Cash Strategist 1/5/21

Author

Published

1/4/2022

Year-end positioning has been a significant factor in the market over the past several weeks. This isn't uncommon and tends to have mixed results in price discovery.

Futures traders and the managed money crowd tend to shore up positions ahead of year end and then reestablish them if desired. This can create choppy trade and, of course, open windows for some marketing opportunities.

Several of the news factors that impacted trade in 2021 will again be factors in 2022. One of the most substantial of these will be the need for large global crops.

While world production of corn, soybeans and wheat increased in 2021, so did demand — to record levels. This is keeping our stocks-to-use on these commodities very snug and likely will for the next year, and potentially longer.

The trade is becoming somewhat accustomed to these tight inventories, though, which has reduced the market response that we typically see to low numbers.

Another factor that was an issue in 2021 and will carry over into the new year will be the global supply chain disruptions. This started with the COVID outbreak but intensified as last year progressed.

The most talked about of the disruptions was to electronic components, which caused delays in the deliveries of vehicles and farm equipment.

A greater concern is what the disruptions to supply chains did to inputs for global commodity production. There are now concerns that several of the world’s leading commodity producers won't have access to needed inputs to produce adequately sized crops. This isn't just in the United States, but all producing countries, including South America. Even with large plantings and favorable weather, there are concerns in the market that a lack of needed fertilizers will limit global production and put us right back in a rationing situation.

What may be the biggest factor for the commodity market this coming year is the state of the global economy.

For the past several months, there has been consistent talk of the state of the global economy and how inflation was becoming a concern. This caused several food producing nations to limit their exports to try to maintain adequate reserves.

Inflation worries have also caused volatility in the managed money markets and influenced how those participants have been involved in commodities. This has caused wide swings in values and made market prediction nearly impossible.

One factor that is likely to be persistent from 2021 to 2022 is market volatility, as there are no indications this will subside anytime soon.

Corn strategy

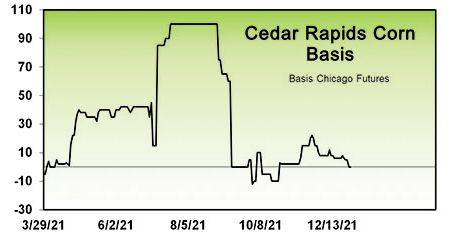

2021 crop: Sales of your 2021 production should now total 60% of bushels. Carry is leaking out of the complex, which makes holding inventory less desirable. Now is a time when basis values can create favorable marketing opportunities as well. Futures are rallying back to summer highs and should be rewarded at these levels.

2022 crop: Sales of your 2022 crop should now total 30% of intended production. New crop corn values have rallied to the point where they are nearly equal to old crop, favoring the marketing of unprotected bushels. The use of risk management tools over a traditional cash sale would also accomplish this.

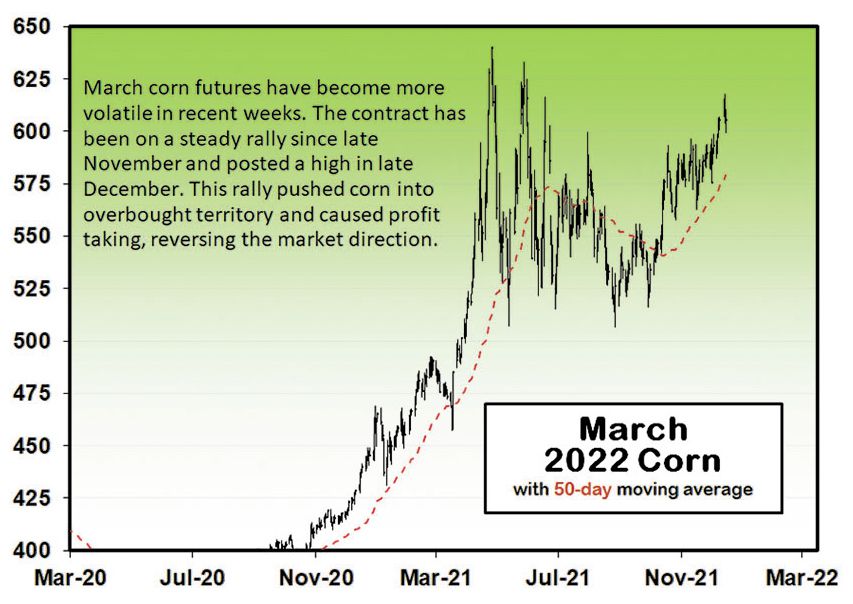

Fundamentals: Corn futures have become more volatile in recent weeks as fundamental influences are being heavily debated. Global production is expected to be high this year, but so is demand. The most debated right now is feed, where low-grade wheat is starting to be heavily used, mainly by China. We are also seeing more interest in U.S. plantings and whether input costs will impact acres planted.

