Relative Value of Soybean Meal and Soybean Oil

Published

7/13/2022

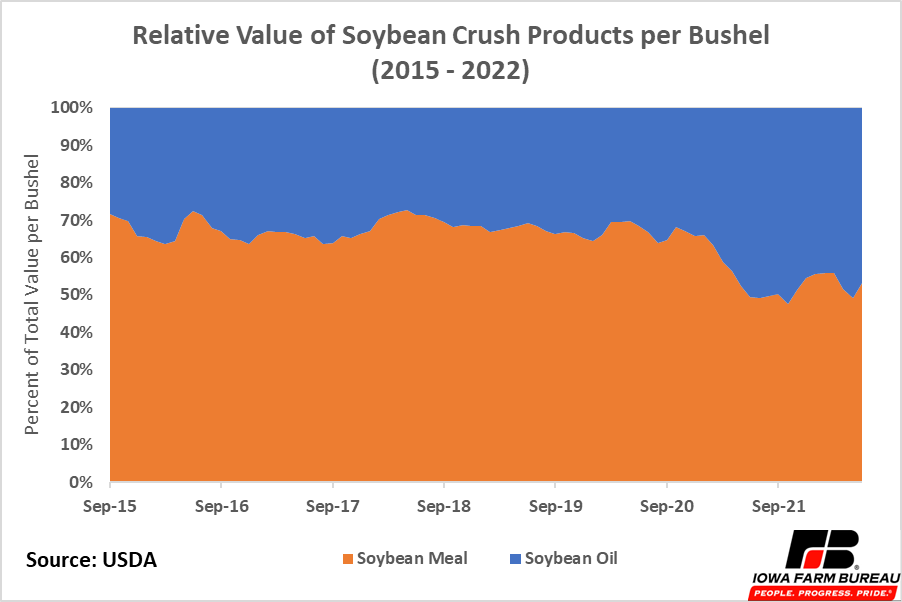

The soybean crush produces two major products, soybean meal and soybean oil. Historically, approximately 2/3 of the total value of soybean crush products came from soybean meal and the remaining 1/3 came from soybean oil. Recently, the relative value of each product has become more balanced, with approximately ½ of the total value of the crush coming from each product (Figure 1). The relative change in the value of soybean crush products could be due to changes in the market for soybean meal, soybean oil, or both.

Figure 1. Relative Value of Soybean Crush Products per Bushel

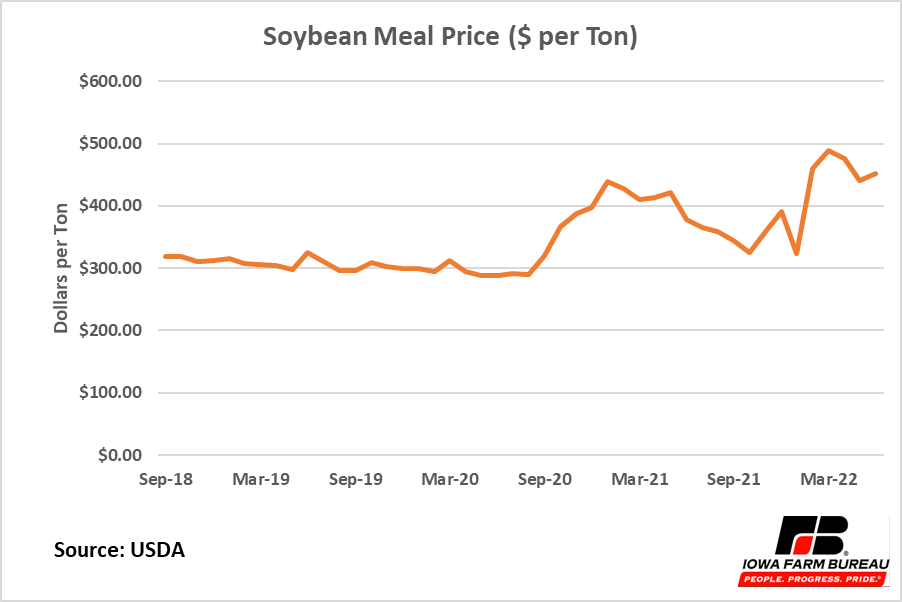

Figure 2. Soybean Meal Price ($ Per Ton)

In October 2020, soybean meal represented 68% of the value of soybean crush products. Though the relative value of soybean meal as a crush product has been trending down, the price of soybean meal has increased by 23% in the same time period (Figure 2). Furthermore, soybean meal yields per bushel have remained constant. The shift in the relative value of the soybean crush is not due to decreases in soybean meal price or yield.

