Hog Market Update: March 2023

Author

Published

3/31/2023

Hog Inventory

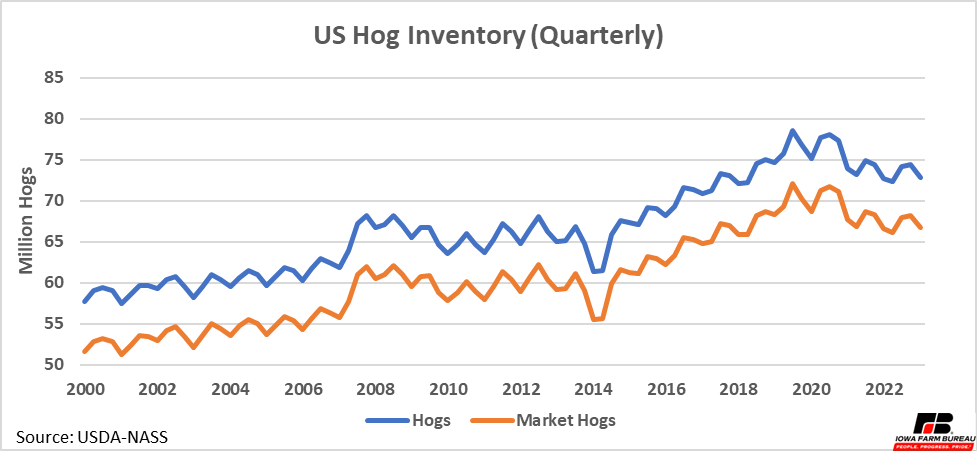

The inventory of all hogs and pigs in the U.S. on March 1, 2023, was 72.9 million head (Figure 1). This was up slightly compared to last year, but down 2% from last quarter.

Market hogs make up the majority of US hogs, representing 92% of all US hogs. Movements in total hog inventory is totally due to changes in market hog inventory. Market hog inventory on March 1, 2023, was 66.7 million head, also up slightly from last year. Breeding hog inventory totaled 6.1 million head, up slightly from last year.

Figure 1. U.S. Hog Inventory (Quarterly)

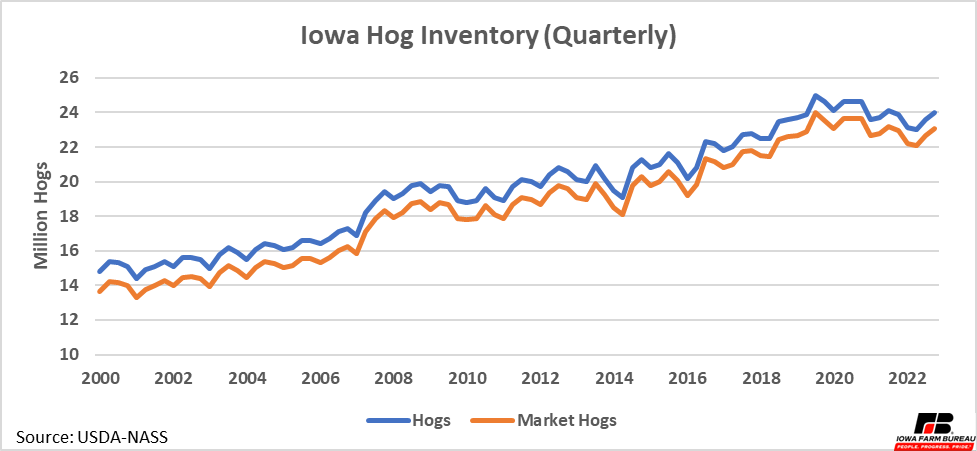

Iowa hog inventory on March 1, 2023, was 23.4 million head, up 1% from last year (Figure 2). In Iowa, 96% of all hogs in Iowa are market hogs. This is a higher than the US share as Iowa finishes the vast majority of the hogs born in-state but also brings in feeder pigs from neighboring states and Canada for finishing. Market hog inventory was 22.5 million head, up 1% from last year. Breeding hog inventory was 900,000 head, unchanged from the last year.

