Interest Rates and Land Values

Author

Published

7/28/2022

As inflation has continued to increase in the U.S. the Federal Reserve (Fed) has been raising the federal funds target rate to combat inflation. In March 2022, the Fed raised the federal funds target rate by 0.25%. The Fed continued raising rates with increases of 0.5% in May, 0.75% in June, and a recent increase of 0.75% on July 27, 2022. The federal funds target rate began the year near zero and is now set to a target range of 2.25% to 2.50% which is close to the theoretical neutral rate of 2.50%.

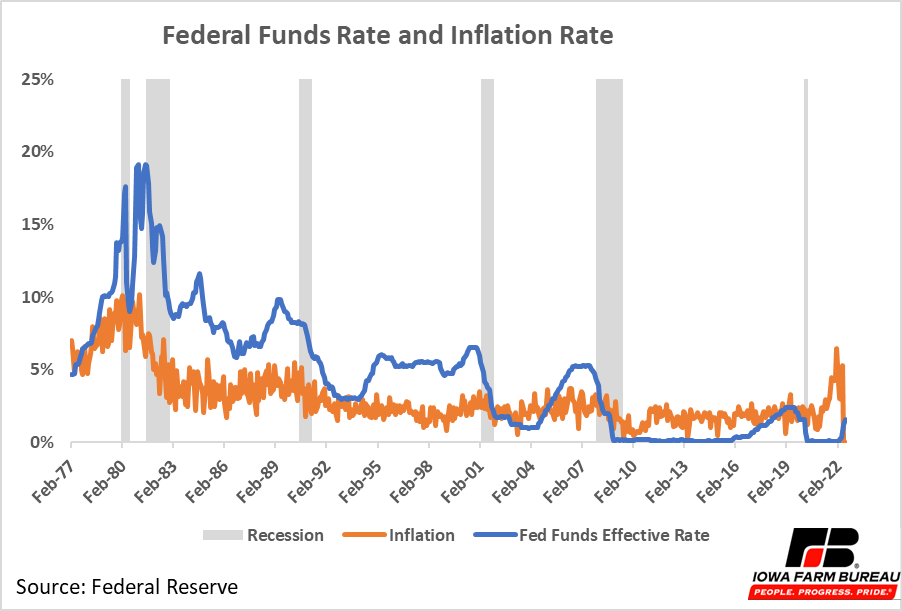

Figure 1 shows the monthly federal funds effective rate and 12-month rolling inflation rate. Recessions are shaded in gray. From 2009 to 2015 the federal funds rate was set near zero, a historic low as the Fed tried to stimulate the economy after the 2008 recession. The Fed began slowly raising rates in 2016. In 2020, the Fed again set rates near zero to combat recession fears caused by the COVID-19 pandemic. Rates remained extremely low in 2020 and 2021.

