Diesel Fuel Price Update

Author

Published

3/17/2023

Introduction

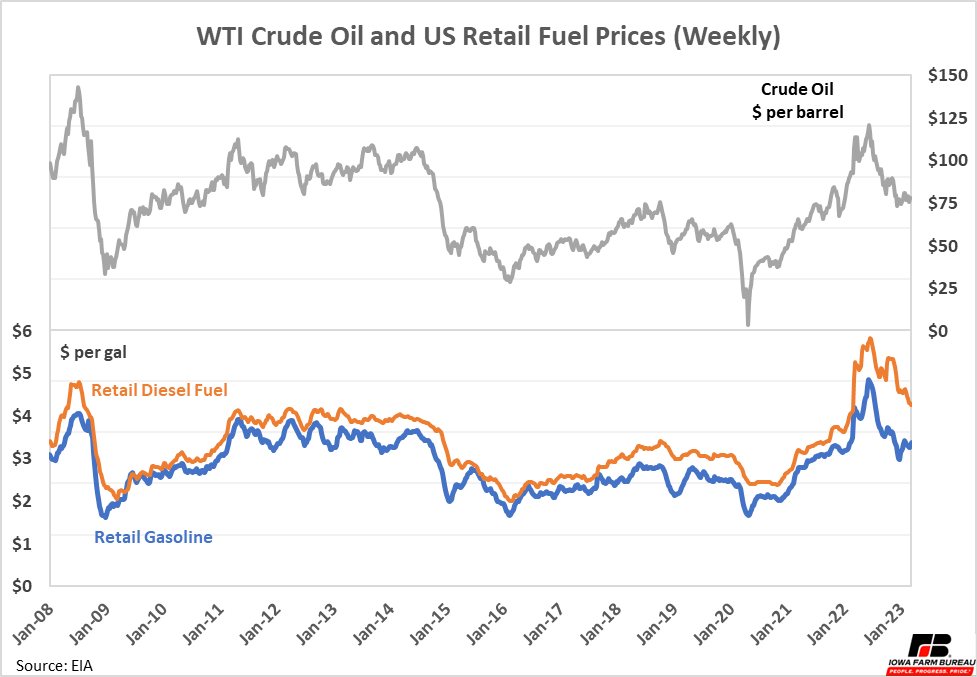

The combination of the US economy coming out of the pandemic and the Russia invasion of Ukraine pushed energy prices to highs in the summer of 2022. Since then, energy prices across the board have been working lower. Crude oil and fuel prices have been no exceptions, both coming down considerably since last summer (Figure 1), but both still significantly higher than average prices over the last 15 years.

Figure 1. WTI Crude Oil and US Retail Fuel Prices

Crude Oil Prices

Recession fears have been cited as the main factor pushing oil prices lower since about August. Recessions typically lead to less economic activity and less demand for liquid-fuels energy. The continued growth of inflation has the market closely watching moves by the Federal Reserve.

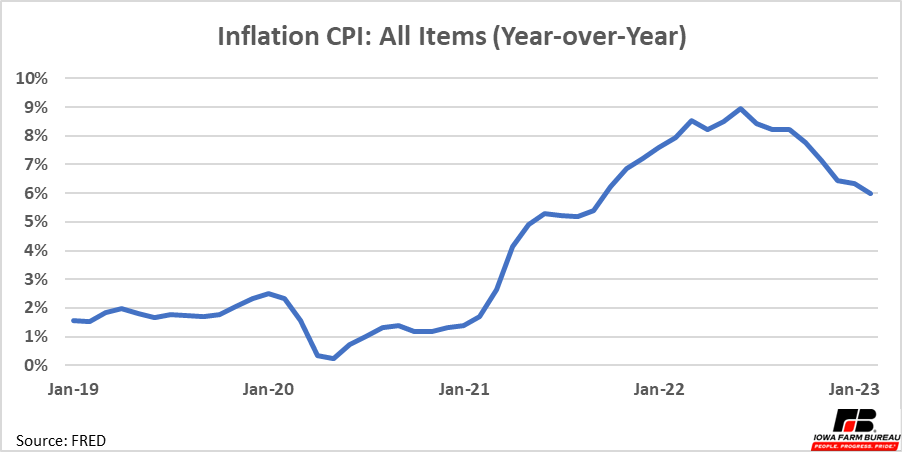

The Federal Reserve (Fed) has been aggressively raising interest rates to combat inflation. Since the beginning of 2022, the Federal Reserve has raised interest rates a total of eight times, from 0.25% at the beginning of the year to a current rate of 4.75%. Year-over-year inflation has slowed somewhat over the past few months (Figure 2). However, this measure of inflation remains high from a historical perspective.

