Hog returns finally turn positive

Author

Published

9/13/2023

Iowa State University publishes monthly estimates of returns to various livestock enterprises. These estimates do not necessarily reflect the bottom line of every producer in the industry, but they provide general margins that producers in the industry are facing.

Iowa State publishes five different margins related to the hog industry: farrow-finish, farrow-weaning, weaning-feeder, feeder-finish, and weaning-finish. This article uses data from the farrow-finish model.

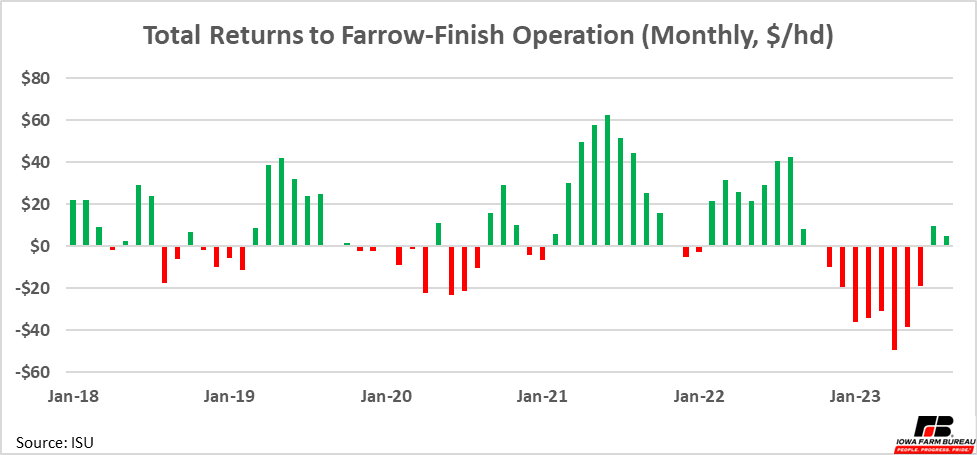

The estimates for total profit from a farrow-finish operation recently turned positive in July (Figure 1). They were negative for eight consecutive months, with most of those months showing significantly negative margins.

Figure 1. Total Returns to Hog Production ($/hd)

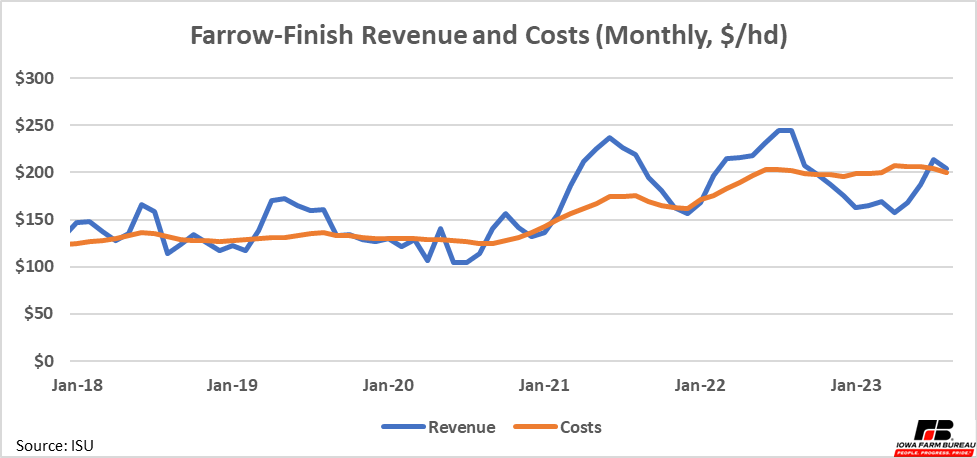

While inflation and higher feed costs get a lot of attention, the negative margins in hog production look to have been caused by losses in revenue concurrent with increased costs. Figure 2 shows that costs have increased relatively steadily over the past 5 years. In comparison, revenue has been much more volatile. The recent large drop in revenue combined with consistent increases in costs led to the negative margins the industry experienced over the past year.