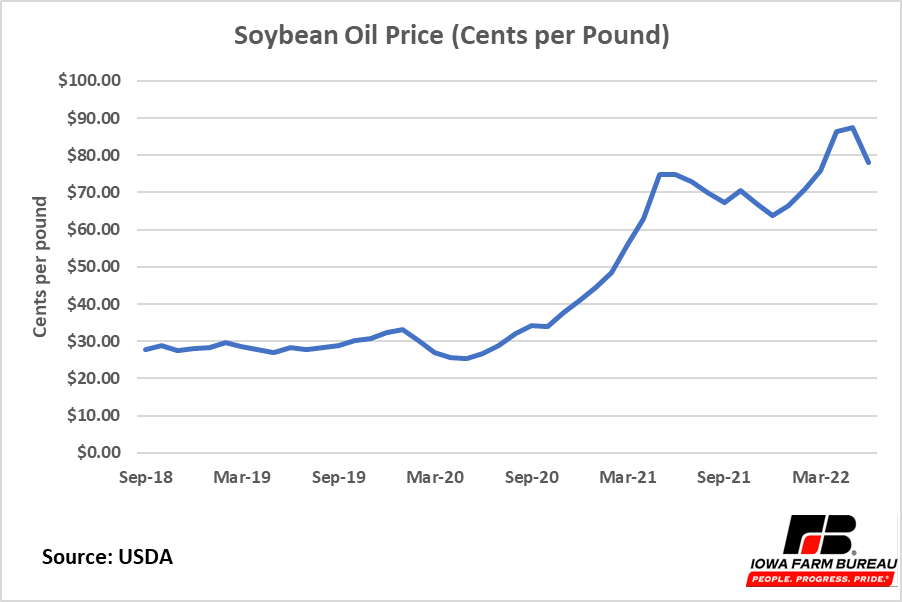

Figure 3. Soybean Oil Price (Cents Per Pound)

Soybean oil yields have also remained relatively constant, but soybean oil prices have increased even more than soybean meal prices. Soybean oil prices are up 130% since October 2020. This large increase in soybean oil prices is what led to the shift in the relative value of soybean oil as a crush product. It is not yet known if the relative value of crush products has permanently changed, or if this is a temporary shift. The expanding biofuels market is one reason to suspect this change may have some permanency.

