U.S. Agricultural Commodity Exports to Taiwan: Current Trends and Outlook (Sep. 26, 2022).

Author

Published

9/30/2022

According to USDA, Taiwan is the U.S.’s eighth-largest trading partner for food and agricultural products. Taiwan depends on imports of several agricultural commodities not domestically produced or produced in reduced quantities. These limitations offer opportunities for U.S. agricultural producers.

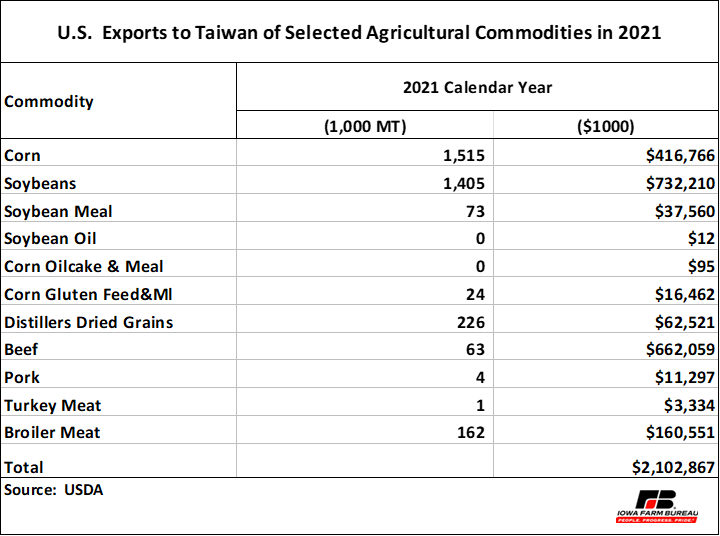

In the 2021 calendar year, Taiwan imported $732.0 million of U.S. soybeans (equivalent to 1.4 million MT or 51.6 million bushels) and $416.8 million worth of U.S. corn (equivalent to 1.5 million MT or 59.6 million bushels). The same year, the number one value U.S. meat product exported to Taiwan was U.S. beef with a total value of $662.1 million (62,571 MT). Also, in 2021, the U.S. exported to Taiwan $160.5 million (162,020 MT) worth of broiler meat, whereas U.S. pork exports to that country were assessed at $11.3 million (3,584 MT). Overall, last year’s value of U.S. exports to Taiwan for the 11 selected agricultural commodities shown in Table 1 was estimated at $2.1 billion.

Table 1. Value of U.S. Exports to Taiwan of Selected Agricultural Commodities (2021)

U.S. Soybean, Corn, and Products Exports to Taiwan

Soybeans

Taiwan’s demand for soybean meal is the driving force behind the country’s demand for soybeans. Taiwan soybean production supplies less than 1% of its soybean demand, which makes the country dependent on foreign suppliers.

