U.S. Ethanol Exports in 2016 and the Outlook for 2017 (04/26/2017)

Author

Published

4/27/2017

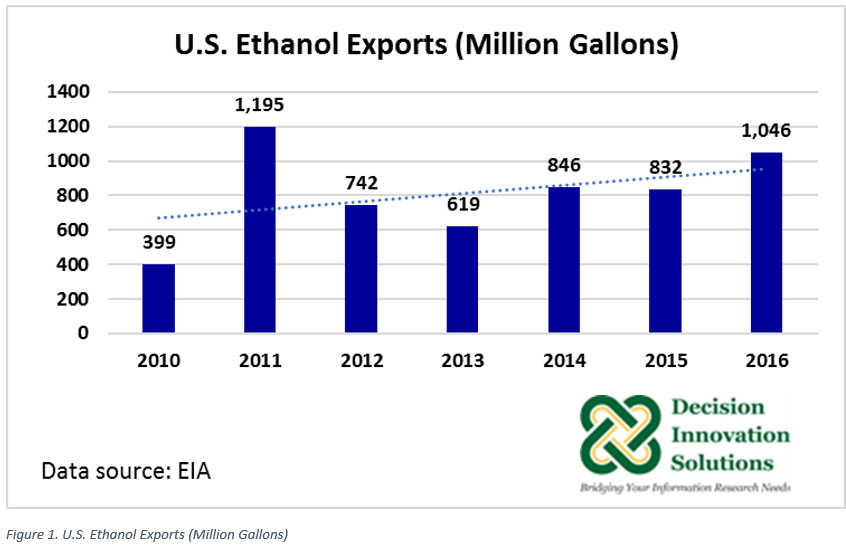

U.S. ethanol exports during 2016 were up 25.7% to 1.046 billion gallons compared with the same period the previous year (832.02 million gallons). 2016 U.S. ethanol exports exceeded prior year levels each of the past four years (see Figure 1), and was the second largest volume exported since the record in 2011 (1.195 billion gallons). This reverses the slight decline that was seen when 2015 ethanol exports declined by 1.6% relative to 2014 (see Figure 1).

In 2010, the United States became a net exporter of ethanol (i.e., ethanol exports surpassed ethanol imports), a position the country has kept since then. The United States imported 0.036 billion gallons of ethanol in 2016, down 60% from the previous year (0.092 billion gallons). The share of U.S. ethanol exports to U.S. ethanol production has increased from 3.0% in 2010 to 6.8% last year.

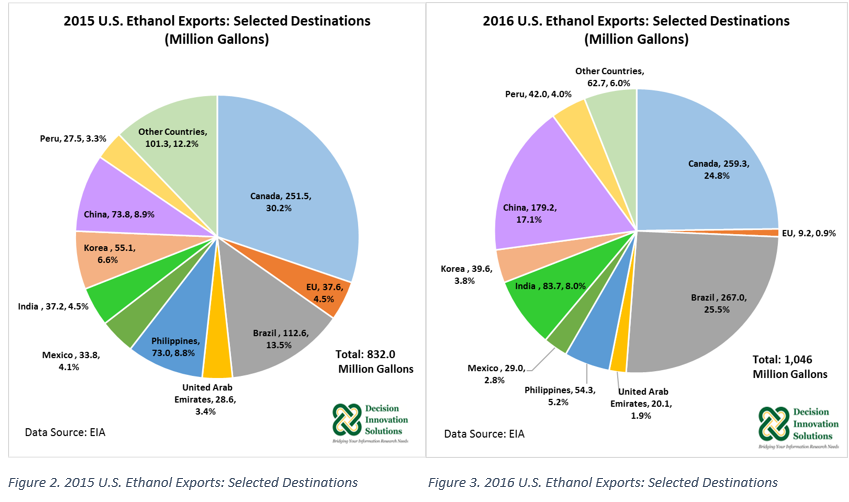

Data from USDA-FAS indicates U.S. ethanol exports during 2016 were valued at $2.018 billion, up 15.3% year over year. Data from the U.S. Energy Information Administration (EIA) shows U.S. ethanol was shipped to 34 different countries in 2016, with Brazil, Canada, and China as the top three destinations. Exports to Brazil (267.0 million gallons), Canada (259.3 million gallons) and China (179.2 million gallons) made up 67.4% of total U.S. ethanol exports in 2016 (see Figures 2 and 3).

Brazil

Brazil was the largest market for U.S. ethanol in 2016, with an export share of 25.5% of total 2016 U.S. ethanol exports. U.S. ethanol exports to Brazil kept a steady pace during 2016 compared with 2015. In 2015 U.S ethanol shipments occurred only during eight months of the year whereas in 2016 exports were registered every month of the year. Exports in November 2016 (50.9 million gallons) reached the highest volume of the year. 2016 exports to Brazil rose 136.2% to 267 million gallons compared with the same period in 2015 (112.60 million gallons) (see Figures 2 and 3).

