Egg Prices Declining on Lower Demand, Higher Production

Author

Published

5/26/2023

Introduction

Last fall, egg prices hit record highs as additional holiday demand and limited supply caused by highly pathogenic avian influence (HPAI) both pushed prices higher. Since then, egg prices have come down considerably. Supply and demand factors at the farm level have been the drivers of these price changes.

Price Movements

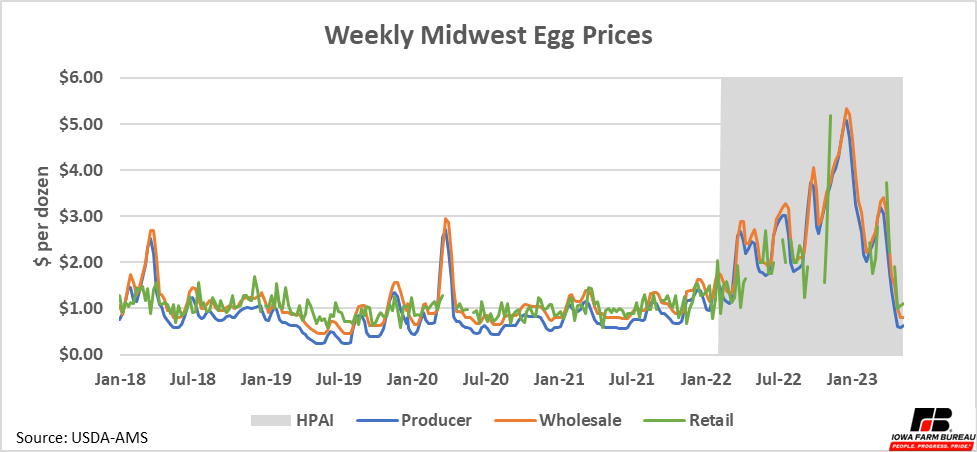

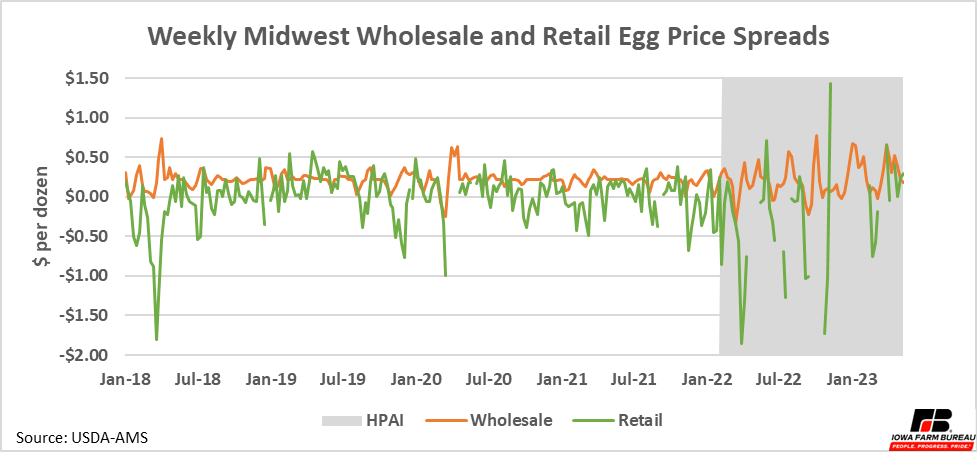

Figure 1 shows egg prices at three levels of the market: producer, wholesale, and retail in the Midwest. The large spike in egg prices last winter is immediately obvious. To confirm the price changes are due to movements in supply and demand we can examine the wholesale and retail margins. Despite the large spike in prices, margins in the industry were stable (Figure 2).

The wholesale margin has been very consistent across the whole period, averaging around $0.22 per dozen eggs. The margin is primarily used to cover packaging and transportation costs so unless those costs vary drastically, it should not change much. While the variation appears larger after the start of HPAI, the average is the same. It could be prices are somewhat delayed in the retail sector or there is a delay in reported prices that began during this period. Either way, it is not likely signaling any changing market dynamics.

The retail price and retail margin need to be interpreted with some caution. The retail price data is collected by the USDA on advertisements made by retailers for eggs. Because of this there are a few considerations to keep in mind with the retail data. First, the reported retail prices are likely to be at the low end each week because retailers are more likely to advertise their prices when they think they are low compared to the market. Also, when egg prices jump, retailers are less likely to advertise egg prices. If no retailers in a region in the USDA sample advertise a price, no retail price is recorded for the week and there will be a gap in the data.