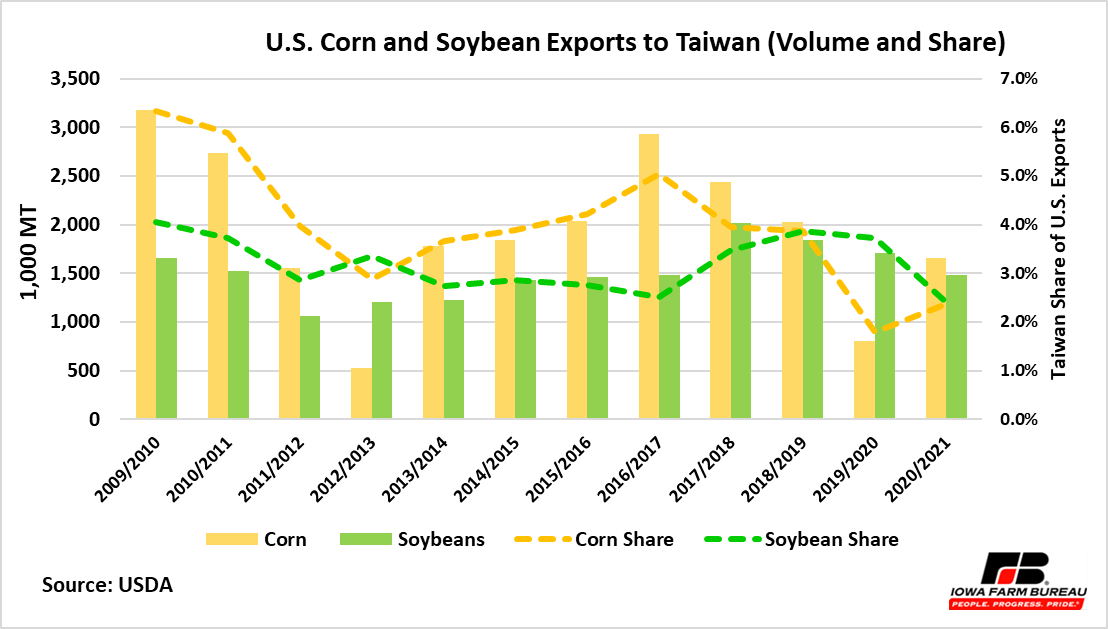

U.S. soybean exports to Taiwan topped 2.0 million MT in 2017/18. Exports during the next three marketing years dropped but remained above levels from 2011/12 to 2016/17. In 2020/21, U.S. soybean exports to Taiwan declined 13% to 1.49 million MT (54.6 million bushels) compared with the previous year (see Figure 1). In 2020/21, the U.S. supplied 57% of the total volume of soybeans imported by Taiwan. In 2020/21, Taiwan was the 6th largest market for U.S. soybeans, and represented 2.4% of the total volume of soybean exported by the U.S.

The most recent data indicates U.S. soybean exports to Taiwan during the first 11 months of the 2021/22 marketing year (1.54 million MT) were up 3.6% from the volume exported during the entire 2020/21 marketing year.

Soybean Meal

Taiwan’s demand for soybean meal is met by domestic crushing of imported soybeans and a reduced amount of soybean meal imports. In 2020/21 Taiwan imported 50,320 MT of U.S. soybean meal, which supplied 95% of the country’s import demand. Taiwan was the 32nd largest market for U.S. soybean meal exports in 2020/21. U.S. soybean meal exports to Taiwan accounted for 0.4% of total soybean meal exports in 2020/21.

Figure 1. U.S. Corn and Soybean Exports to Taiwan (Volume and Share)

Corn

Taiwan’s main demand for corn is for feed, which represents about 96% of its total corn demand. Considering that Taiwan produces only about 2% of its total corn consumption, like in the case of soybeans, most corn is supplied by foreign corn producers.

U.S. corn volumes of exports to Taiwan have varied from a record high of 3.2 million MT in 2009/10 to a low volume of 530,233 MT in 2012/13 (Figure 1). The second largest volume of U.S. corn exported to Taiwan was in 2016/17 at 2.9 million MT. The U.S. has supplied from 70% of Taiwan’s total corn imports in 2009/10 and 2016/17, to 13% in 2012/13. In 2020/21 the U.S. supplied 38% of the country's corn imports, which was equivalent to 1.66 million MT (65.20 million bushels).

In 2020/21 Taiwan was the 7th largest international market for U.S. corn. Exports to Taiwan have accounted for about 3.4% of total U.S. total corn exports from 2016/17 to 2020/21, on average.

Distillers Dried Grains (DDG)

In Taiwan, inclusion rates for distillers dried grains (DDG) fluctuate according to relative prices of other feed grains. U.S. DDG exports to Taiwan have varied over the last 12 years and reached a record high of 261,943 MT in 2016/17. In 2020/21 U.S. DDG exports to Taiwan were estimated at 224,863 MT, which were down 11% from the previous year and 14% below from the record volume exported in 2016/17. Taiwan was the 16th most important market for U.S. DDG in the 2020/21 marketing year.

