World Pork Trade

Author

Published

11/5/2025

Ranking as the top exporter and within the top 5 for pork production and consumption, the United States continues to be a major player in the world pork market (Table 1). China continues to outpace both the United States and the European Union in pork production and consumption. China’s pork production accounts for nearly half of global production (49%). Similarly, their pork consumption accounts for just over half (50.3%) of global consumption and, by volume, nearly three times that of the European Union who is the second largest consumer.

Table 1. Major players in world pork market

Table 1. Major players in world pork market

Relative Value of U.S. Pork Exports and Imports

To get a more detailed look into world pork trade, the remainder of this article will reference UN Comtrade data and is not comparable to Table 1 which references USDA data. Note that data for 2025 only includes data for the first three quarters of the year.

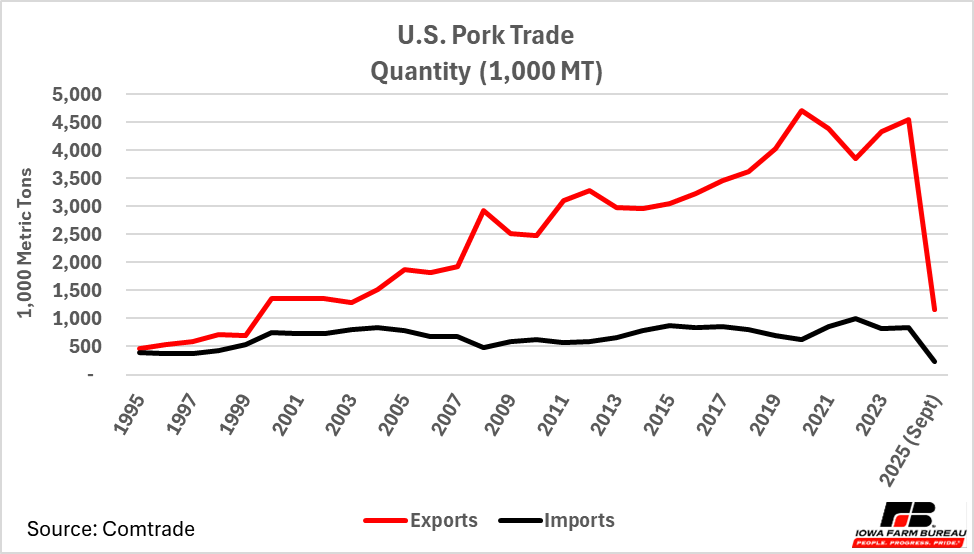

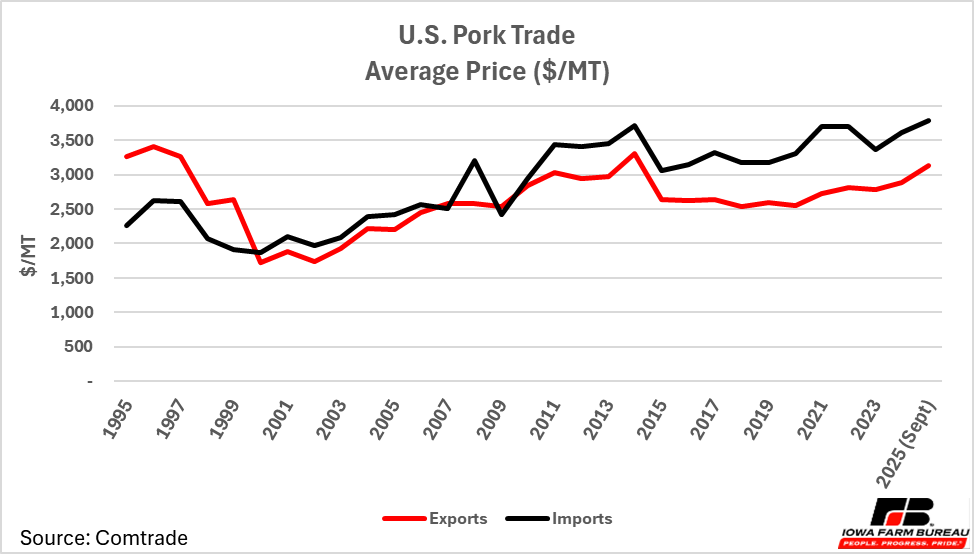

Figure 1 shows United States pork exports and imports in terms of volume; Figure 2 shows United States pork exports and imports in terms of value; Figure 3 shows average price of pork exports and imports per metric ton (MT). The United States continues to export more pork relative to what they import and the gap, as shown in the Figures 1 and 2, continues to increase over time. Notice that in Figure 3, the average price of imports is above that of exports indicating the United States is exporting more lower quality cuts than importing. As of September 2025, the United States would need to export 3.4 million MT of pork ($9.4 million) to reach 2024 levels. Average price of both pork exports and imports per metric ton are currently at the highest price level seen since 2014.

