The CBO Baseline and How It Shapes the Farm Bill Reauthorization Debate

Author

Published

3/8/2023

Each year, the Congressional Budget Office (CBO) as part of its overall analysis and projections of the federal debt of the U.S., released its 10-year baseline for the mandatory-spending programs contained in the Farm Bill. The 2023 estimate has added importance because it is the baseline that will be used in this year’s Farm Bill reauthorization debates in Congress.

A feature of the CBO baseline is its primary assumption that enacted statutes continue without change through the baseline years. Thus, mandatory farm bill programs, even if scheduled to expire, are assumed to continue, and spending projections are built around assumptions about key program criteria (i.e., for farm programs prices, yields, etc. for the program crops). The baseline is important because another aspect of the congressional budgetary laws are the enforcement mechanisms such as pay-as-you-go (PAYGO) policies which were codified in (2 U.S.C. §§931-939). PAYGO is intended to be a budget-neutral policy that in its simplest form says that new spending (beyond that which is in the baseline) must be offset with either spending cuts elsewhere or by offsetting new revenues. Most often, budgetary rules such as PAYGO are applied at the congressional committee level, meaning that increases in spending for any new programs in the Ag Committee must be accompanied with either spending cuts within other programs under the jurisdiction of the Ag Committee. For example, changes that increased the cost of farm programs would have to be offset by reductions in the cost of conservation, crop insurance, or food assistance programs that are under the jurisdiction of the Ag Committee.

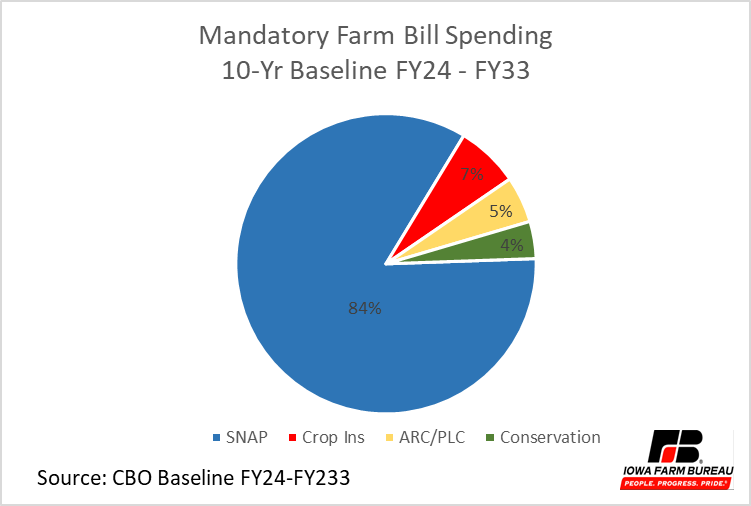

The Farm Bill’s baseline runs from fiscal year 2024 through fiscal year 2033 and as background to the baseline, CBO provides actual outlays for FY2022 and estimated outlays for FY2023, which began October 1, 2022. The 10-year baseline (FY2024-2023) for the Farm Bill is projected to be approximately $140 billion each fiscal year, or $1.4 trillion for the 10-year period. Food assistance programs, such as the Supplemental Nutrition Assistance Program (SNAP), account for 83% of the projected Farm Bill spending. Farm-related programs, crop insurance (6.7%), ARC/PLC (4.9%), and conservation (3.9%) make up a total of 15.5% of the mandatory spending baseline in the Farm Bill (Figure 1).

Figure 1. Mandatory Farm Bill Spending, 10-Yr Baseline FY24-FY33

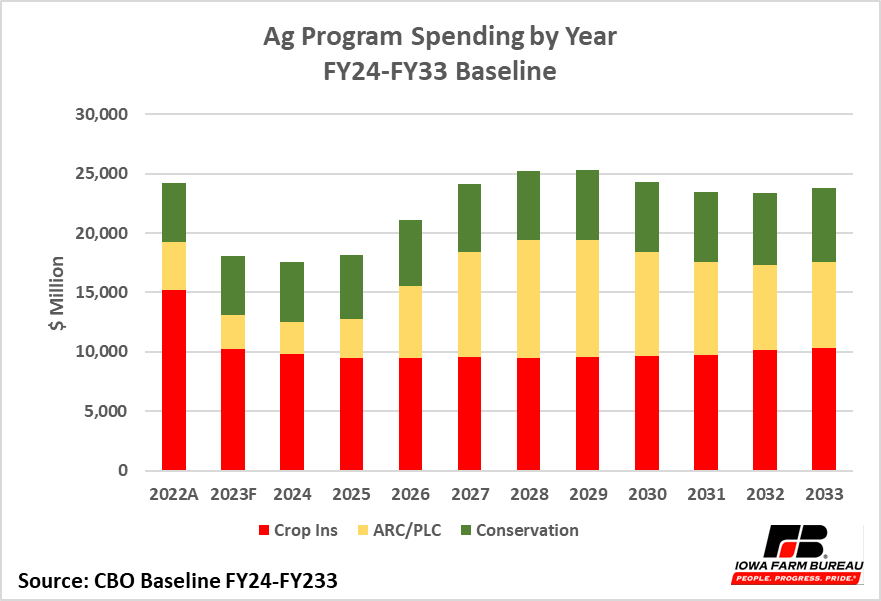

On an annual basis, baseline mandatory spending on the ag-related programs is shown in Figure 2.