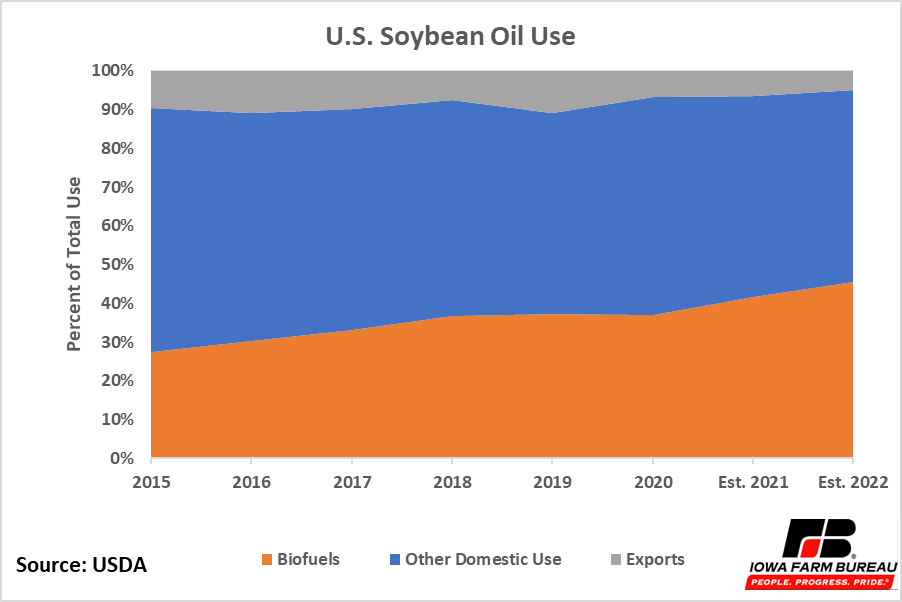

Figure 4. U.S. Soybean Oil Use

The U.S. domestic use of soybean oil has been changing over time as usage of soybean oil for biofuel is on the rise. The percentage of domestic soybean oil used for biofuel has increased approximately 10 percentage points from 2015 to 2020 and is estimated to increase another 10 percentage points from 2020 to 2022 (Figure 3). Meanwhile, exports and other domestic use has fallen. If more biofuel plants come online, the percentage of soybean oil used for biofuels may continue to increase. The US has a total of 66 biofuel plants with a capacity of 2,633 million gallons of biofuel production per year. Iowa has the highest biofuel production capacity of 394 million gallons per year.

Soybean crush is expected to increase in the coming years with much of this increase in domestic crush driven by a desire to have more soybean oil available for domestic biofuel production. Including expansions and new plants, plans for a total of 430 million bushels of additional crush capacity have been announced with 85 million bushels of the expanded capacity slated for locations in Iowa. Total soybean crush for 2022 is estimated to be 2,255 million bushels. An additional 430 million bushels of crush capacity would create 2.3 million metric tons of soybean oil and 9.0 million metric tons of soybean meal. The growing biofuels industry provides a market for additional soybean oil, but the market for additional soybean meal is not yet known.