Figure 2. Iowa Hog Inventory (Quarterly)

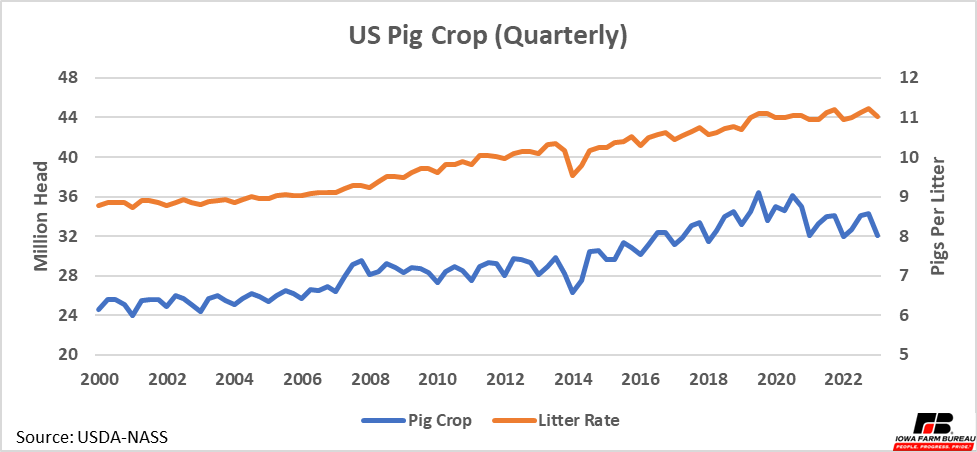

Pig Crop

The US December-Feb pig crop was 32.1 million head, up slightly from last year (Figure 3). Litter size averaged 11.0 pigs per litter, up from 10.95 a year ago. The Dec-Feb quarter typically has the lowest pig crop due to fewer sows farrowing and a litter rate has seasonally been lower in this quarter. In general, US litter rates have increased year-over-year. Compared to the same quarter 10 years ago, litter rates are up over 9%.

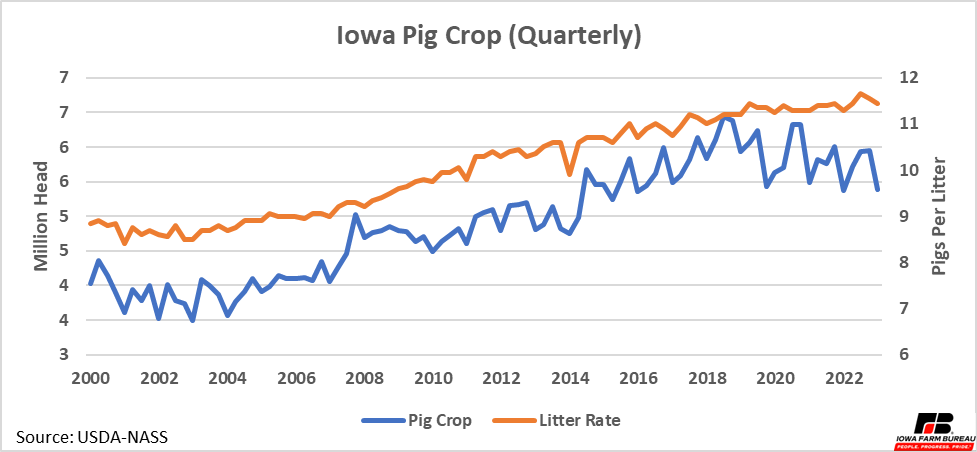

In Iowa, the December-February pig crop was 5.4 million head, up 3% from last year (Figure 4). Like the U.S., Iowa’s litter rate has continued to climb, resulting in larger pig crops despite steady sow inventories. Compared to the same quarter 10 years ago, litter rates in Iowa are up almost 11%.

Figure 3. U.S. Pig Crop (Quarterly)

Figure 4. Iowa Pig Crop (Quarterly)