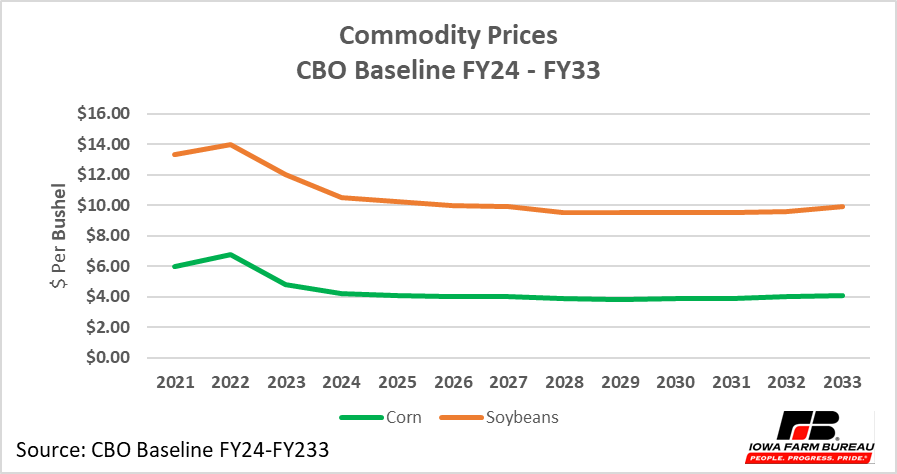

CBO is expecting crop prices to decline from current levels by FY 24 and remain relatively steady at the lower levels through FY33 (Figure 3).

Figure 2. Ag Program Spending by Year, FY24-FY33

Figure 3. Commodity Prices, CBO Baseline FY24-FY33

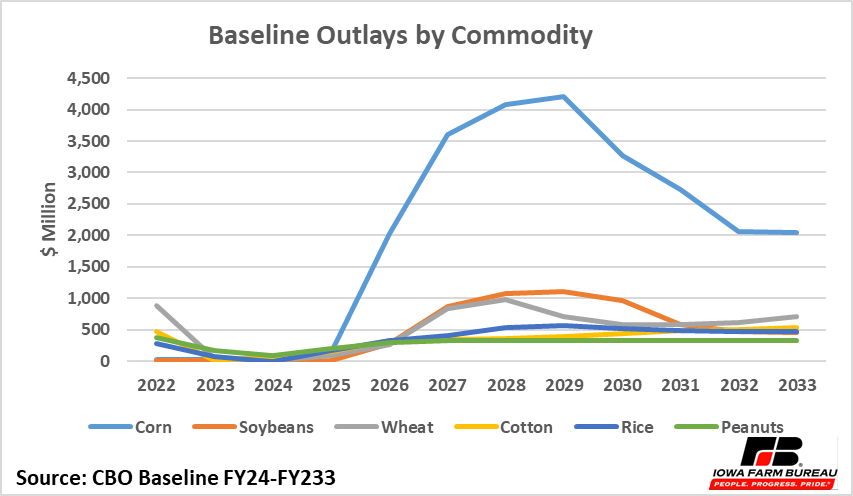

Program payments are expected to be relatively minimal for all commodities through the FY25 year, then increasing through FY29 before trailing off into FY32 and FY33. Due to the large acreage involved, corn and soybeans account for 62% of all the baseline crop commodity outlays with corn accounting for 50%, soybeans 12%, wheat 11%, cotton 7.4%, rice 8.3%, and peanuts 6.2%. For the non-crop outlays, the livestock disaster program makes up 11% of commodity outlays and the dairy margin program 3% of outlays after adjusting for premium paid. No other commodity is above 2% of projected outlays.

Figure 4. Base Outlays by Commodity

CBO projects relatively little change for conservation spending in the baseline. CRP accounts for about one-third of the conservation outlays, EQIP accounts for about one-third of the outlays and all other conservation programs (CSP, ACEP, RCPP, etc.[1]) account for the other third. The Inflation Reduction Act of 2022 provides for roughly $18 billion of funding for conservation programs with more than $15 billion of that scheduled to be spent by FY31. The funding from the Inflation Reduction Act for EQIP, CSP, ACEP and RCPP are included in the CBO baseline but are not part of the Title II (or farm bill) baseline projections. The funding through the Inflation Reduction Act is distinct and separate from mandatory farm bill spending. What this means is that those funds will only impact the baseline if they are rescinded as offsets to pay for increased spending in the baseline.

Under the budget rules in place, farm bill reauthorization debates are for the most part a zero-sum activity that generally have to stay within the boundaries of the CBO baseline spending forecasts known as the baseline. In general, increasing spending anywhere within the Farm Bill will require an offset of that cost to maintain budget neutrality. If funding for any program in the Farm Bill (research, export promotion, raising support prices, etc.) is to occur, there will be political haggling over where that money will come from, and which other programs will be modified to provide the funds.

Economic analysis provided by David Miller, Consulting Chief Economist, Decision Innovation Solutions on behalf of Iowa Farm Bureau.

[1] CRP – Conservation Reserve Program; EQIP – Environmental Quality Incentives Program; CSP – Conservation Stewardship Program; ACEP – Agricultural Conservation Easement Program; and RCPP – Regional Conservation Partnership Program.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!