Hog and Pig Report, June 2022

Author

Published

7/2/2022

Hog & Pig Report – June 2022

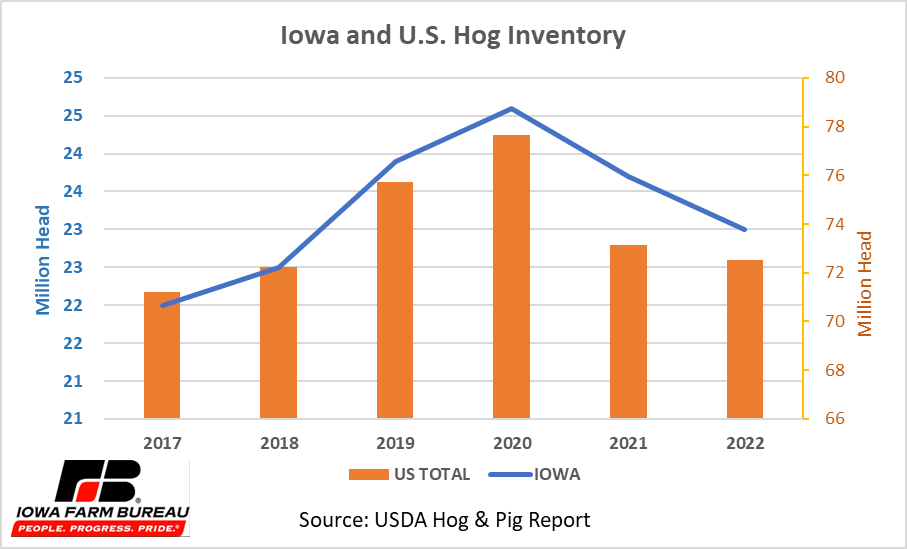

The inventory of all hogs and pigs in the U.S. on June 1, 2022 was 72.5 million head. This was down 1 percent from June 1, 2021, and down slightly from March 1, 2022. Iowa’s hog inventory was 23 million head, down 3% from 2021 and down 0.4% from March 2022. Iowa now holds 31.7% of the U.S. hog inventory.

The inventory of all hogs and pigs in the U.S. on June 1, 2022 was 72.5 million head. This was down 1 percent from June 1, 2021, and down slightly from March 1, 2022. Iowa’s hog inventory was 23 million head, down 3% from 2021 and down 0.4% from March 2022. Iowa now holds 31.7% of the U.S. hog inventory.

Figure 1. Iowa and U.S. Hog Inventory

The U.S. hog breeding inventory was estimated to be 6.17 million head, down 1 percent from last year, but up 1 percent from the previous quarter. Iowa’s hog breeding herd was estimated to be 940,000 head, up 3.3% from a year ago, and up 4.4% from the previous quarter. Iowa holds 15.2% of the U.S. hog breeding herd.

