Higher Interest Rates Increase Storage Costs

Author

Published

1/2/2024

Storing grain has multiple costs associated with it. These include:

- Rent or commercial storage charges if storage is not owned

- Additional drying and shrinkage

- Additional handling and transportation

- Quality deterioration

- Additional Electricity

- Additional Labor

- Interest on Grain Inventory

The last one, interest on grain inventory, is the subject of this article. Interest on grain inventory is the interest costs accumulated by not selling grain. Costs could be accrued in two different ways.

If a farmer has an operating loan, the additional interest accumulated on the operating loan after harvest is the interest cost of storage. The loan could be paid off at harvest if grain is sold immediately and not stored.

For farmers without an operating loan, interest costs are the missed opportunity of placing funds from sales into a savings account or other short-term low-risk investment that would provide additional revenue to the farm.

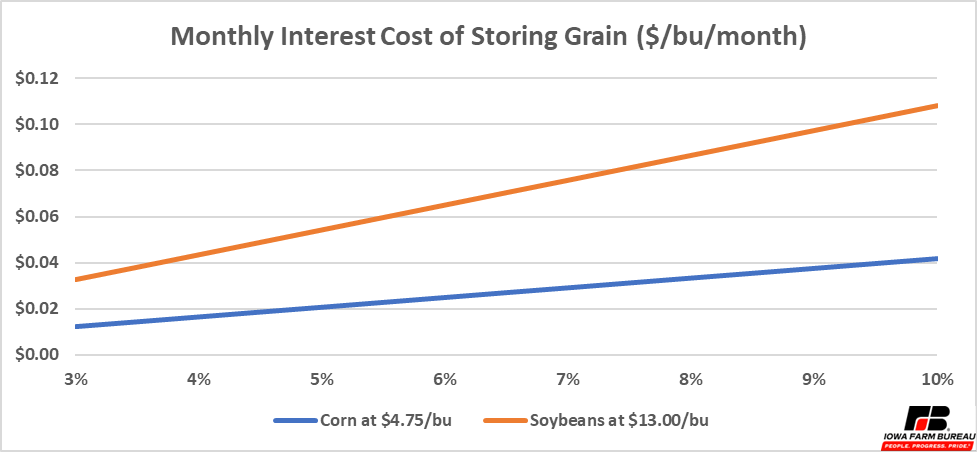

As US interest rates have increased over the past two years, the interest cost of stored grain has also increased. Figure 1 shows how the monthly interest cost of stored grain changes are interest rates increase. This assumes harvest prices of $4.75/bu for corn and $13.00/bu for soybeans.

Figure 1. Monthly Interest Cost of Storing Grain

These costs seem close when looking at only the monthly cost of one bushel. However, when considering multiple months of storage, higher interest costs quickly add up.

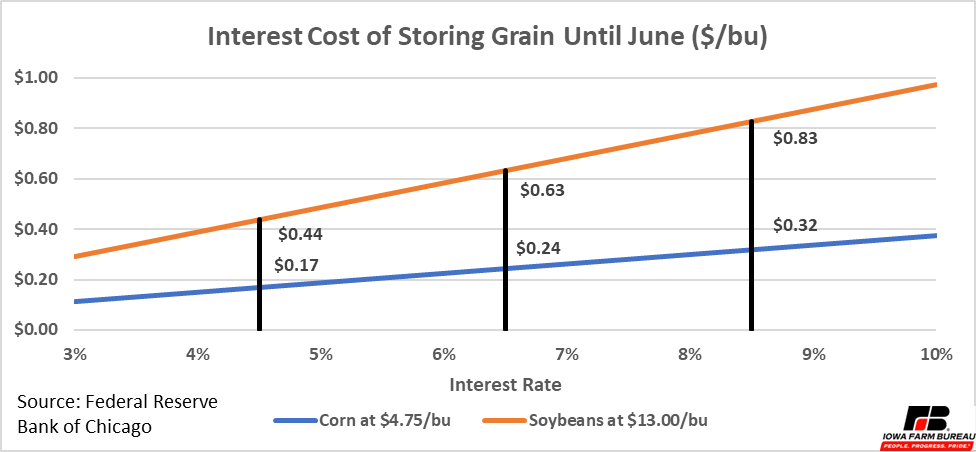

Figure 2 shows the cost of storing grain until June (9 months). Interest costs of storing grain are called out at 4.5%, 5.5%, and 6.5%.