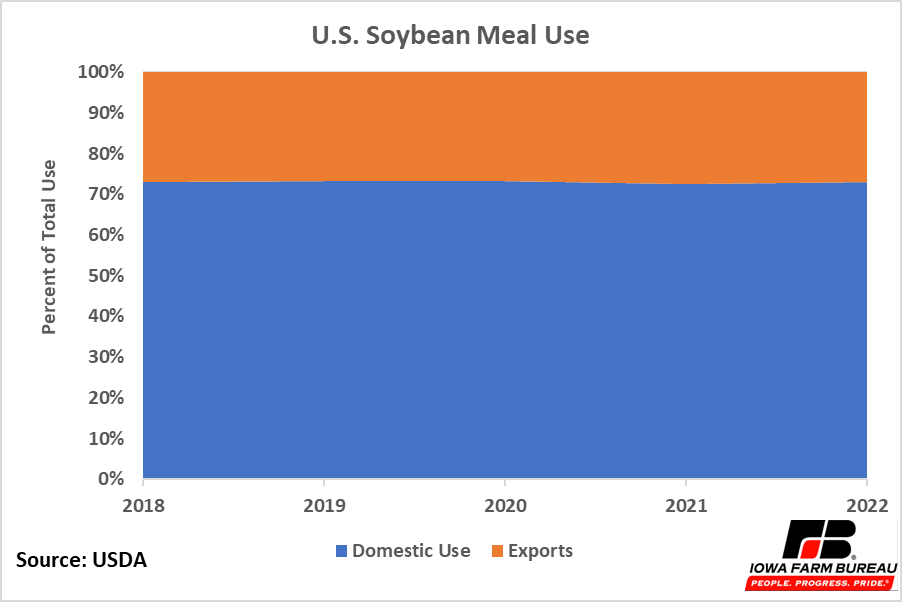

Figure 5. U.S. Soybean Meal Use

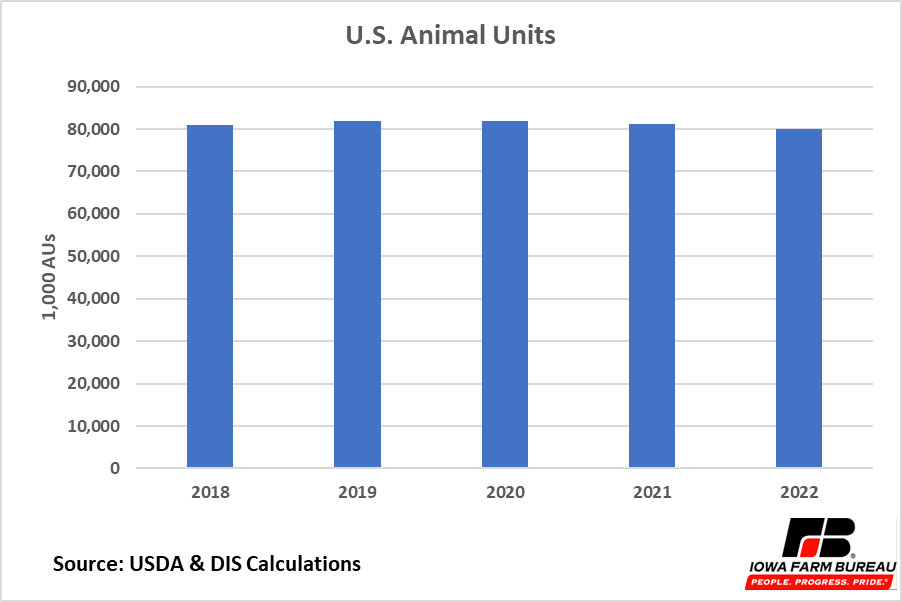

Figure 6. U.S. Animal Units

Current soybean meal demand remains strong. Even with higher price levels, domestic use and exports of soybean meal have remained steady at 73% and 27% respectively (Figure 5).

Most soybean meal is fed to animals. Total U.S. animal units have remained steady over the past 5 years as shown in Figure 6. While the mix of animal units changes some year-to-year, the overall level of animal units has been not been changing. Domestic demand for soybean meal is likely to remain steady in the future unless there is an increase in domestic meat, poultry, egg, and milk production; or unless there is a significant enough change in the relative prices of soybean meal, competing protein meals, and energy feeds like corn such that soybean meal displaces these other meals. Dried Distillers Grains (DDGs) could be the feed ingredient most affected by relative changes in soybean meal prices.

When soybean crush capacity expands to provide more soybean oil to the growing biodiesel market, it will become important to increase market demand for soybean meal. If demand is not increased and soybean meal production increases, this will create downward pressure on the price of soybean meal. This could shift the relative value of soybean meal as a crush product even lower in the future, potentially making the relative value of soybean meal lower than the relative value of soybean oil.