Figure 1. U.S. pork exports and imports volume

Figure 1. U.S. pork exports and imports volume

Figure 2. U.S. pork exports and imports value

Figure 2. U.S. pork exports and imports value

Figure 3. Average price of U.S. pork exports and imports per MT

Figure 3. Average price of U.S. pork exports and imports per MT

Major Trade Partners for United States Pork

Over the last five years, Mexico has been the top purchaser of United States pork, accounting for, on average, 35% of all United States pork exports (Table 2). At this point in 2025, Mexico remains the top export destination for United States pork (438 thousand MT), Japan follows with 168 thousand MT of pork.

While the United States imports minimal pork, Canada and Mexico are the top suppliers of pork to the United States. Canada accounts for a significant majority (70%). Mexico follows with a large gap with 20 thousand MT, currently accounting for 9% of all pork imported into the United States.

Note that the data in Table 2 excludes all data for 2025 as the table outlines a five year average.

Table 2. Major partners of U.S. Pork Trade

Table 2. Major partners of U.S. Pork Trade

Trade Partners of Other Major Exporters and Importers

As highlighted earlier, the United States is only one of numerous other countries that play a major role in global pork trade. As highlighted in Table 3, Canada, the European Union, Germany, and Spain are also major exporters of pork. Over the last five years, on average, Canada has exported 1.1 million MT of pork, with their largest purchaser being the United States, but not by any sizeable margin. Unsurprisingly, China is also the largest purchaser of pork from the European Union and Spain.

At this point in the year, the United States and Japan remain the top two suppliers of pork to Canada, with Japan surpassing the United States in terms of exports volume and value for the year (173.5 thousand MT). Italy is currently Spain’s top pork export destination overtaking China’s top spot, but we could see some adjusts to the five year averages shown in Table 3 at the end of 2025.

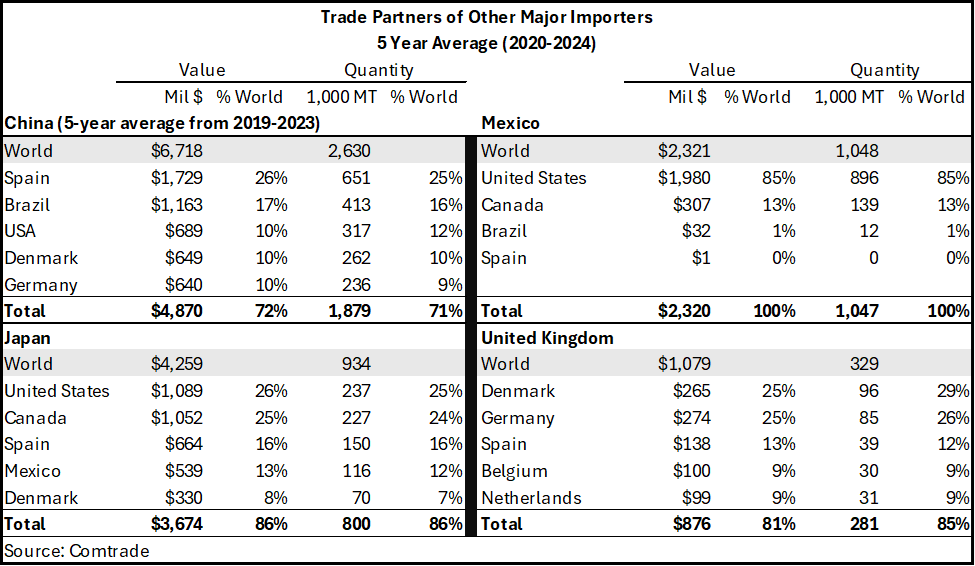

Table 4 highlights major importers of pork, with China dominating at 2.6 million MT of pork, on average. The United States is China’s third largest supplier of pork behind both Spain and Brazil. The United States is Mexico’s largest supplier of pork, accounting for 85% of all pork imports to Mexico in terms of both volume and value.

As it stands in 2025, Mexico has imported 791.8 thousand MT from the United States, a sizeable margin from Mexico’s other suppliers. Mexico has imported 106.8 MT of pork from the Netherlands in 2025. Notice that Table 4 does not include the Netherlands as a pork trade partner for Mexico over the last five years. Relative to what the United States supplies Mexico this amount is very minimal but still indicates that we could see some adjustments to these averages as the conclusion of 2025. Table 3. Trade Partners of Major Pork Exporters other than The United States

Table 3. Trade Partners of Major Pork Exporters other than The United States

Table 4. Trade Partners of Major Pork Importers other than The United States

Table 4. Trade Partners of Major Pork Importers other than The United States

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!