The Relationship of Diesel Fuel Prices to Crude Oil Prices Has Changed

Author

Published

9/8/2022

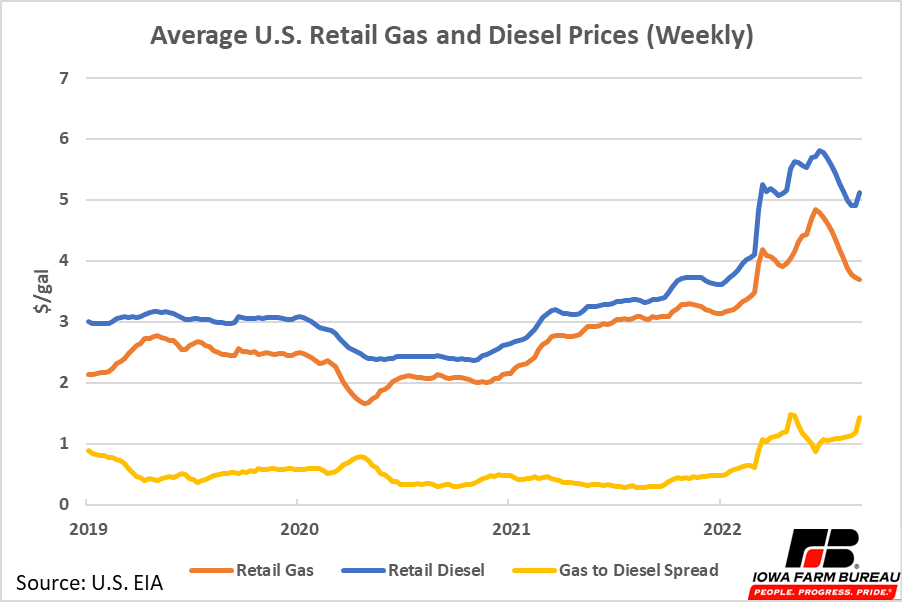

The price of gasoline and diesel have both come down substantially from highs earlier this year but are still above 2021 levels (Figure 1). Both gasoline and diesel fuel prices spiked in early March 2022 right after Russia invaded Ukraine. Russia is a major producer and exporter of crude oil, the major input in fuel production. Retaliatory sanctions disrupted normal trade flows and created uncertainty in the market, which caused prices to increase. The prices of both gasoline and diesel fuel continued to increase through the summer, peaking in June, before beginning to decline in early July. The price of gasoline has declined at a faster rate than the price of diesel. In fact, the price of diesel increased slightly in the last two weeks while the price of gasoline has continued to decline. This has caused the spread between gasoline and diesel prices to increase over the last six months.

Figure 1. Average U.S. Retail Gas and Diesel Prices (Weekly)