Notice at 4.5%, the interest cost of storing $4.75/bu corn until June was $0.16/bu. In other words, you need a price that is $0.16 higher in June than at harvest to just cover the interest costs of storing the grain. This doesn’t account for other costs associated with storage that also need to be covered.

If interest rates increase to 6.5%, but all other costs remain the same, you now need $0.30 to cover the same corn for the same length of time. This means you need an additional $0.16/bu of gain in the market. Similar calculations are also true for soybeans.

Figure 2. Interest Cost of Storing Grain

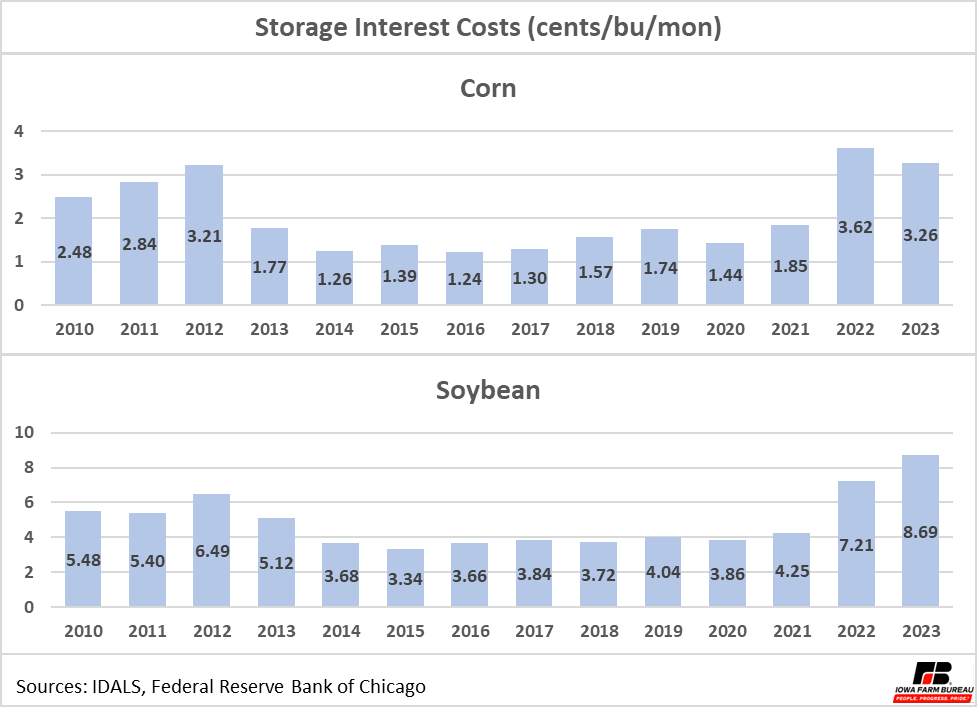

In practice, storage interest costs increase when the interest rates increase and when the price of grain increases. To examine the relative size of this year’s storage interest costs, this year’s costs were compared to pervious year’s costs using October cash prices and average operating loan interest rates from Q3 each year (Figure 3).

For corn, storage interest costs will be the second highest since 2010. Only last year had higher costs due to higher prices of corn.

For soybeans, this year is projected to have the highest costs since 2010. The increase in interest rates was enough to offset the moderately lower prices compared to last year.

Figure 3. Storage Interest Costs

As we transition into a world where interest rates are no longer near zero and commodity prices move higher, storage interest costs may need to be considered more closely to ensure profitability is maximized. Note that even with higher storage interest costs, storage can still be a good option to increase farm income. It just takes a bigger move in the cash price of the commodity to cover the higher costs of storage as interest rates increase.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!