Update on U.S. Corn Exports for the Current Marketing Year.

Author

Published

8/1/2022

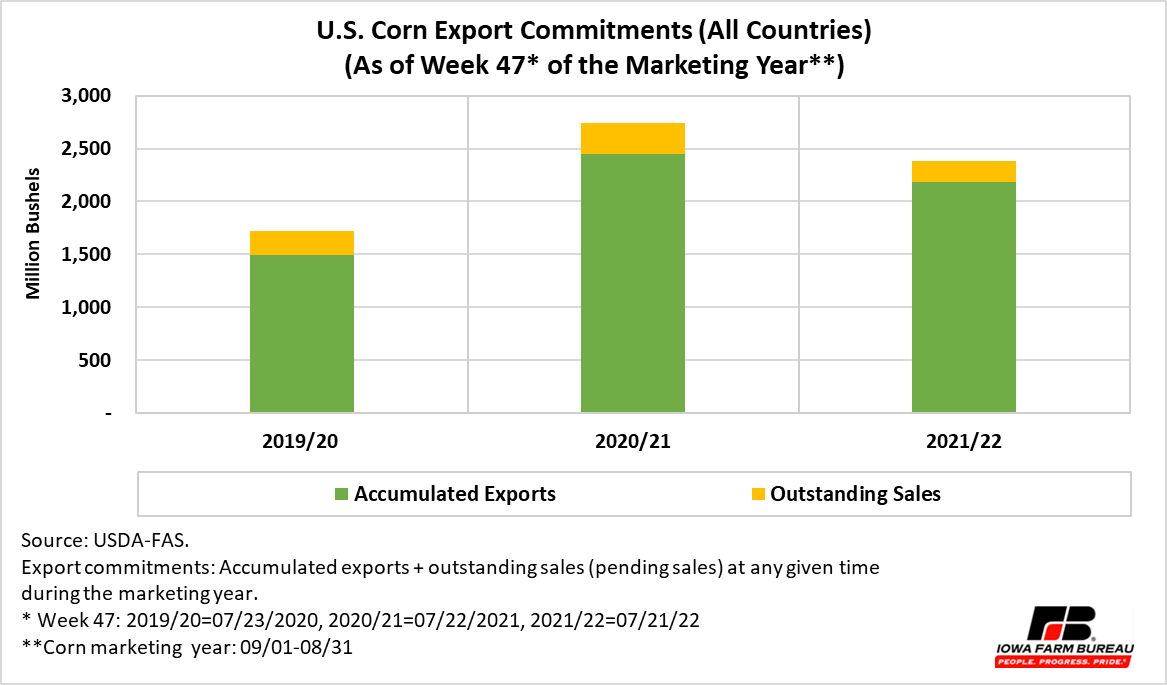

The latest USDA’s trade data published on July 28, 2022, indicates U.S. total corn accumulated shipments to all countries through July 21st, 2022 (47th week of the current marketing year1) were reported at 2.18 billion bushels, down 10.8% from last year but up 45.8% from two years ago (1.5 billion bushels) (Figure 1).

Pending U.S. corn sales (outstanding sales2) as of July 21st, 2022, reached a volume of 205.07 million bushels. A year ago, U.S. corn sales waiting for shipment were up 30.9% to 296.86 million bushels from the volume estimated this year. In addition, outstanding corn sales two years ago (July 23, 2020), were ahead by 18.5 million bushels compared with this year.

Based on this data, total commitments (accumulated exports + outstanding sales) by the 47th week of the current marketing year were estimated at 2.385 billion bushels, which were down 13% relative to last year (2.742 billion bushels) but 38.7% above the volumes at the same time two years ago (2019/20 marketing year) (1.720 billion bushels).

Figure 1. U.S. Corn Exports Commitments (All Countries, as of Week 47th of the Marketing Year)