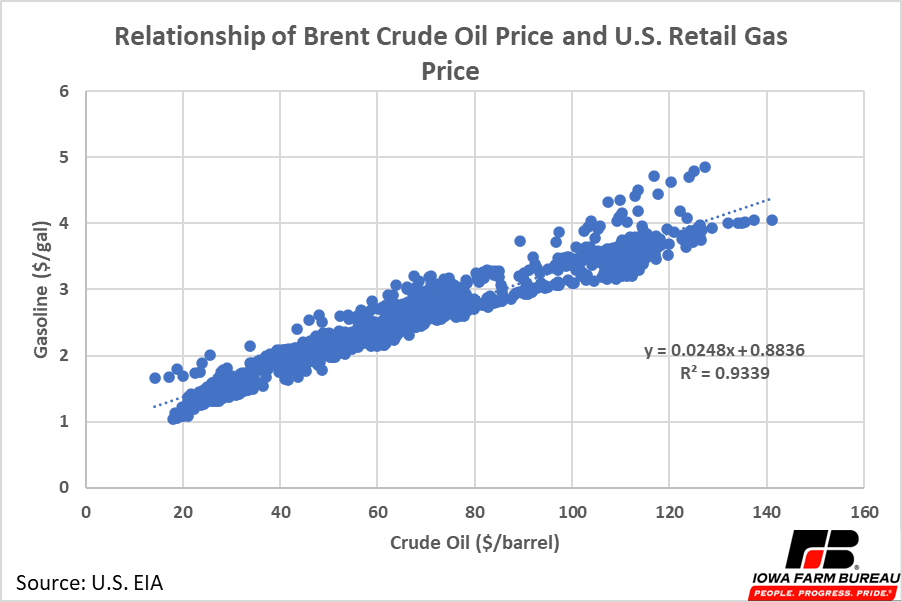

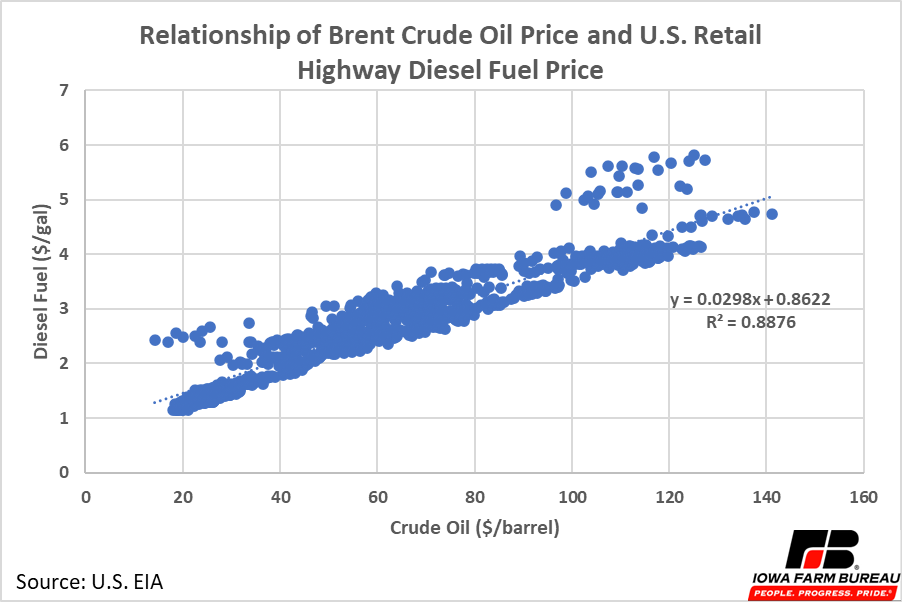

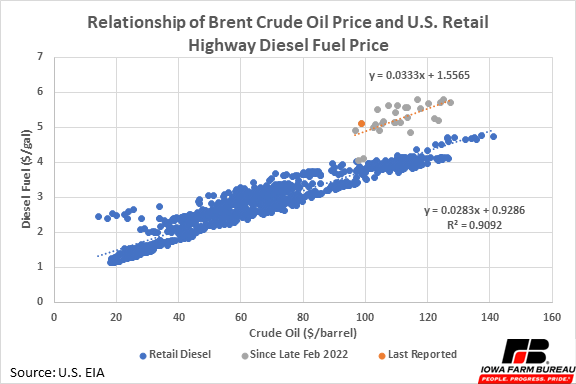

As the primary input in the production of diesel fuel, crude oil has historically been a good indicator of fuel prices. The relationship between the price of Brent crude oil, essentially a gauge of the world price of crude oil, and the price of U.S. retail gas and diesel prices is illustrated in Figure 2 and Figure 3. Changes in the price of crude oil explain 93% of the changes in the price of gasoline from 2000 to the present. Similarly, changes in the price of crude oil explain 89% of the changes in the price of retail diesel fuel from 2000 to the present.

Figure 2. Relationship of Brent Crude Oil Price and U.S. Retail Gas Price

Figure 3. Relationship of Brent Crude Oil Price and U.S. Retail Highway Diesel Fuel Price