The retail margin appeared more consistent prior to the HPAI outbreak. Prior to the outbreak the margin averaged -$0.01 per dozen but after the HPAI outbreak the margin averaged -$0.32 per dozen. It is not all that surprising to see the margin negative. For one, eggs are a staple item grocery stores often sell at or below cost to get customers in the door. Second, because these are advertised prices, they are even more likely to be on sale below cost.

The more negative margin during HPAI is also not that surprising. When egg prices spike like they dd during HPAI, retailers try to absorb the additional costs to keep customers coming to the store for a time. This makes their margins smaller than usual. If costs remain high, eventually retailers raise prices and often stop advertising prices at the same time. This creates periods of especially negative margins. Retail margins are likely higher than reported by this data but not by a huge amount.

In short, both wholesale and retail margins in the egg market are relatively small and consistent. The large changes in egg prices over the past year occurred due to market factors at the farm level. The supply and demand factors present at the farm level are discussed next.

Figure 1. Weekly Midwest Egg Prices

Figure 2. Weekly Midwest Whole and Retail Egg Price Spreads

Egg Supply

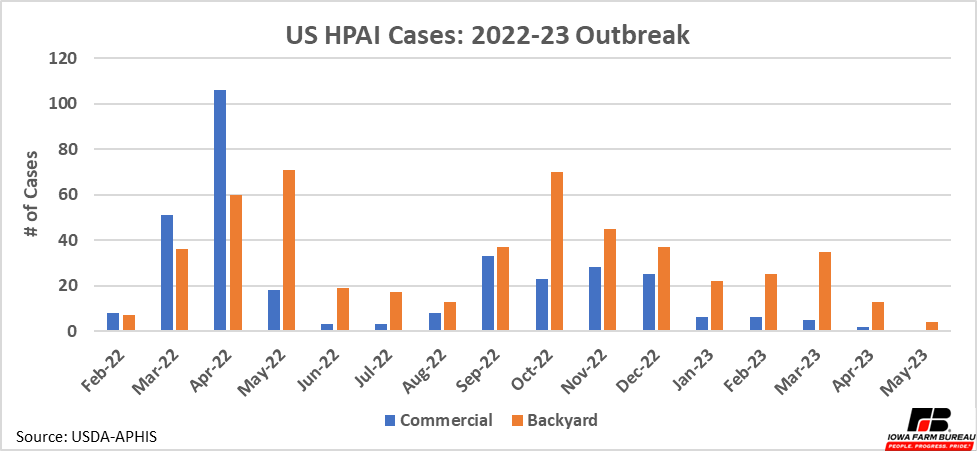

HPAI has been a major factor limiting egg supply. The current outbreak has lasted over a year now starting in February 2022 and is still impacting US flocks today. A bright spot has been since the beginning of the year, fewer new cases have been identified in the US, especially in commercial flocks (Figure 3).

Figure 3. US HPAI Cases: 2022-23 Outbreak

Since the start of the outbreak, 58.8 million birds in 47 states have been infected by the virus. Almost 75% of these birds have been table egg layers and 17% have been turkeys. Other groups such as broilers, pullets, and ducks have also been affected by the virus, but to a lesser extent.

In Iowa, 16.0 million birds (27% of all US affected birds) have been affected since the start of the outbreak. Of Iowa’s affected birds, 93% have been layers. Iowa is a major egg laying state, so this is not surprising.