Figure 1. Federal Funds Rate and Inflation Rate

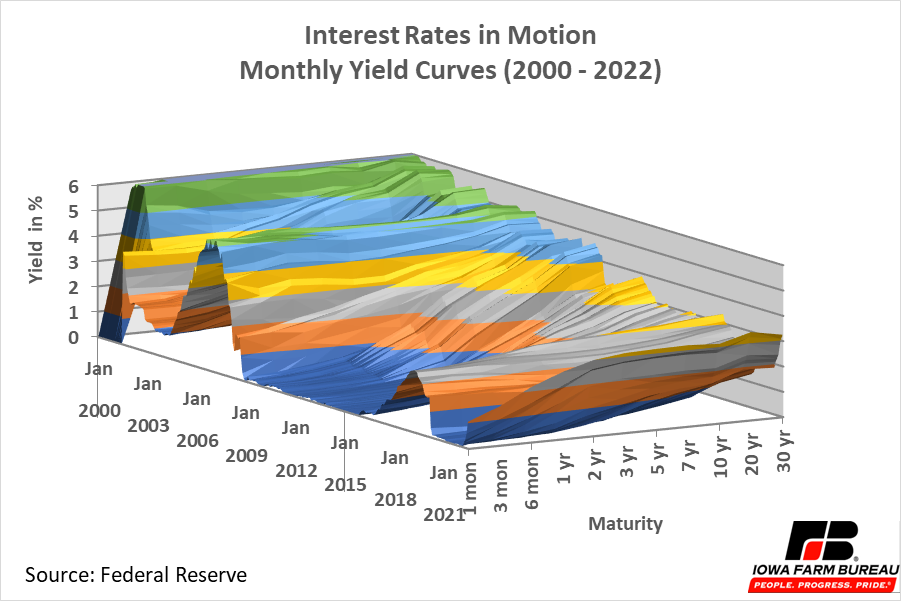

The federal reserve rate is the rate at which large banks can lend money they have deposited at the federal reserve to each other to maintain short term liquidity. The rate is set by the market but influenced by Federal Reserve policies. When the federal reserve rate rises, other interest rates also rise as money lenders pass on increased borrowing costs to the market. Interest rates of maturities ranging from 1-month Treasury bills to 30-year Treasury bonds for the past 21+ years are shown in Figure 2. It has been more than 10 years since any federal treasury bond has had a monthly rate above 4 percent. Interest rates in Figure 2 and other figures throughout this article display U.S. bond interest rates, not rates for private loans. Interest rates for private loans are affected by collateral and credit rating and are typically higher than U.S. bond interest rates.

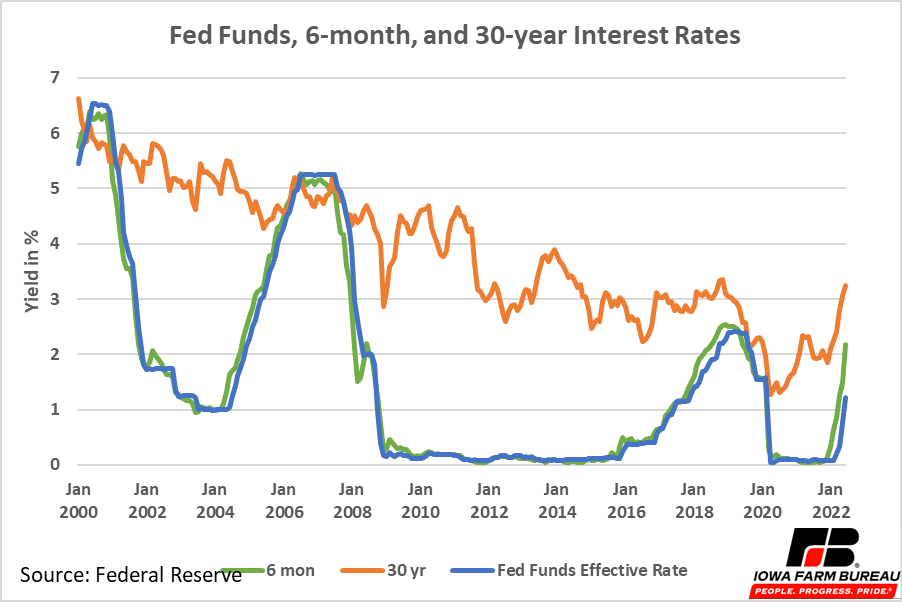

When the Fed lowers interest rates, shorter maturity rates tend to react the most, but both short- and long-term rates typically move with the federal reserve rate. The relationship between the federal funds rate and short- and long-term interest rates is illustrated in Figure 3. The 6-month interest rate follows the federal funds rate closely, while the 30-year interest rate is affected by the Federal Funds rate, but the relationship is not as strong.

Figure 2. Interest Rates in Motion Monthly Yield Curve (2000 - 2022)

Figure 3. Fed Funds, 6-month, and 30-year Interest Rates

Changes in interest rates will eventually impact farmland values. The value of land is inversely related to interest rates. As interest rates increase, the value of land is expected to decrease. A simple method to model farmland values is by taking the average annual income per acre divided by the interest rate.

For example, if net cash income (cash rent) from the land is $350 per acre and the interest rate is 4%, the land value would be $350/0.04 or $8,750 per acre. If cash rent stays the same, but the interest rate rises to 5.5%, the value of land would be $350/0.055 or $6,364 per acre. As the interest rate rises, the value of land decreases.