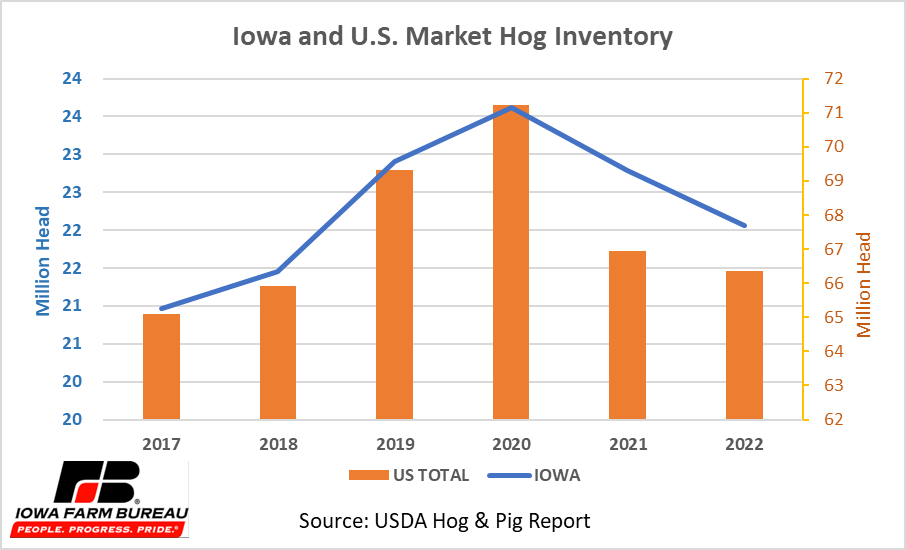

Market hog inventory in the U.S. was 66.4 million head, down 1 percent from last year, and down slightly from last quarter. Iowa’s market hog inventory was 22.06 million head, down 3.2% from a year ago, and down 0.6% from last quarter. Iowa holds 33.2% of U.S. market hogs.

Market hog inventory in the U.S. was 66.4 million head, down 1 percent from last year, and down slightly from last quarter. Iowa’s market hog inventory was 22.06 million head, down 3.2% from a year ago, and down 0.6% from last quarter. Iowa holds 33.2% of U.S. market hogs.

Figure 2. Iowa and U.S. Market Hog Inventory

The U.S. March-May 2022 pig crop, at 32.9 million head, was down 1 percent from 2021. Sows farrowing during this period totaled 2.99 million head, down 1 percent from 2021. The sows farrowed during this quarter represented 49 percent of the breeding herd. The average pigs saved per litter was 11.00 for the March-May period, compared to 10.95 last year. For Iowa, the March-May pig crop was 5,782,000 head, down 0.6% from last year. This was from 475,000 sows farrowing, resulting in 11.3 pigs per litter.

For the June-August 2022 period, Iowa is expected to farrow 510,000 sows which would be 1% more than a year earlier. However, farrowing intentions for the September-November 2022 period are forecasted to be down 3% from a year earlier.

