Corn Ending Stocks Decrease for Both the 24/25 and 25/26 Marketing Years

Author

Published

6/24/2025

The USDA released its updated WASDE report on June 12, 2025. It should be noted that wheat-by-class projections for the 2025/26 crop year will not be published until the July WASDE report.

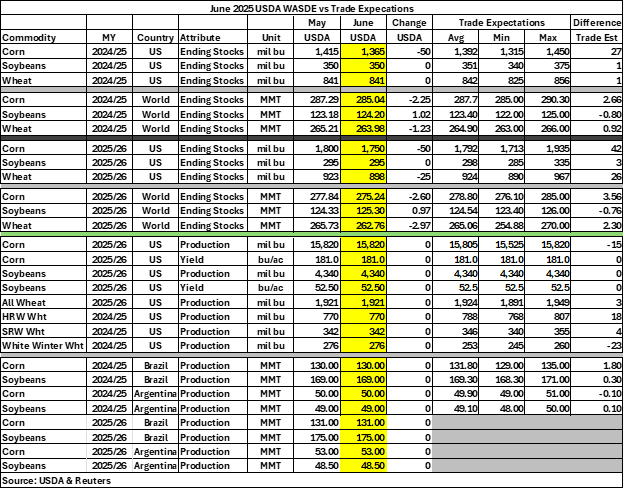

Table 1 shows U.S. soybean and wheat ending stocks remain unchanged for the 2024/25 marketing year, but corn ending stocks decreased by 50 million bushels (mb). Soybean and wheat ending stocks are only 1 mb under trade expectations, while corn is 27 mb below expectations.

World corn and wheat ending stocks for the 2024/25 marketing year slightly decreased by 2.25 million metric tons (MMT) to 285.04 MMT and 1.23 MMT to 263.98 MMT respectively. World soybean ending stocks increased by 1.02 MMT to 124.20 MMT. Corn and wheat ending stocks underperformed expectations by 2.66 MMT and 0.92 MMT respectively, while soybean ending stocks are 1.02 MMT over expectations

For the 2025/26 marketing year, U.S. corn and wheat ending stocks decreased by 50 mb and 25 mb respectively to 1,750 mb and 898 mb. Soybean ending stocks remain unchanged at 295 mb. Corn, soybean, and wheat ending stocks are all less than the amount experts predicted by 42 mb, 3 mb, and 26mb respectively.

Both world corn and wheat ending stocks decreased more than 2 MMT to 275.24 MMT and 262.76 MMT respectively, while soybean ending stocks increased by nearly 1 MMT to 125.30 MMT. Corn and wheat ending stocks are both below expectations by 3.56 MMT and 2.30 MMT respectively. Soybeans slightly outperformed the average expectation by 0.76 MMT.

Wheat production for the 2025/26 marketing year is estimated to be 1,921 mb, just short of expectations by 3 mb. As previously mentioned, wheat-by-class projections for the new crop will not be available until July. Therefore, for the 2024/25 marketing year hard red winter wheat, soft red winter wheat, and white winter wheat all remain unchanged. Both hard red winter wheat and soft red winter wheat fell short of expectations by 18 mb and 4 mb respectively. White winter wheat exceeded expectations by 23 mb.

Table 1 shows key report estimates along with trade analyst expectations.

Table 1. June 2025 USDA WASDE vs Market Expectations

Initial Market Reaction

The immediate reaction to the USDA report saw July corn futures drop from $4.40 to $4.36 less than half an hour after the WASDE report was released. July corn futures started to recover and increased to $4.38 by midafternoon. September corn futures followed a similar pattern, dropping from $4.27 to $4.24 before slowly rising to $4.26. December corn futures also followed the trend, dropping from $4.41 to $4.38 and then rising to $4.40.

Prior to the June WASDE being released, soybean futures were already dropping but rose slightly in anticipation of the report. All soybean futures for 2025 initially decreased by 6-7 cents. July soybean futures fell from $10.47 to $10.41 shortly after the report released, before rising to $10.43. August soybean futures decreased by 6 cents to $10.39 before increasing to $10.41 by midafternoon. September soybean futures followed a similar trend, dropping 7 cents to $10.16 before recovering to $10.19 throughout the afternoon. November soybean futures fell from $10.30 to $10.24 before making up ground and closing at $10.27. July soybean meal futures initially rose by $1/ton to $295.20/ton before fluctuating throughout the rest of the day. August soybean meal futures followed the same pattern, increasing from $297.60/ton to $298.80/ton before fluctuating until the market closed. July soybean oil futures decreased from 48.27 cents to 47.05 cents within half an hour of the WASDE releasing. Similarly, August soybean oil futures dropped from 48.44 cents to 47.25 cents shortly after the report was released.

July, September, and December wheat futures all fell by 5 cents within half an hour of the WASDE releasing, following the new crop falling shy of expectations by trade analysts. July wheat futures fell to $5.26; September wheat futures dropped to $5.41; and December wheat futures decreased to $5.63.

Changes to Domestic Balance Sheets

This section summarizes changes to the corn and soybean balance sheets in more detail.

For corn in the 2024/25 marketing year, the only changes are exports increasing by 50 mb to 2,650mb, leading to total use increasing from 15,240 mb to 15,290 mb. The other change is ending stocks decreasing by 50 mb to 1,365 mb.

For the 2025/26 marketing year, beginning stocks decreased by 50 mb to 1,365 mb, total supply decreased by 50 mb to 17,210 mb, and ending stocks decreased by 50 mb to 1,750 mb.

Table 2. June 2025 WASDE Corn Balance Sheet

There were no changes in the 2024/25 or 2025/26 soybean balance sheets.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!