Soybean strategy

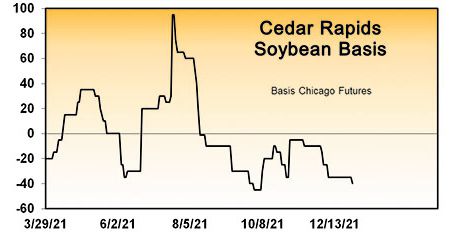

2021 crop: Sales of your 2021 soybean crop should now total 60% of production. Volatility is building in the soy complex, creating windows of marketing opportunities. We need to closely monitor soybean basis values, as these are attractive and may create a two-step cash sale.

2022 crop: We feel you should extend sales coverage of your 2022 production to total 30%. Values are below current 2021 levels, though, which makes the marketing of unprotected bushels less attractive even though values are historically favorable. The use of risk management structures to achieve this is warranted, including options.

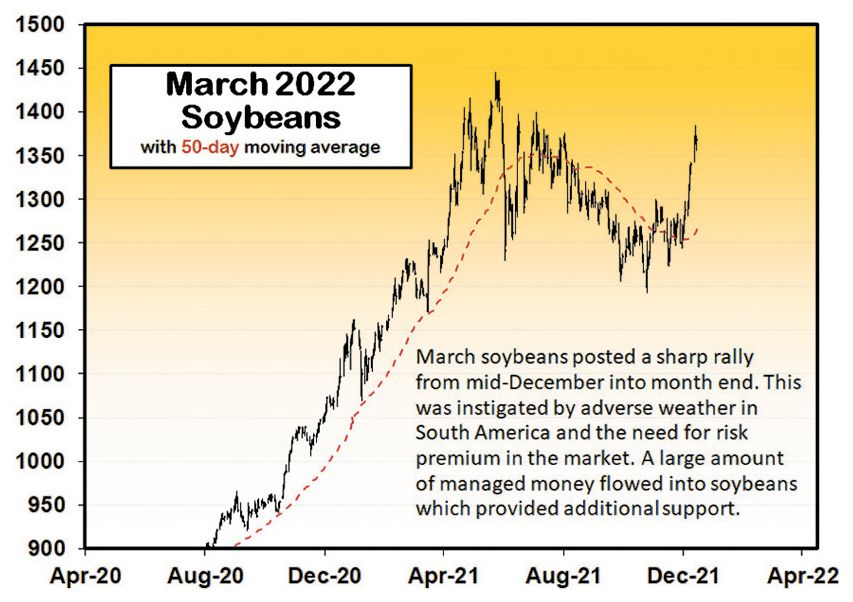

Fundamentals: All eyes in the soy complex are on South American weather and production. Very early harvest has taken place in Brazil but not enough to determine production. Domestically, the trade is monitoring product demand, which is running above expectations and supporting crush margins. This is expected to cushion the loss of exports as the South American harvest advances.

Cash Strategist Sales Recommendations

Prices are new crop or nearby futures

Corn

2021

01-21-20 — 10% sold @ $4.10

05-29-20 — 10% sold @ $3.70

07-09-20 — 10% sold @ $3.79

08-27-20 — 10% sold @ $3.92

09-22-20 — 10% sold @ $3.99

10-08-20 — 10% sold @ $4.06

60% sold

_________________________

2022

09-22-20 — 10% sold @ $3.92

10-08-20 — 10% sold @ $3.98

10-27-20 — 10% sold @ $3.99

30% sold

Soybeans

2021

06-05-20 — 10% sold @ $8.87

07-09-20 — 10% sold @ $9.02

08-17-20 — 10% sold @ $9.19

08-27-20 — 10% sold @ $9.34

10-08-20 — 10% sold @ $9.81

10-27-20 — 10% sold @ $9.84

60% sold

_________________________

2022

10-27-20 — 10% sold @ $9.20

12-22-20 — 10% sold @ $10.05

03-29-21 — 10% sold @ $11.25

30% sold

Cash Strategist Hotline: 309-557-2274

Neither AgriVisor LLC nor the Iowa Farm Bureau Federation is liable for any damages that anyone may sustain by reason of inaccuracy or inadequacy of information provided herein, any error of judgment involving any projections, recommendation or advice or any other act of omission. This publication is owned by the Iowa Farm Bureau Federation with advice provided by and copyrighted by AgriVisor Services LLC, 1701 Towanda Avenue, Bloomington, Illinois, 61701. No reproduction of any material in whole or in part of this page may be made without written consent.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!