supplier to Japan. For Japan, seasonal prices determine corn sourcing between the U.S. and Brazil.

Although exports to China declined 55.0% during the first four months of the 2023/24 marketing year relative to the same period in 2022, they made up 13% (61.3 million bushels) of total exports during that period, (see Figure 1) and was the third largest market for U.S. corn during 2023/24 (September-December).

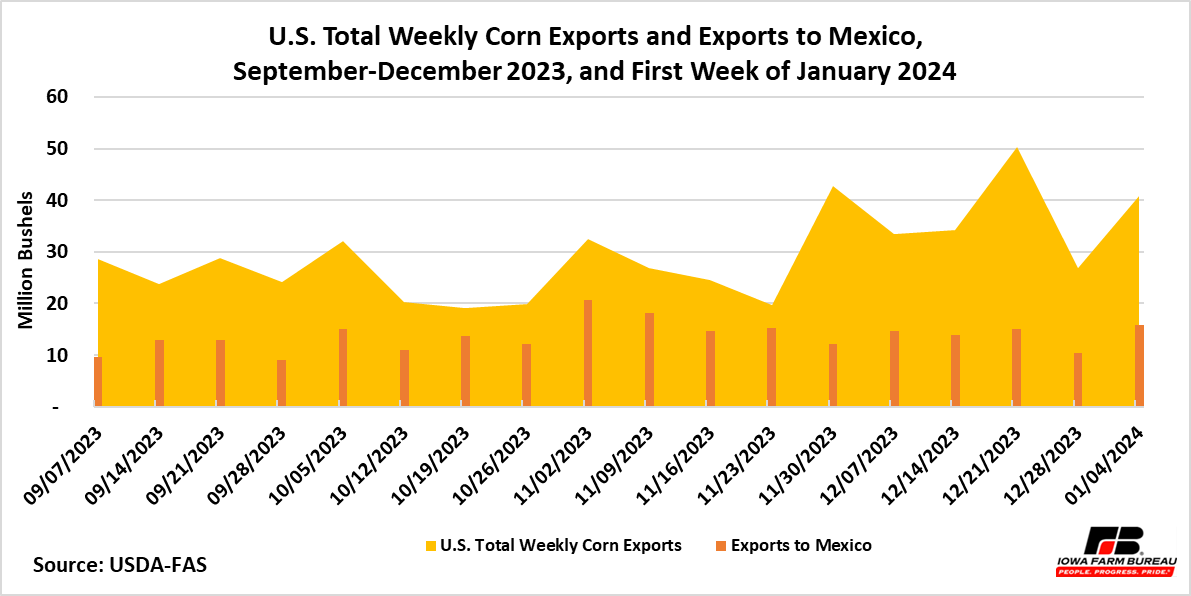

In the latest data published (January 11, 2024), U.S. weekly corn exports for the first week of 2024 were up 52% to 40.8 million bushels in comparison with the previous week and it was the third largest sale of the 2023/24 marketing year. Almost 40% (15.8 million bushels) of the sales during the first week of January 2024 went to Mexico (see Figure 2), followed by exports to Japan (11.2 million bushels, 27%) and Colombia (9.3 million bushels, 23%).

Figure 2. U.S. Total Weekly Corn Exports and Exports to Mexico, September-December 2023, and First Week of January 2024

The pace of sales for U.S. corn was reflected in the December 2023 WASDE report by an increase in the projected total U.S. corn exports in 2023/24. Exports were raised 25 million bushels to 2.10 billion compared with the forecast in November 2023. U.S. corn exports were projected 26.4% higher than in 2022/23 (1.66 billion bushels). In the January 2024 WASDE report, 2023/24 U.S. corn outlook was for larger production, greater domestic use, and higher ending stocks. The U.S. corn export outlook was not changed from the projection in December. January 2024 projected average farm price for 2023/24 was $4.80/bushel, down five cents per bushel from last month’s projection and down $1.74/bushel compared with the 2022/23 price ($6.54/bushel).

Based on the total volume of U.S. corn exported through January 4, 2023 (528.6 million bushels) and if total outstanding sales reported at that time (663.3 million bushels) are realized, the U.S. still has to export 908.1 million bushels of corn between January 5th and the end of August to reach the expected U.S. corn export volume for 2023/24.

Export promotion programs:

On January 8, 2024, the USDA-FAS announced the allocation of more than $203 million to nearly 70 agricultural organizations to help expand export markets for U.S. food and agricultural products through the Market Access Program (MAP) and Foreign Market Development (FMD) program[3] for fiscal year (FY) 2024. These two programs are authorized by Farm Bills. Relevant to corn, the U.S. Grains Council was awarded $8.7 million under MAP and $2.9 under FMD.

Also, on November 29, 2023, USDA announced a new fund that complements FY2024 funds “Regional Agricultural Promotion Program (RAPP)” to support eligible projects that enable exporters to get access into new markets and increase market share in growth markets[4]. RAPP is a $1.2 billion program, which will be made available over five years. Application for the first-year tranche of RAPP funding is $300 million.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!