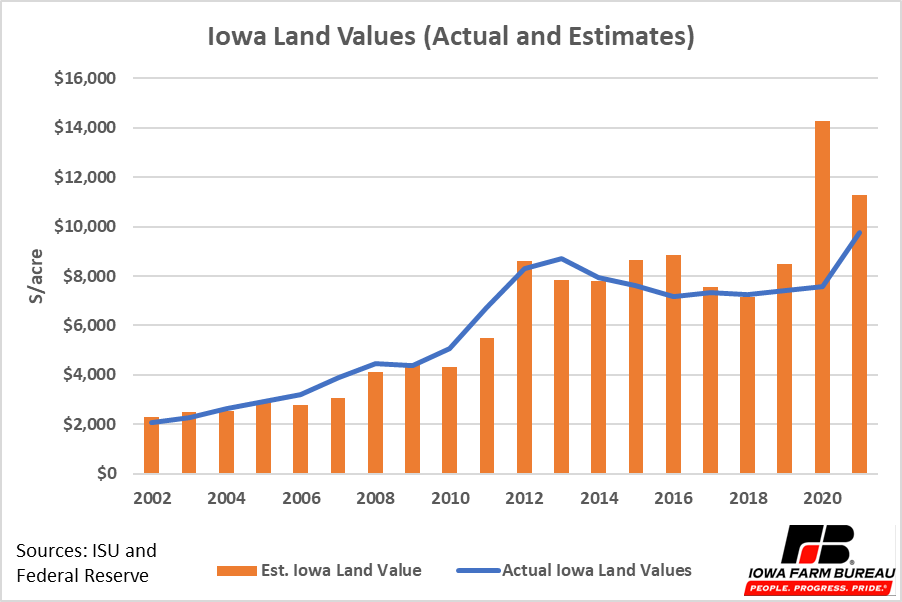

Iowa State University conducts annual surveys of land values and rents in Iowa. The land value survey is taken in fall, so the data does not reflect the most recent land values. The annual rent survey is taken in the spring. Reported state average land rental rates and 30-yr interest rate are used to estimate land values. These estimates are compared to reported state average land values in Figure 4. Historically, rent and interest rates have been a good predictor of land values. The historically low 30-year interest rates in 2020 and 2021 were expected to increase the state average land values even more than what was reported in the State average value of land. Even though 30-year interest rates reached their lowest point in 2020, it took time for the change in land values to occur and to show up in the data. This was likely due to two factors (1) investors had a lot of uncertainty about the stability of future cash rental rates due to erratic market reactions to COVID-19, and there was significant uncertainty about how long emergency actions by the Fed would remain in place. While it is possible it will take time for increases in interest rates to be reflected in land prices, increased interest rates if accompanies by high levels of inflation and rising cash rents may slow downward adjustments in land prices.

Figure 4. Iowa Land Values (Actual and Estimates)