Figure 2. Hog Revenue and Costs

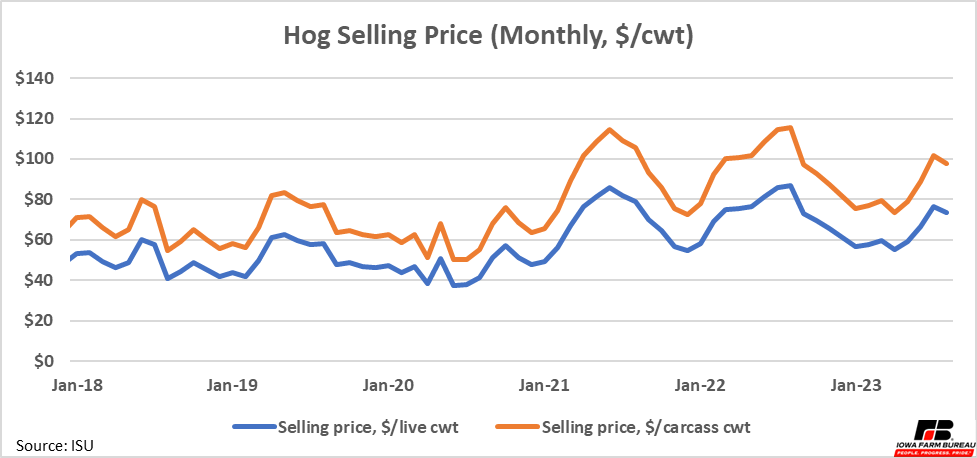

Revenue in hog production comes from the sale of hogs. Hog prices dropped significantly in 2022, leading the decrease in hog revenue (Figure 3).

Figure 3. Hog Selling Price

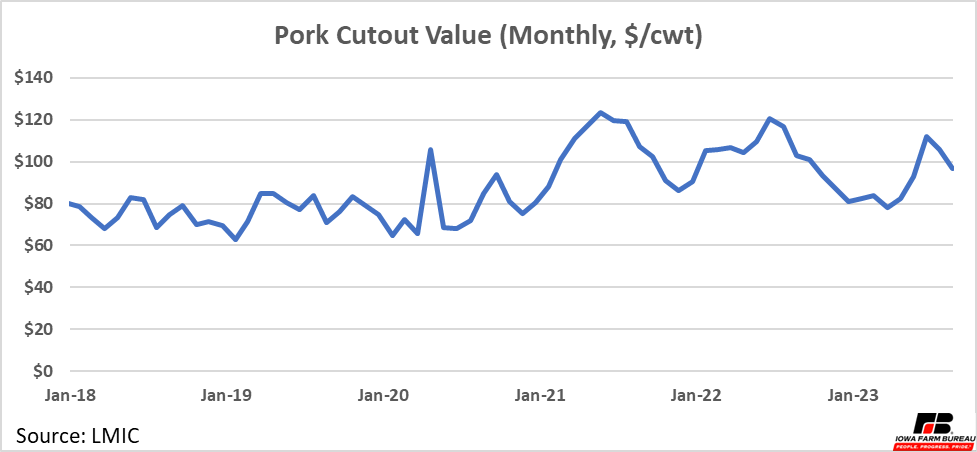

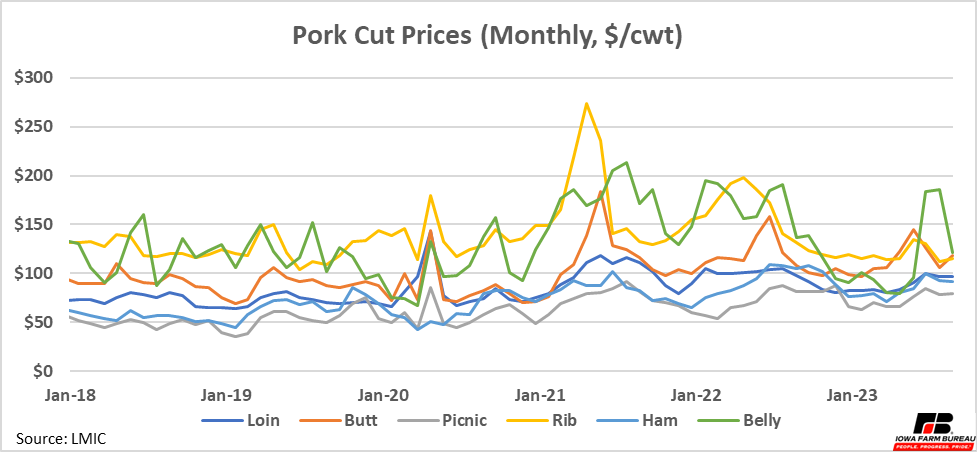

This decrease in prices was evident in wholesale pork prices as well (Figure 4). Large drops in the prices of pork ribs and pork belly contributed to the decline in cutout value (Figure 5). Belly prices recently rallied, however, at least in part driving increases in pork cutout and hog prices, and in turn helping to push farrow-finish margins back above zero.

Figure 4. Pork Cutout Value

Figure 5. Pork Cutout Value

It remains to be seen if positive margins will persist. So far in September, pork cutout prices have weakened from July and August levels. Belly prices are also down significantly, and this is contributing to the drop in the total cutout value. If belly and other prices remain low, estimated margins could dip below zero again in September. However, if overall cutout prices can move above $100/cwt or better, hog prices should increase, keeping the farrow-finish margin in positive territory.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!