Exports

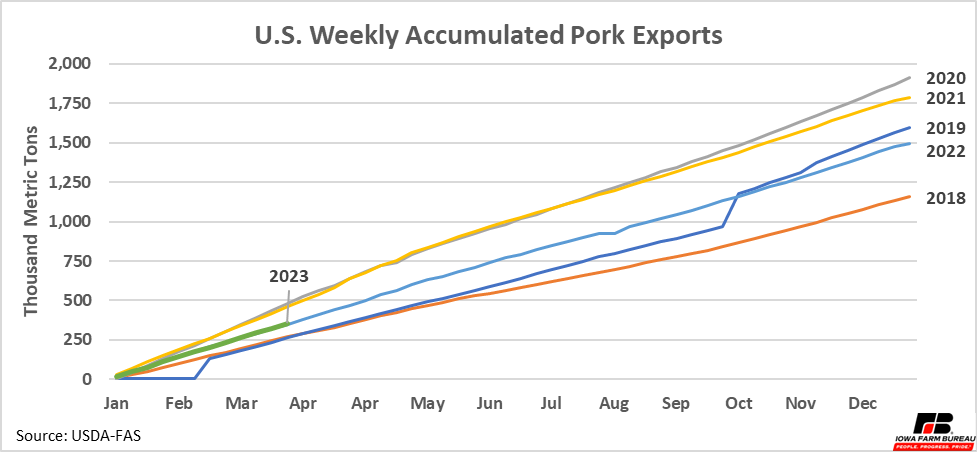

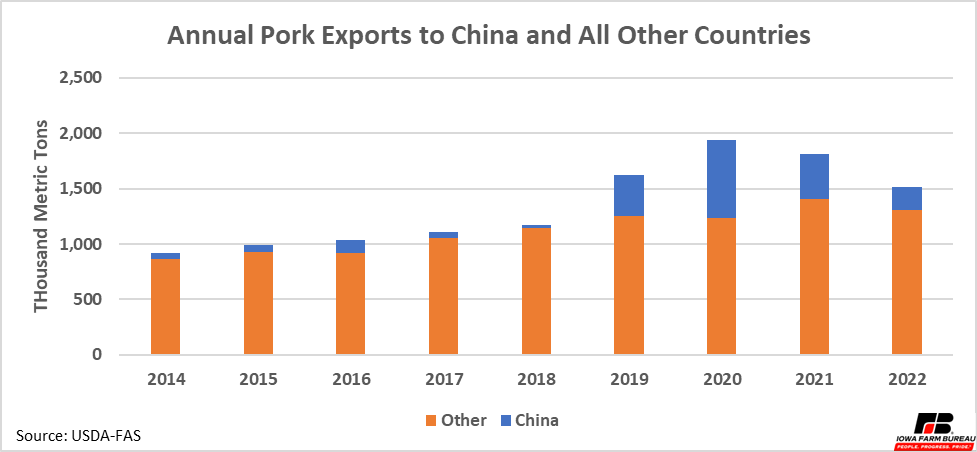

Pork exports have started the year on par with exports in 2022 (Figure 5). Pork exports in 2020 and 2021 were especially strong compared to exports in 2018 and 2019. African Swine Fever (ASF) cases greatly impacted China’s herd during that period and led China to import more pork from the US (Figure 6). However, China’s herd has been recovering from the outbreak, lowering Chinese demand for US pork in 2022.

Earlier this month, reports of ASF returning to China were circling, but these were later determined to be untrue. Exports this year are still forecast to be similar to those in 2022.

Figure 5. U.S. Weekly Accumulated Pork Exports

Figure 6. Annal Pork Exports to China and All Other Countries

Cash Prices

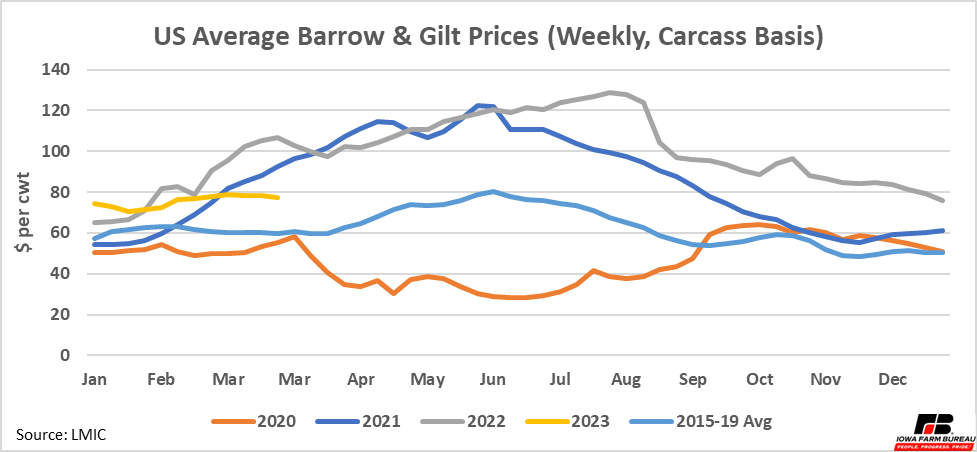

Weekly market hog prices have followed a seasonal pattern, typically peaking in July and recording lows in December and January (Figure 7). COVID-19 broke this price pattern in 2020, when reduced slaughter capacity sent prices to lows in the summer of 2020. However, all other years from 2015-2022 have followed the general trend.