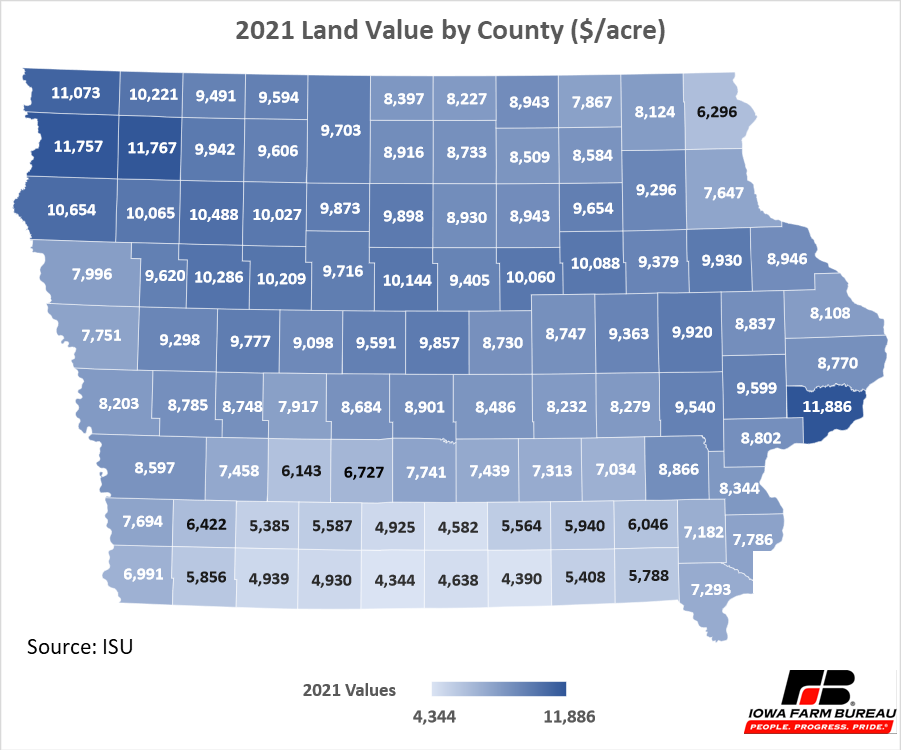

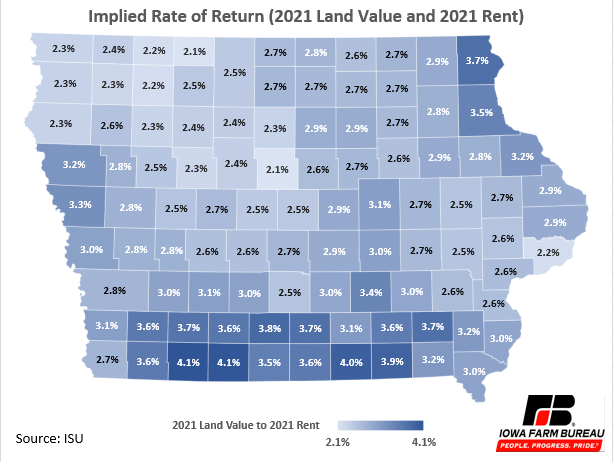

Land values vary across the state (Figure 5). Factors like CSR and the presence of tile impact the potential profitability of land and as a result, the value of land. However, land purchasers can also influence land prices based on their expectations of immediate cash returns from the land and expectations of capital gains from land appreciation over time. In different areas of the state, land owners appear to be willing to accept lower cash rates of return (interest rates) on their investments if their land purchases seem “less risky” and they have expectations of more stable rents and land appreciation over time. The rate of return a person accepts on land is implied by the price they pay for the land and the rent they charge (or would have paid if they farm the land themselves).

For example, an investor who pays $10,000 per acre for land and collects rent $300 per acre per year is accepting a rate of return (interest rate) of $300/$10,000, or 3% on the money invested in the land. This calculation only looks at the rate of return of the land investment, additional returns from farming the purchased land are not included in this calculation.

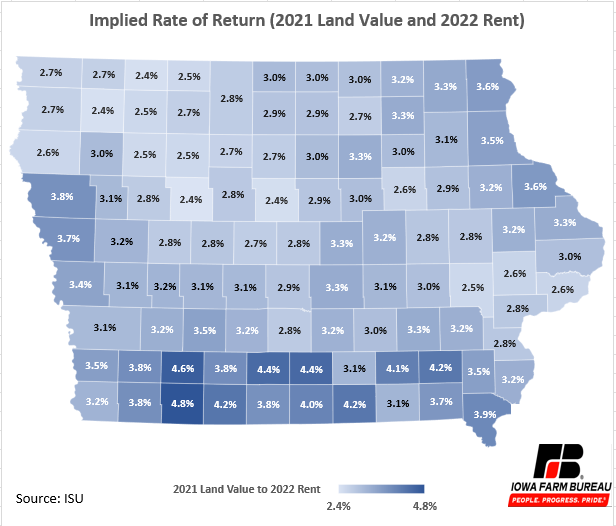

The implied rate of return accepted by purchasers varies by county. Figure 6 and Figure 7 show the implied cash rate of return accepted by land purchasers by comparing 2021 county average land values to 2021 county average rental rates and 2022 county average rental rates. Rental rates increased across the State in 2022, so 2022 returns are slightly higher than 2021 returns. Counties in areas with higher land values compared to the rest the state appear to have the lowest cash rates of return. While rental rates in counties with high land values may be higher than other counties, the rents are not high enough to maintain a return on investment as high as counties with lower land values. Put another way, counties with the highest land values appear to have land purchasers willing to accept lower rates of return on their investment (the ownership of land is deemed less risky) than in counties will lower land values.