Month-to-month inflation was 0.4% from January to February which was an improvement from 0.5% from the month before. However, inflation of 0.4% month-to-month equates to about 5% year-over-year. The Fed’s target is to get inflation back to their long-term target which is around 2% year over year, so inflation is still tracking higher than the Fed’s target. It is expected that rates will be raised again on March 22 when the Federal Reserve has its next meeting. This means higher interest rates will continue and recession fears will not be going away anytime soon.

Figure 2. Inflation CPI: All Items (Year-over-Year)

Diesel Fuel Prices

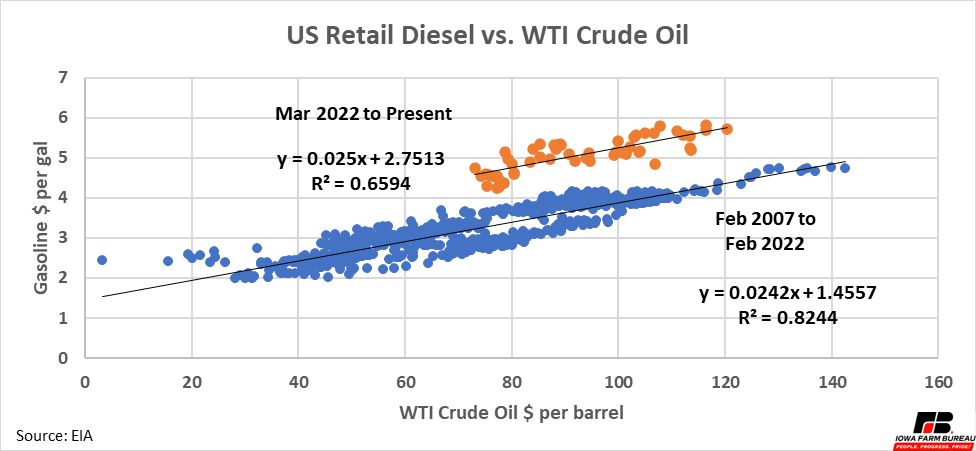

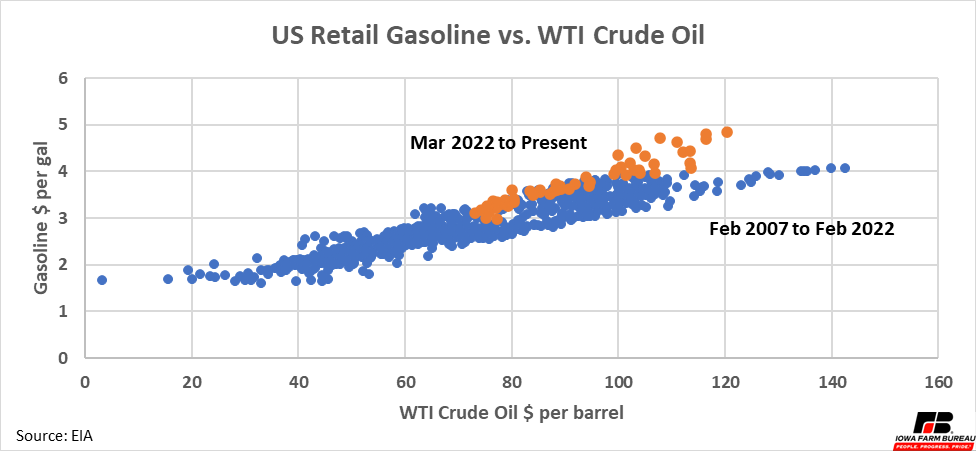

Despite crude oil prices falling, there still appears to be a new premium in the diesel fuel market. Diesel fuel prices historically moved at a fixed relationship with crude oil prices (Figure 3). However, since the Russia invasion of Ukraine, the prices of diesel fuel relative to crude oil have increased by about $1.30 per gallon. In other words, at every crude oil price, the price of diesel is about $1.30 higher than it was prior to the Russia invasion of Ukraine. Interestingly, while gasoline prices have a slight premium to crude oil since the invasion, the premium has not been nearly as large (Figure 4).

Figure 3. US Retail Diesel vs. WTI Crude Oil

Figure 4. US Retail Gasoline vs. WTI Crude Oil

Conclusion

Recession fears have pushed crude oil prices lower over the past 6 months, and diesel fuel and gasoline prices have followed crude oil prices down. However, diesel fuel prices remain well above their historic relationship with crude oil prices. This new relationship started around the time Russia invaded Ukraine and has continued ever since. Diesel fuel prices are about $1.30 more expensive per gallon relative to the historic relationship between crude oil and diesel fuel.

Looking ahead, recession fears are likely to continue to keep crude oil prices returning to recent highs, which should keep diesel prices off recent highs as well. It is looking more and more like this new premium between crude and diesel may be here to stay. However, if relationships were to return to normal, it looks like this is a premium of about $1.30 per gallon that could be removed.

Economic analysis provided by Aaron Gerdts, Research Analyst, Decision Innovation Solutions on behalf of Iowa Farm Bureau.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!