Exports to Brazil are boosted by the country’s zero import tariff for ethanol. According to the latest USDA-FAS’s Global Agricultural Information Network (GAIN) report, Brazil-Biofuel Annual, published in August 2016, Brazil’s import tariff for ethanol is 20%, but since April 2010, ethanol has been included in Brazil’s “list of exceptions” and the tariff has been reduced to zero. This tariff will remain in effect through December 31, 2021. Brazil’s ethanol-use mandate continues unchanged at 27% (E27). The most recent EIA report, U.S. ethanol exports data by country, indicated January 2017 U.S. ethanol shipments to Brazil of 58.9 million gallons was the third largest monthly volume since November 2011.

Canada

From 2012 to 2015, Canada was the top market for U.S. ethanol; however, in 2016 Canada became the second largest market for U.S. ethanol after Brazil (see Figure 3). The United States shipped 24.8% of its total ethanol exports to Canada during 2016. Exports in 2016 increased 3.1% to 259.3 million gallons relative to the same period in 2015. In August 2016, USDA-FAS projected total Canadian ethanol imports of 264.2 million gallons in 2017, with the United States expected to supply most of those imports.

China

China was the third largest importer of U.S. ethanol in 2016. U.S. exports to China surged last year, outpacing the 2015 volume by 142.7% to 179.2 million gallons. China imported 105.3 million gallons more ethanol during 2016 than during 2015. The United States exported 17.1% of total U.S. ethanol volume exports in 2016 to China.

Exports during 2017 may not keep the same pace as in 2016. USDA-FAS’s GAIN report published on January 18, 2017 indicated China had a tentative tariff rate of 5% for denatured ethanol in 2016; however, the rate was restored to 30% starting January 1, 2017. The new tariff is expected to have an adverse impact on U.S. ethanol exports to China in 2017. EIA’s most recent data through January 2017 indicates no U.S. ethanol exports to China have been registered since December 2016.

India

India imported 83.7 million gallons of U.S. ethanol in 2016, outpacing the 2015 volume by 46.5 million gallons. India’s ethanol production during 2016 and 2017 has been estimated/projected at 550.9 million gallons and 506.7 million gallons, respectively, down 9% and 16% from the 2015 volume. Based on the latest annual biofuels report published by USDA-FAS on June 2016 for India, a two-year production decline is projected, which is due to a reduction in domestic sugarcane acres. The main feedstock in India’s ethanol production is sugarcane molasses, with only a small portion of the production made from grains. India is projected to import 158 million gallons of ethanol in 2017 from all sources, up 33% from the estimated volume in 2016. Imported ethanol is expected to sell at the same price as local suppliers, which could discourage imports, however, the smaller production and larger ethanol import projections may offer opportunity for U.S. ethanol to increase its market share in India.

Other Export Destinations

Other important destinations for U.S. ethanol in 2016 were the Philippines (54.3 million gallons), Peru (42 million gallons), South Korea (39.6 million gallons), and Mexico (29 million gallons). 2016 ethanol exports to these four countries represented 15.8% of 2016 U.S. total exports; however, except for Peru, U.S. ethanol exports to these markets declined in 2016 (see Figure 3).

U.S. ethanol exports to Peru represented only 4.0% of total exports in 2016, but U.S. exports to that country grew 52.8% year over year. Peru’s ethanol production started to fall in 2015 in response to the closure of two production plants that year (USDA-FAS’s GAIN report, December 2016). In order to meet domestic demand, Peru’s ethanol imports increased in 2016. Ethanol Imports are expected to continue this trend in 2017 to meet the domestic supply gap (USDA-FAS’s GAIN report, December 2016). Because of the U.S. Peru Trade Promotion Agreement, Peru’s import duty on U.S. ethanol is only 3% and by 2018, U.S. ethanol imported by Peru will be duty-free.

Ethanol Exports in 2017

2017 U.S. ethanol exports are expected to keep a strong pace in markets such as Canada and Brazil. Exports to India and Peru also are expected to grow in 2017. Exports to China on the other hand, may fall in 2017 in response to the higher import tariff for ethanol reinstated in January 2017. The wide range of foreign markets that import U.S. ethanol is one of the strengths of the U.S. ethanol industry, and may help compensate for the disruptions in exports to China. In 2016, the United States shipped almost one-fifth (179.2 million gallons) of the total U.S. ethanol exports to China during that period. Exports to China were valued at $296.031 million.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!