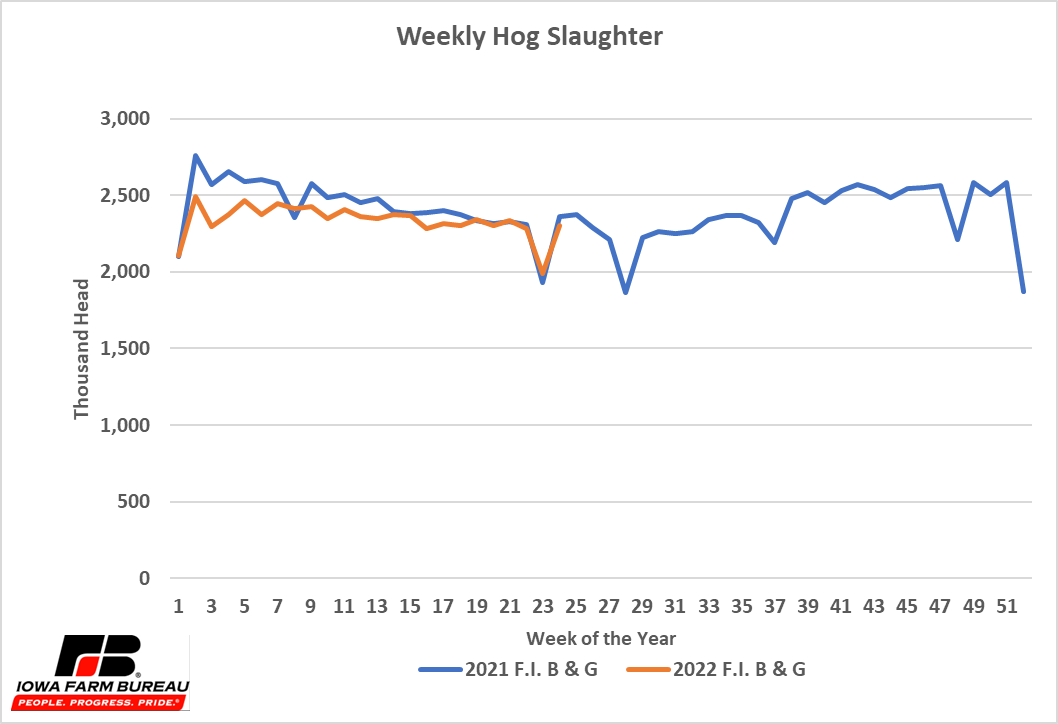

Market hog slaughter started 2022 running nearly 10% below 2021 weekly rates. By February, weekly market hog slaughter was running 4.5% below 2021 levels. Since the first week of May, market hog slaughter rates have been about equal to 2021 slaughter rates.

Market hog slaughter started 2022 running nearly 10% below 2021 weekly rates. By February, weekly market hog slaughter was running 4.5% below 2021 levels. Since the first week of May, market hog slaughter rates have been about equal to 2021 slaughter rates.

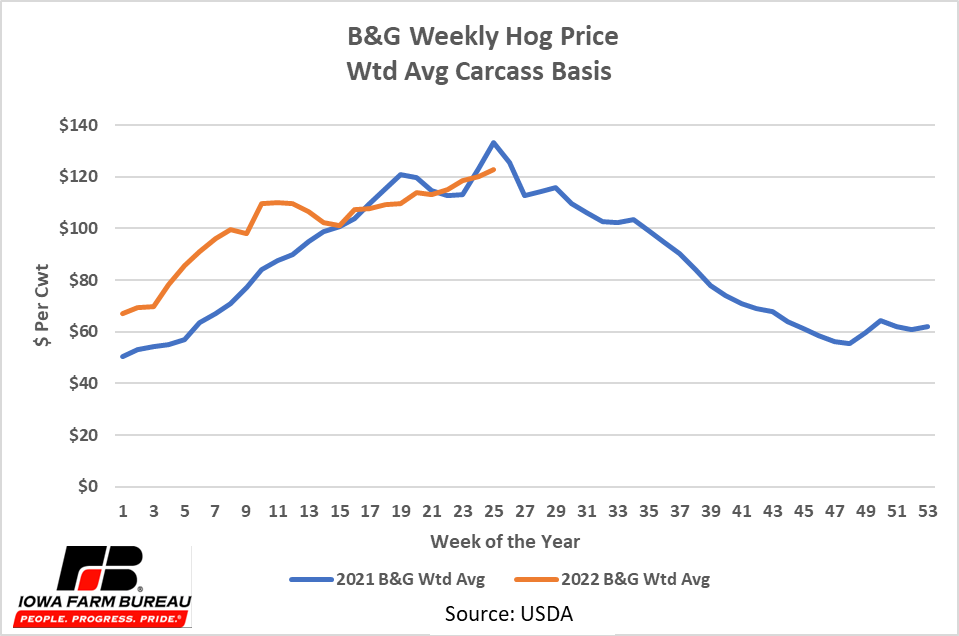

Weekly market hog prices (weighted average, carcass weight) started 2022 33% higher than January 2021 prices. The price premium in 2022 grew to more than 50% by early February but fell below year ago levels by mid-April. Market hog prices over the past 4 weeks have been both higher than and lower than year-ago prices. It is likely that market hog prices in the second half of 2022 will run above year-ago levels.

Weekly market hog prices (weighted average, carcass weight) started 2022 33% higher than January 2021 prices. The price premium in 2022 grew to more than 50% by early February but fell below year ago levels by mid-April. Market hog prices over the past 4 weeks have been both higher than and lower than year-ago prices. It is likely that market hog prices in the second half of 2022 will run above year-ago levels.

Figure 4. B&G Weekly Hog Price

Economic analysis provided by David Miller, Consulting Chief Economist, Decision Innovation Solutions on behalf of Iowa Farm Bureau.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!