Finding potential bright spots in dismal 2020 corn revenue outlook

Author

Published

5/21/2020

Can there a hopeful revenue perspective for farmers even with the 2020 corn prices at current levels? In these unprecedented times of trade problems, demand destruction, a probable large crop, Covid-19 impacts and more, prices have been driven to low levels not seen in years!

Farmers would always rather get their returns from the market but hope for some 2020 crop revenue may need to come from risk management decisions already made and decisions yet to come.

Note: For a brief 19 minute recorded presentation with more information on this topic, please click here.

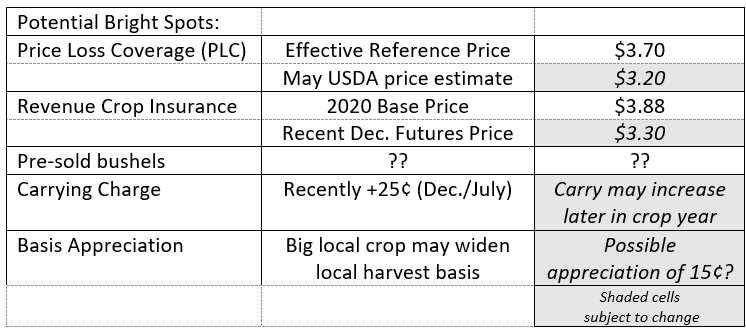

Price Loss Coverage (PLC): Most Iowa farmers elected Price Loss Coverage for their farm program for 2019 & 2020. The PLC effective reference price for 2020 corn is $3.70. A PLC payment is made if the market year average (MYA) price is less than that level. The MYA price won’t be determined until the end of the 2020 crop year, but as a proxy the most recent USDA estimate $3.20. The final MYA price, your farm program yield and the fact that the payment is made on 85% of corn base acres all will be factors in potential PLC payments.

Revenue Crop Insurance Coverage: Over 90% of Iowa farmers buy crop insurance and more than 90% of those policies are revenue-type coverage. The 2020 corn base price (Feb. average of Dec. corn futures) is set at $3.88. The corn market is anticipating a large crop and a recent December futures price was approximately $3.30. That price will change and determine the fall crop insurance price in October. If we use $3.30 as fall price guess, price is already 15% below the base price. Depending upon your yield, your level of coverage and the fall price, crop insurance may be a help for 2020 revenue.

Pre-sold bushels: The best opportunities were very early, but for those that have risk management positions in place on a portion of new crop bushels, that is another source of financial stability.

Carrying Charge: If storage is a part of your 2020 corn plan, monitor the carrying charge for 2020 crop. At this writing, the carrying charge from December corn futures to July corn futures has grown to 25 cents. Not every year, but the historical seasonal tendency for this carry is to get wider during the growing season and a storage hedge can lock in a desirable carry. Always factor in your costs of ownership.

Basis Appreciation: A large local crop may result in a wide local basis this fall. Storage can be used judiciously to capture any basis gain by storing the crop – often with good results as elevators and processors demand bushels later in the crop year.

Even though exact amounts are undetermined, some or all of these factors may help to mitigate the weak corn prices…..and that is the reason for hope! Similar factors may also help with 2020 soybean crop revenue.

The last several years, yield has been the key to revenue for many farmers. Let’s hope that is the case this year, but also use all the tools available as building blocks toward revenue survival in 2020 and the opportunity to begin a plan for 2021.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!