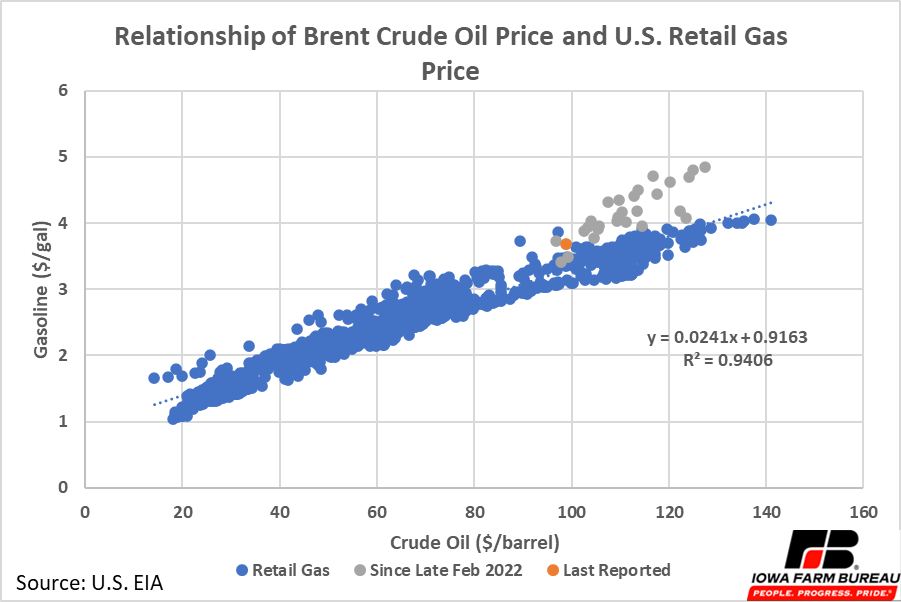

After the Russian invasion of Ukraine, the relationship between crude oil prices and gasoline prices and especially the relationship between crude oil and diesel fuel prices appears to have changed. Figure 4 and Figure 5 are the same plots as Figure 2 and Figure 3 but highlight the data points that occurred after late February, when Russia invaded Ukraine, in gray and the most recent data point in orange. The blue trendlines included in these figures do not include the highlighted data points, so the data runs from 2000 to mid-February 2022.

First looking at Figure 4, notice almost all the gray points in the graph are above the trendline, which means gasoline has been more expensive relative to crude oil in the last six months than in years past. Furthermore, notice the most recent data point, highlighted in orange, is closer to the trendline than most of the other gray points. This could indicate that the price of gasoline is returning to more normal relationship with crude oil. The same is not true for diesel fuel.

Figure 4. Relationship of Brent Crude Oil Price and U.S. Retail Gas Price

In Figure 5, notice the distinction between the grouping of the blue points and the grouping of the gray and orange points is much larger than in Figure 4. The gray points are much higher above the trendline in Figure 5 than in Figure 4. Also, the orange point, representing the most recent data point, remains well above the trendline, closer to the group of gray points than the group of blue points. This indicates the relationship between crude oil and diesel fuel has not yet begun to move toward the “normal” relationship seen in previous years. In fact, there is growing evidence that the relationship between diesel fuel and crude oil has shifted with a 63 cents per gallon higher base and a 17.6% higher factor relationship per dollar of crude oil price. (The gray set of dots has shifted higher and has a steeper slope than the blue set of dots.) This shift in the relationship of diesel fuel to crude oil suggests that changes have occurred in the supply and demand of refinery capacity and distribution for diesel fuel that are different from the supply and demand of refinery capacity and distribution for gasoline. Whether or not this is a permanent shift in relationships will need to be monitored in the future and solutions sought to return the diesel fuel to its historical relationship with crude oil.

Figure 5. Relationship of Brent Crude Oil Price and U.S. Retail Highway Diesel Fuel Price

The Russian invasion of Ukraine likely had some effect on the altered relationship between crude oil prices and diesel fuel prices. However, several other factors have likely contributed to the new relationship as well. Verleger (2022) notes multiple reasons diesel prices were higher during this period in addition to the Russian invasion of Ukraine:

Reduced exports from China – China limited its exports of diesel fuel, cutting export quotas by almost 60%.

Output restrictions from OPEC – OPEC, a group of oil exporting countries, limited their crude oil production. Verleger also notes crude oil for OPEC counties tends to produce more diesel fuel when refined than crude oil from other countries. As an example, Verleger points out one barrel of Arab Light crude can produce almost twice as much diesel fuel as one barrel of West Texas light crude oil.

Economic incentives that cut U.S. refinery capacity – U.S. policies to encourage lower carbon fuel production have encouraged companies to limit investment in refinery capacity in favor of investment in the production of alternative fuels. For example, two large refineries in California have stopped operating and are being converted to renewable diesel facilities.

Regulations on marine fuel sulfur content – In 2020, regulations requiring the removal of most sulfur from marine diesel fuel were put into place. This led to increased demand for low-sulfur diesel, which most industries use.

All these factors have lowered the supply of diesel fuel, and together have likely contributed to higher diesel prices relative to crude oil prices. In the short term, these factors will likely continue to affect the diesel market, keeping diesel prices high relative to the price of crude oil. Lower crude oil prices, should they come, would put downward pressure on diesel fuel prices. However, that alone will not resolve what appears to be a large shift in the relationship between diesel fuel prices and crude oil.

References

Kingston, John. “Why diesel prices are soaring beyond crude and gasoline and are likely to continue that way” Freight Waves. April 28, 2022, Accessed 9/6/2022 from https://www.freightwaves.com/news/diesel-prices-soaring-beyond-crude-gasoline-and-likely-to-stay-that-way

Verleger, Philip K. “Striking Diesel/Jet Fuel Shortages Are Coming” International Economy. 2022, pp. 42-43, 66-67. Accessed 9/6/2022 from https://www.pkverlegerllc.com/publications/papers/striking-dieseljet-fuel-shortages-are-coming-tie-spring-2022-3766/

Economic analysis provided by David Miller, Consulting Chief Economist, Decision Innovation Solutions on behalf of Iowa Farm Bureau.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!