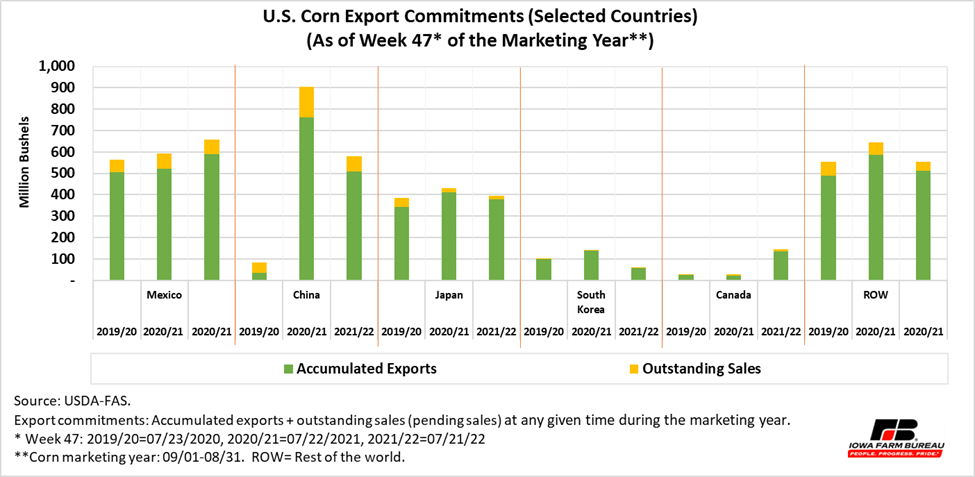

The top destination for U.S. corn in the 2021/22 marketing is Mexico (Figure 2). Accumulated U.S. corn exports to Mexico by July 21, 2022, were estimated at 590.6 million bushels, up 67.8 million bushels from last year. This volume of U.S. corn sold to Mexico accounted for 27% of total U.S. accumulated corn exports so far. As of now, the volume of U.S. corn waiting for shipment to Mexico is about 66.87 million bushels. If realized, the total volume of U.S. corn export to Mexico would reach 657.47 million bushels in 2021/22. USDA’s projection indicates Mexico would import 689 million bushels from all sources. At this rate, the U.S. would supply 95% of Mexico’s total import corn demand in 2021/22.

Figure 2. U.S. Corn Export Commitments (Selected Countries, as of Week 47th of the Marketing Year)

In 2020/21 China was a key driver in world import demand of corn. China accounted for about 16% (1.162 billion bushels) of global corn import demand (7.29 billion bushels) and 32% (888 million bushels) of U.S. total corn exports (2.753 billion bushels). This indicates that in 2020/21, the U.S. had a 78% market share in the Chinese corn market. In the most recent data (as of July 21, 2022), U.S. corn accumulated exports to China were assessed at 507.65 million bushels, down 255.04 million bushels from a year ago, but up 473.94 million bushels compared with July 23, 2020 (33.71 million bushels). By the 47th week of the current marketing year (July 21, 2022), accumulated U.S. corn exports to China made up 23% of U.S. corn total shipments compared with 31% and 2%, during the 47th week of the 2020/21 and 2019/20 marketing years, respectively.

As of July 21, 2022, the U.S. still had 71.67 million bushel of U.S. corn pending shipment to China. If realized, the U.S. would export a total of 579.32 million bushels of corn to China by the end of this marketing year. According to USDA’s projection, China is expected to import a total of 905 million bushel of corn from all sources. This projection is down by 256 million bushels from previous year. At this rate, the U.S. would supply about 64% of China’s total corn import demand in the 2021/22 marketing year.

The third largest importer of U.S. corn is Japan in 2021/22. Accumulated exports and pending sales by July 21, 2021, were estimated at 377.62 million bushels and 16.14 million bushels, respectively. Both accounts were down from the previous year by about 33.76 million bushels and 3.64 million bushels, correspondingly. If outstanding sales are materialized, U.S. corn exports to Japan would reach a total volume of 393.76 million bushels. This volume would make up 65% of Japan total corn imports in 2021/22.

Overall, USDA’s projects that U.S. corn exports in 2021/22 will be down 11% to 2.450 million bushels relative to last year (2.753 billion). The U.S. would have to export an average of about 54 million bushels in each of the next five weeks until the end of the marketing year to meet that projection. The average weekly corn export shipments the past two weeks are running about 39 million bushels per week.

USDA’s most recent data on export value indicates that during the first nine months of the 2021/22 marketing year (Sept 2021 to May 2022), the value of U.S. corn exports was up 14% to $14.771 billion from the same period the previous marketing year. In contrast, the volume of exports from September 2021 to May 2022 was down 9.7%. This may indicate the inflationary effect on corn prices during the 2021/22 marketing year. U.S. corn average farm price is up $1.42/ bushel to $5.95/bushel in the 2021/22 marketing year compared with the previous marketing year ($4.53/bushel).

USDA’s latest projections for the coming marketing year of 2022/23, show U.S. corn exports would decline 2% to 2.4 billion bushels based on expected lower supplies and strong domestic demand. Despite expected increase in exports from Argentina and Brazil, global trade is projected to diminish with a decline in Ukraine exports of about 550 million bushels. China corn imports from all sources are expected to fall 21.7% to 709 million bushels year-over-year with a reduction in imports from Ukraine.

Economic analysis provided by Patricia Batres-Marquez, Senior Research Analyst, Decision Innovation Solutions on behalf of Iowa Farm Bureau.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!