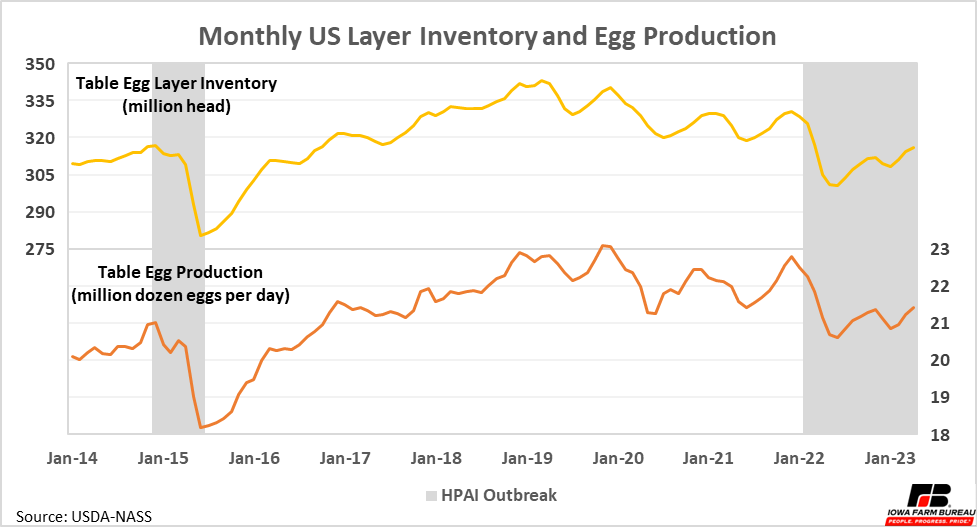

The surge of cases early in the outbreak dragged US layer inventories and egg production down (Figure 4). As cases has persisted it has limited the recovery of the US flock. Notice inventories and production were recovering but faced a setback last fall when cases spiked again.

Regarding the recent spike and fall in egg prices, the supply explains part of the story. Notice January 2023 was a recent low point for egg production before bouncing back again over the past three months. Egg prices peaked in December and early January and other than a brief spike in late March/early April, prices have trended down (Figure 1).

Figure 4. Monthly US Layer Inventory and Egg Production

Egg Demand

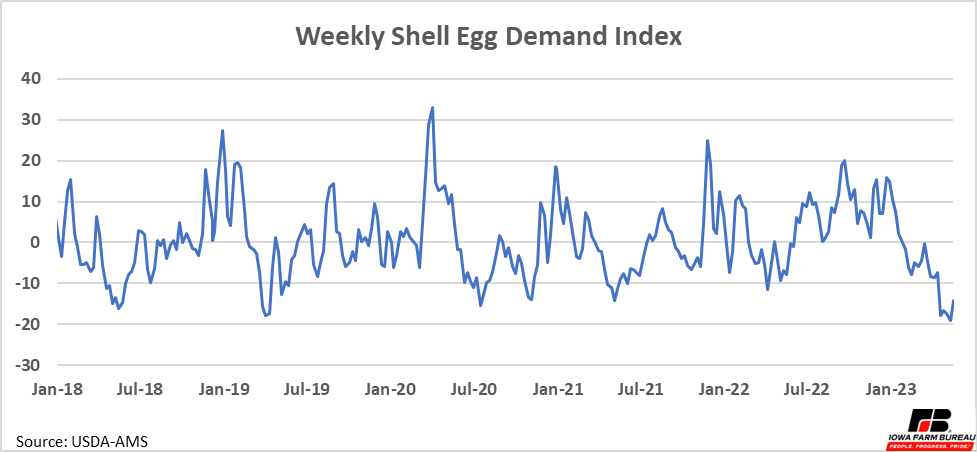

The other side of the story on egg prices is demand. The USDA-AMS reports proxies for egg demand each week (Figure 5). The demand proxy is calculated using days of eggs on hand, which measures how many days current egg inventories would last at current consumption levels. The index compares the previous 26-week average of days of eggs on hand to the current days of eggs of hand. The index goes down when current days of eggs on hand is higher than the previous average because this means less eggs are being used. The reverse is also true.

Egg demand typically increases around the winter holidays and then falls to a low in the spring or summer before rising again. This pattern is exactly what has been happening this year. Demand was high around Thanksgiving and Christmas but since then has fallen considerably. In fact, the index has fallen to at least a five-year low.

Figure 5. Weekly Shell Egg Demand Index

Conclusion

Supply and demand shifts at the farm level worked together to first push egg prices to record highs in December/January as supply fell while demand rose. Similarly, shifts in both supply and demand have been pushing egg prices back to the current “normal” levels we are seeing this spring as production is up and demand has fallen from the seasonal high.

It appears almost all the changes in egg prices have been due to market forces at the farm level, as wholesale and retail margins have remained consistent. As egg prices have come back down, wholesalers and retailers have passed savings through to the consumer.

There have been no new commercial cases of HPAI identified in May. While anytime the outbreak ended would be great, it would be especially helpful if the outbreak ended sometime soon. After the last outbreak it took about 6 months to build inventory and production back up to pre-outbreak levels. If this much time is needed again, it would be best to have the recovery complete or near complete by Thanksgiving time, to handle the additional seasonal demand next year.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!