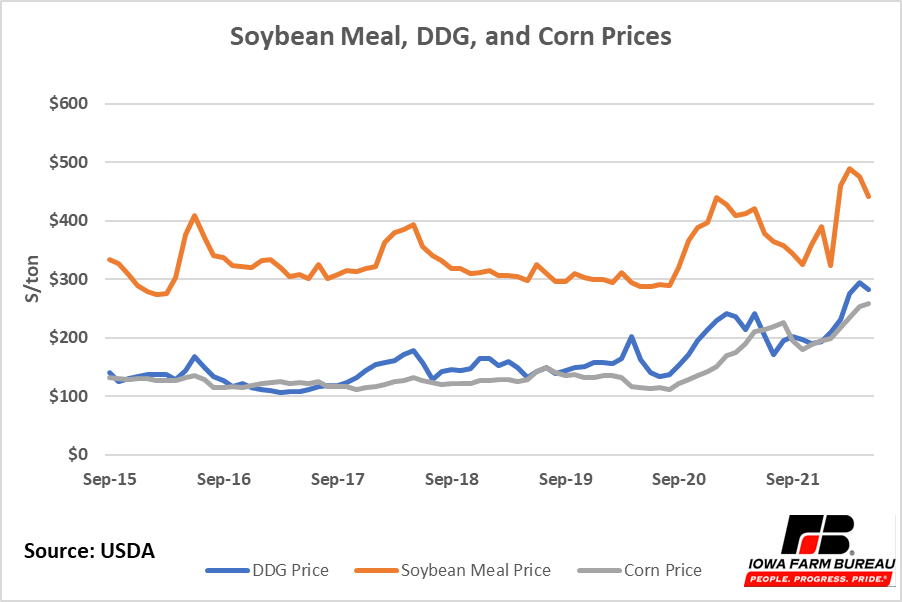

Figure 7. Soybean Meal, DDG, and Corn Prices

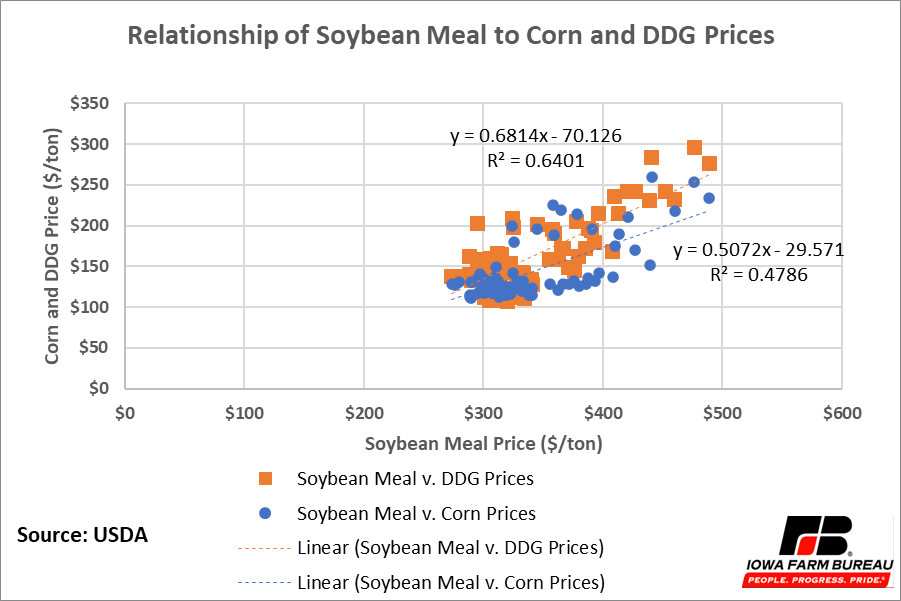

Figure 8. Relationship of Soybean Meal to Corn and DDG Prices (2015 - 2022)

A permanent change in the relative value of soybean meal and soybean oil could have impacts on other markets as well. If soybean meal becomes the secondary product of the crush as demand for soybean oil for biodiesel production expands, and the price of soybean meal falls (at least on a relative value basis) due to increases in supply, the DDGs markets could be affected as both soybean meal and DDGs are used as protein feeds. The corn market could also be affected as DDG is a byproduct of corn ethanol production. Figure 7 shows the prices per ton of soybean meal, DDG, and corn since 2015. In Figure 7, the prices appear to move together, but the relationship between the prices is not easily discerned from the line graph.

The relationship between the price of soybean meal and the prices of DDG and corn is more obvious in Figure 8. Figure 8 plots the monthly price of DDG against the monthly price of soybean meal and the monthly price of corn against the monthly price of soybean meal. The trendlines indicate a $1 dollar decrease in the price per ton of soybean meal is associated with a $0.68 per ton decrease in price per ton of DDGs and a $0.50 per ton decrease in the price per ton of corn. Furthermore, 64% of the variation in the price of DDGs is associated with the variation in the price of soybean meal and 48% of the variation in the price of corn is associated with changes in the price of soybean meal. These results indicate changes in the price of soybean meal impact both DDG and corn prices but have a larger impact on DDG prices.

While it is still unknown if the relative values of soybean meal and soybean oil have permanently shifted, the relative values of the soybean crush products will be important to monitor as the soybean crush and biofuels industries expand. Failure to develop a market for additional soybean meal could lead to a decrease in the price of soybean meal, which could have implications for the corn market as well.

Economic analysis provided by Aaron Gerdts, Research Analyst, Decision Innovation Solutions on behalf of Iowa Farm Bureau.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!