How Has Income Compared to Inflation?

Author

Published

12/18/2023

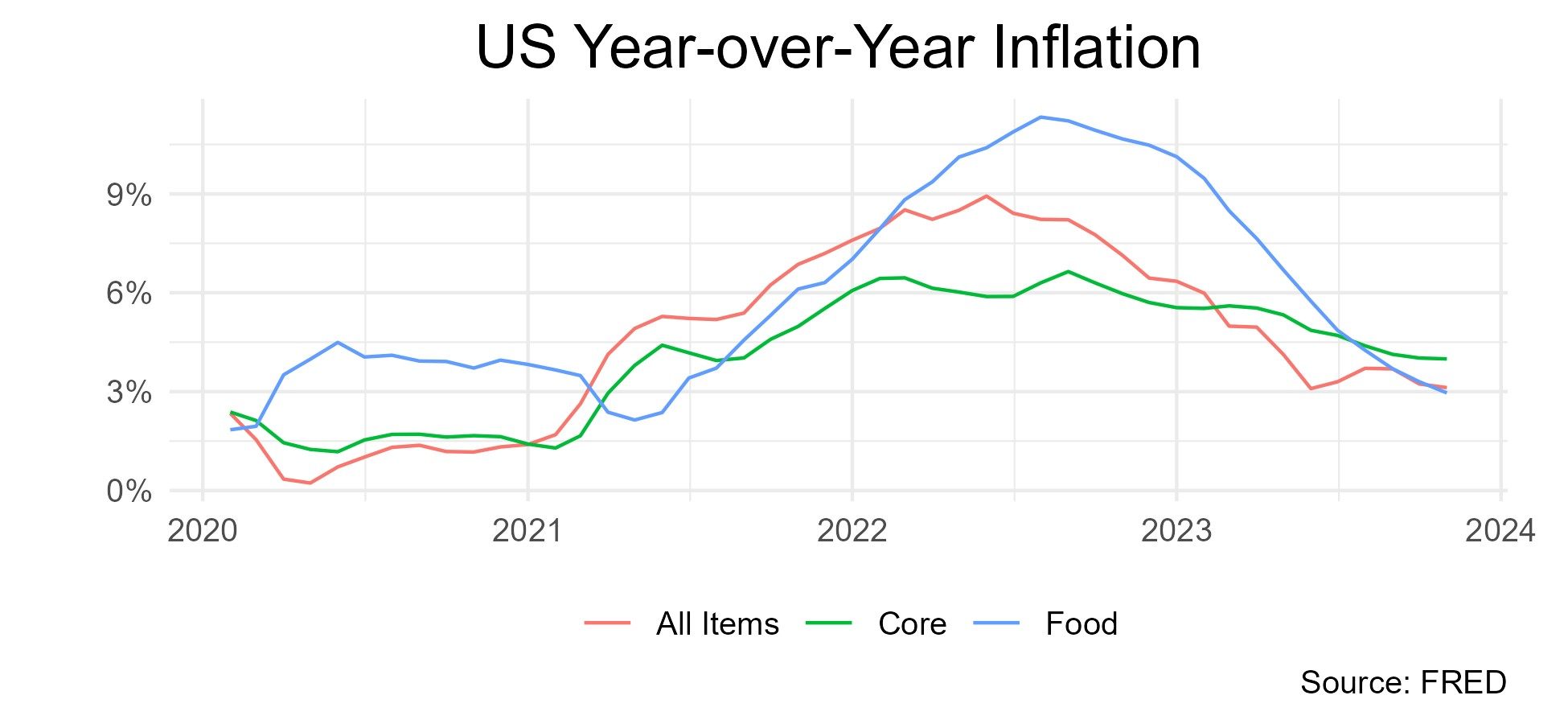

Inflation is the weighted average rise in prices of all goods in the market. If inflation rises faster than income, real income falls and employees are more likely to seek higher wages. Inflation rose to relatively high levels in 2022 (Figure 1). One category that was particularly affected was food, which for most of 2022, showed higher inflation levels than the CPI average. And, while the rate of food inflation has come down from lofty levels, year-over-year food inflation is still running near 3% which means consumers continue to see higher prices in the grocery market.

Figure 1. US Year-Over-Year Inflation

Another factor was the large government payments that increased personal incomes in 2021. These payments increased personal income for a short period. It potentially allowed employees the option to stop working either permanently or temporarily, which decreased the supply of available workers and increased the price of labor. This combined with high inflation gave employees bargaining power to increase their wages.

