Hog Returns Rise by 97% from Previous Month

Author

Published

8/22/2025

Iowa State University publishes monthly estimates of cost returns on hogs that provides a general outlook on the margins that many producers are experiencing.

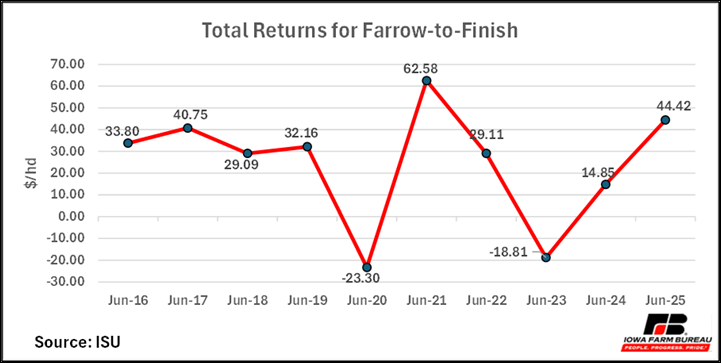

Total returns for farrow-to-finish producers rose to $44.42 per head in June 2025, the highest since July 2021 (Figure 1). Returns nearly doubled from May ($22.51) to June, increasing by 97.3%. This report marks 15 consecutive months of positive returns, the longest streak since another 15-month stretch from January 2017 to March 2018. Hog profits have been positive for eight of the last ten June’s, reaching a high in 2021 at $62.58 per head.

Figure 1. Total Returns for Farrow-to-Finish Producers

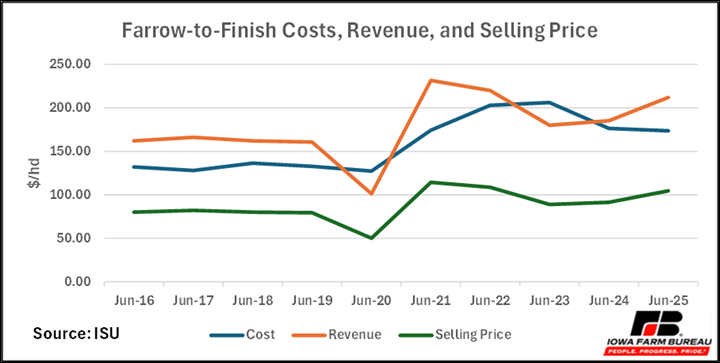

Despite elevated hog returns, total costs rose to $173.72 per head in June (Figure 2). Corn and soybean meal prices declined, leading to feed costs decreasing by 63 cents. However, nonfeed costs and death loss rose by $2.32 and $1.24 respectively, resulting in the slight boost to total costs. The death loss value may have increased due to concerns regarding Porcine Reproductive and Respiratory Syndrome (PRRS) cases being higher than expected. Revenue surged to $211.97 per head, an increase of 13.29% from May and 14.50% from June 2024. The selling price is currently $104.68 per carcass cwt, a $13.26 jump from last June.

Figure 2: Farrow-to-Finish Costs, Revenue, and Selling Price

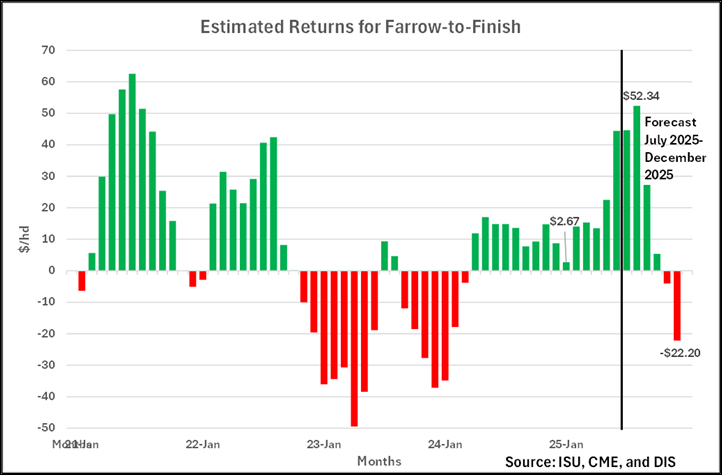

To predict the returns of farrow-to-finish producers, this forecast uses daily cash grain bids and futures prices of corn and soybean meal to project feed costs, while using a 12-month rolling average to estimate nonfeed costs. This forecast also uses negotiated hog prices instead of formulated hog prices to project hog prices throughout the rest of 2025. These assumptions can result in returns having larger swings than what takes place in the actual market.

The estimated returns for farrow-to-finish producers results in returns marginally increasing to $44.65 per head in July before peaking at $52.34 per head in August. Projected returns begin a downward trend in September, falling to $27.27 per head and officially turning negative in November, representing the end of a 19-month stretch of positive returns. December returns fall to -$22.20, marking a disappointing finish to an otherwise favorable year.

The sharp drop in returns is largely due to October-December hog futures prices being $20-$28 less than current hog prices and seasonal hog basis trends. The five-year average of monthly hog basis shows it widening in October (-$4.51), November (-$5.17), and December (-$10.53) and being much weaker than the hog basis in the summer months.

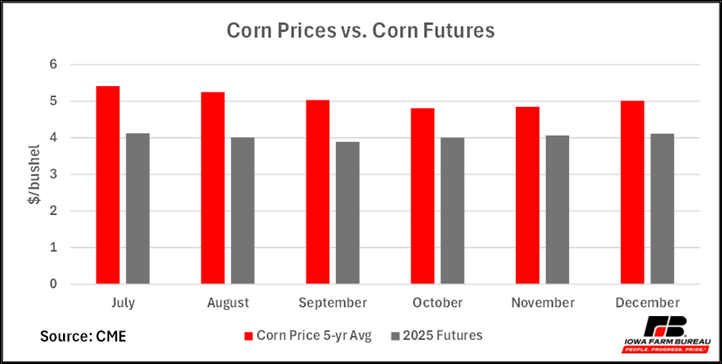

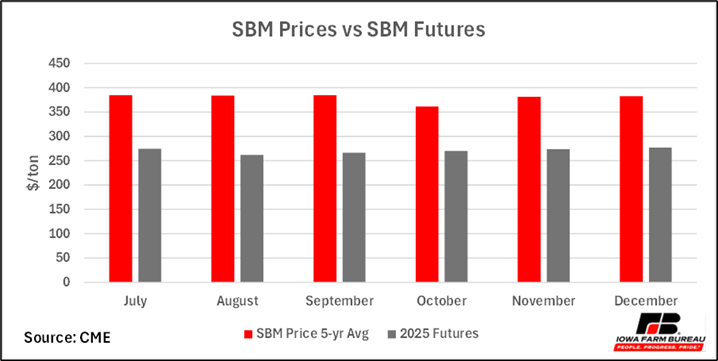

As seen in figures 4 and 5, corn and soybean meal futures are well below the five-year monthly price averages, leading to the expectation that total costs will decline and be an average of $165.08 per head over the final half of the year.

Figure 3. Estimated Returns for Farrow-to-Finish in Iowa

Figure 4. Comparing Five-Year Average Corn Price vs 2025 Futures

Figure 5. Comparing Five-Yr Average Soybean Meal Prices vs. Soybean Meal Futures

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!