While cash returns on investment in some counties is lower than others, the range across Iowa counties has been consistent with the 30-year interest rate. Over the last two years, 30-year interest rates have been between 2-3%. This is comparable with the low end of average interest rates accepted land purchasers in Iowa. If interest rates increase this could cause land values to decrease or rents to increase as investors look to maintain a rate of return consistent with 30-year interest rate.

Figure 5. 2021 Land Value by County ($/acre)

Figure 6. Implied Rate of Return (2021 Land Value and 2021 Rent)

Figure 7. Implied Rate of Return (2021 Land Value and 2022 Rent)

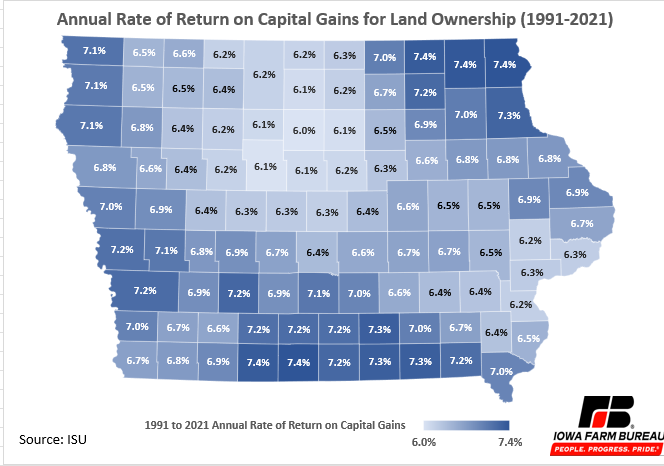

A second return to land ownership is that which accrues to capital appreciation. In Iowa, land held for the past 30 years has seen a general annual appreciation rate of 6.0% to 7.4% depending on the county the land is in (Figure 8). Thirty of Iowa’s counties had annual rates of return greater than 7.0% for the period of 1991 through 2021. Every county in the state had annual average appreciation rates for farmland that were 6.0% or greater.

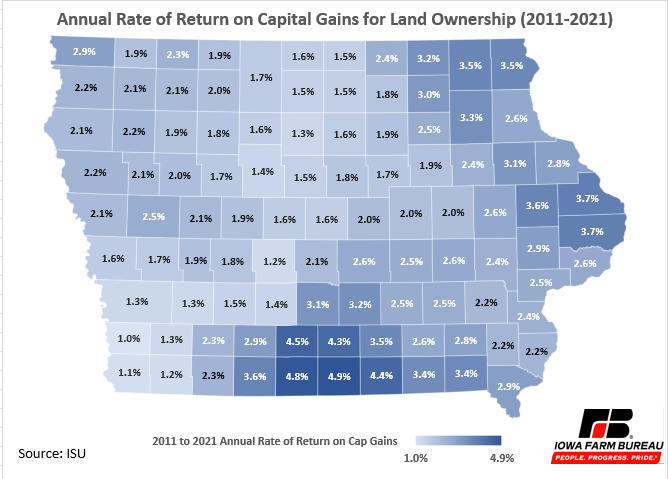

The average rate of return due to appreciation in land values for the period of 2011 through 2021 is shown in Figure 9. The highest rates of return due to appreciation have been in southcentral Iowa with rates of capital appreciation between 4.3% and 4.9% per year.

Figure 8. Annual Rate of Return on Capital Gains for Land Ownership (1991-2021)

Figure 9. Annual Rate of Return on Capital Gains for Land Ownership (2011-2021)

Given that land values are inversely related with interest rates, land values are expected to decrease when interest rates increase. It is still unclear when or if land values will decrease in response to increases in the federal funds rate by the Federal Reserve since one of the drivers of rate increases by the Fed is very high rates of inflation which tend to be positively correlated to increasing crop prices and cash rents. While all interest rates are related to the Federal Funds rate, long term interest rates do not move as closely with the Federal Funds rate as short term interest rates. Changes enacted by the Federal Reserve may take time to affect long-term rates and land values. Furthermore, land rental rates will also play a part in the movement of land values. If corn and soybean profit margins remain strong, rents may increase. If rents increase this could negate the effect of rising interest rates on land values and keep land values at current levels or even move land values higher.

Economic analysis provided by Aaron Gerdts, Research Analyst, Decision Innovation Solutions on behalf of Iowa Farm Bureau.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!