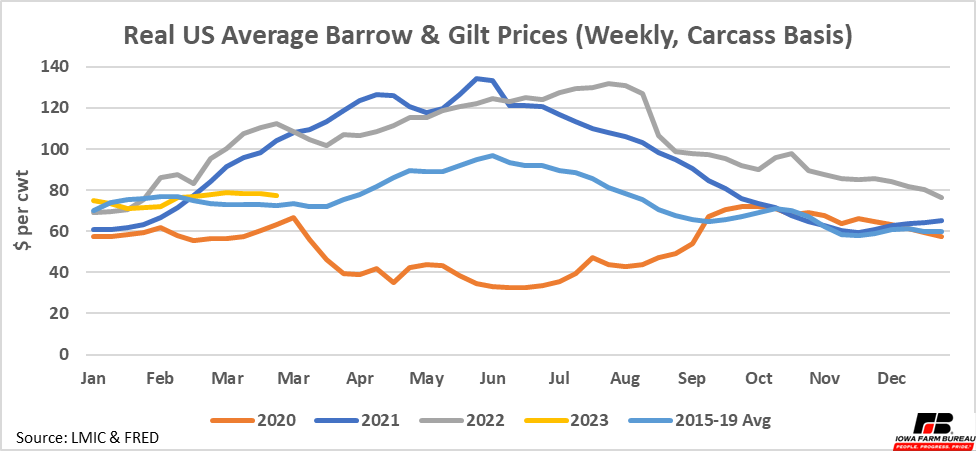

Both 2021 and 2022 saw especially high peaks, even after accounting for the relatively high inflation the US has had over the past two years (Figure 8). Hog prices started 2023 above prior years’ prices but have not increased as rapidly in the first quarter as they did in 2021 and 2022. After adjusting prices for inflation, they are very close to the 2015-2019 average.

Figure 7. US Average Barrow & Gilt Prices

Figure 8. Real US Average Barrow & Gilt Prices

Futures

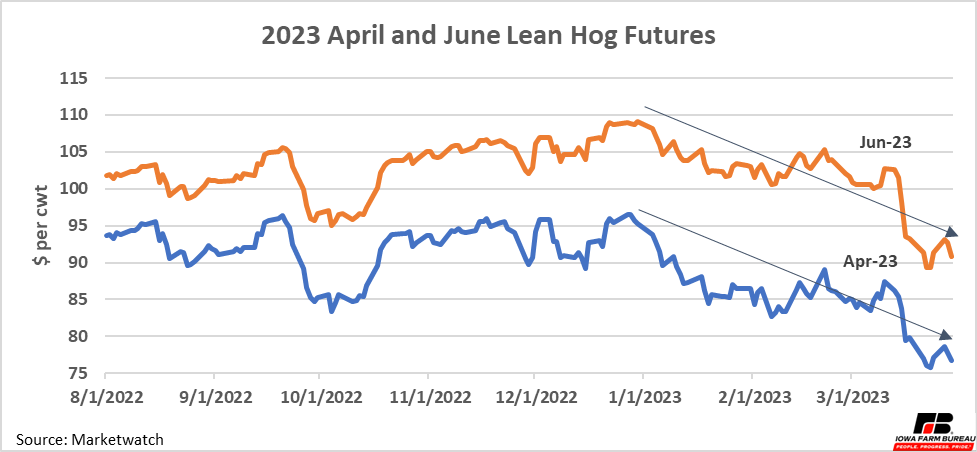

Hog futures show a long-term downward trend that started last December. Summer futures contracts are higher than spring futures, indicating the typical seasonal increase in prices is likely to occur again this year (Figure 9).

Figure 9. 2023 April and June Lean Hog Futures

Take Aways

Hog inventories show a seasonal movement, typically lowest in March and highest in September. Litter rates follow a similar pattern. Year-over-year hog inventories are up slightly from last year but still below recent peaks in 2019 and 2020 in both the US and Iowa. Growth in litter rates remains small but steady.

So far, 2023 total pork exports are following the same pace set by 2022 pork exports. Exports in 2022 were lower than 2020 and 2021, but in those years China had higher than usual demand because its domestic pork production had been impacted by ASF. Now that its herd is recovering, less demand from China for US pork should be expected.

Hog prices have started this year relatively high, but after accounting for inflation are not as high as 2021 and 2022. Despite hog futures generally trending down, summer-time contracts are still higher than other months, indicating the typical seasonal price increase will likely occur again this summer.

Lean hog futures are currently in a downward trend that started at the end of December. This could push summer-time cash hog prices below year ago by summer, even though we are likely to see some level of seasonal strength between now and early summer. However, unforeseen factors could impact prices before this summer.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!