Farm entities now required to file ownership report under anti-money laundering law

Published

1/8/2024

Iowa farm entities and small businesses should take note of a new requirement under the Corporate Transparency Act (CTA), intended to curb money laundering, that requires many of them to file an ownership report this year with the federal government.

Most small entities are now required to file a beneficial ownership information (BOI) report with the Financial Crimes Reporting Network, also known as FinCEN, an agency within the Treasury Department.

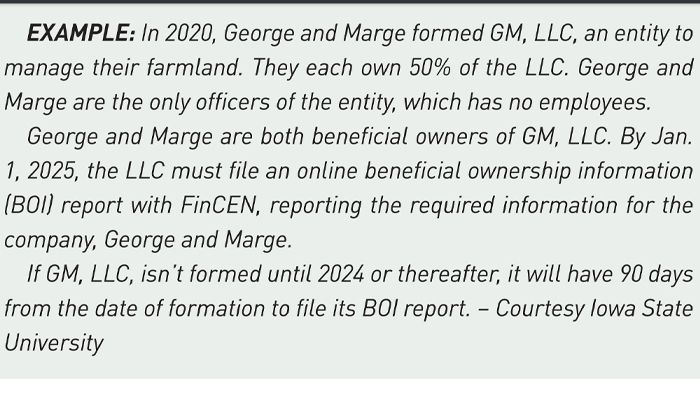

Limited partnerships, corporations and LLCs, whether single-member or multiple-member, are among the entities that must report ownership, subject to limited exceptions. General partnerships and sole proprietorships generally don’t have to file beneficial ownership reports.

The online portal opened this month, and applicable farm entities and small businesses have until Jan. 1, 2025, to file initial reports electronically.

Entities first formed in 2024 or thereafter have 90 days from creation to file the necessary report, and businesses will have 30 days to report changes in ownership from previously filed reports.

The CTA is part of the Anti-Money Laundering Act of 2020 and is designed to prevent money laundering, corrupt financial transactions and financial terrorism.

FinCEN will maintain the national registry of beneficial owners of entities and is authorized to share the collected information with government agencies and financial institutions, subject to protocols and safeguards.

Applicable entities can visit https://www.fincen.gov/boi for more information and to file the report online. A reporting entity is required to provide information such as its name, address and taxpayer identification number. For each beneficial owner reported, the entity will be asked to provide the individual’s name, birthdate, address and identifying number.

A beneficial owner is identified as someone who “directly or indirectly exercises substantial control” over the entity, or “directly or indirectly owns or controls 25% or more of the ownership interests” of the entity.

Failure to file complete or updated information can result in financial penalties of up to $10,000 and possible imprisonment up to two years.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!