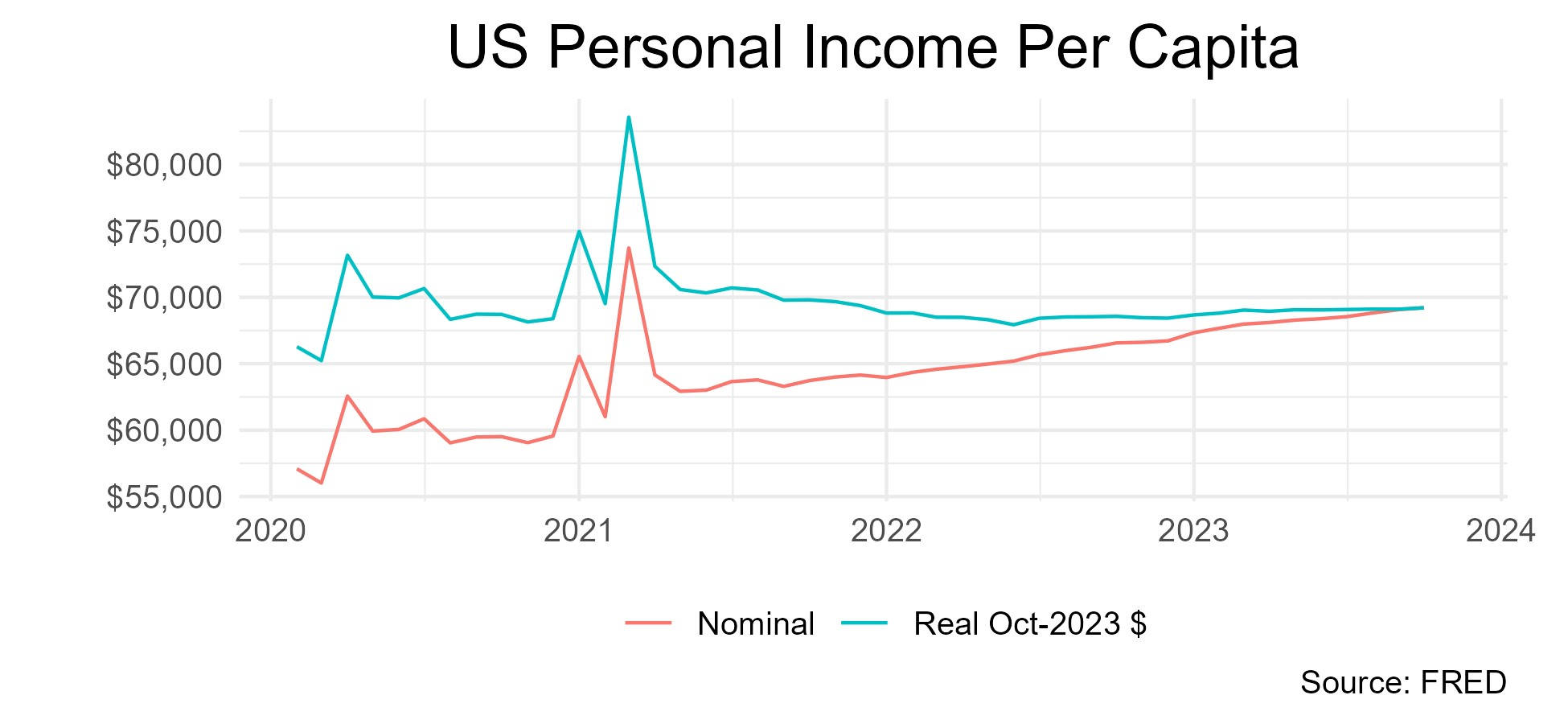

Figure 2 shows both nominal and real personal incomes. The real income is put into today’s dollars (today = October 2023). This is why real and nominal income are equal at the most recent month.

The large government payments are relatively easy to see in this graph as well. They are the large spikes in 2021.

Examining real personal income, we can see that it has done a pretty good job keeping up with inflation. Except for in early 2022, when inflation was extremely strong, real income has been relatively staple. Keep in mind, this is only because nominal income grew consistently.

Also, this will not be true for all employees. Some employees may have gotten significant raises while others could have received little to no raises. This simply represents the average for the US.

Figure 2. US Personal Income Per Capita

US real income has historically trended up over time. If the US economy is healthy, eventually real income will likely start growing again. This will be easier if inflation subsides so nominal incomes do not have to increase as much for real incomes to increase.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!