U.S. Pork and Beef Exports to Taiwan

Pork

According to USDA data, pork is the number one meat consumed in Taiwan, followed by broiler meat, and beef. However, consumption of broiler meat has substantially increased since 2012 and is fast approaching pork consumption. Pork consumption in Taiwan is met mainly by domestic production, while pork imports supply about 9% of total domestic consumption since 2012,on average.

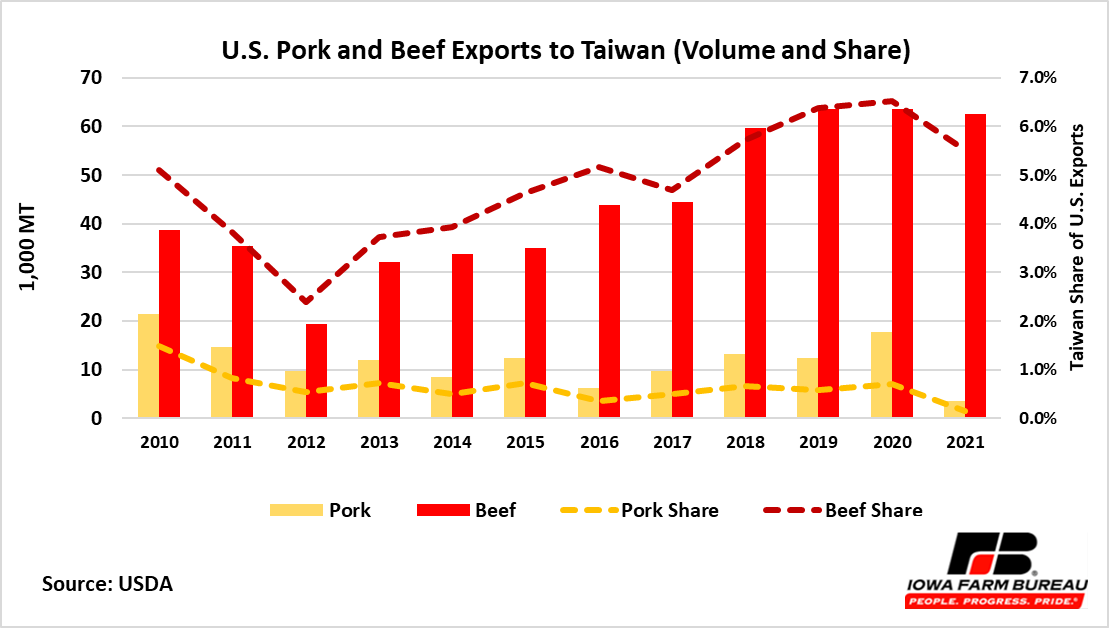

U.S. pork exports to Taiwan declined 80% to 3,584 MT in 2021 compared with the previous year (17,600 MT) (see Figure 2). According to USDA, this decline was due to some regulatory actions implemented in January 2021[1], such as country of origin labeling measures, which had a negative impact in the market. U.S. pork exports to Taiwan in 2021 supplied 4% of Taiwan’s pork import demand, which was down 22% from the previous year. U.S. pork exports to Taiwan represented only 0.1% of the total volume exported in 2021. Last year, Taiwan was the 23rd largest market for U.S. pork.

Beef

About 97% of Taiwan’s beef consumption depends on imports. In 2021, Taiwan imported about 62,571 MT of U.S. beef (see Figure 2). That volume made up about 34% of Taiwan’s beef import demand. Taiwan was the 6th largest market for U.S. beef in 2021. U.S. beef shipments to Taiwan made up about 5.5% of total exports in 2021.

Figure 2. U.S. Pork and Beef Exports to Taiwan (Volume and Share)

Taiwan Import Outlook of Selected Agricultural Products

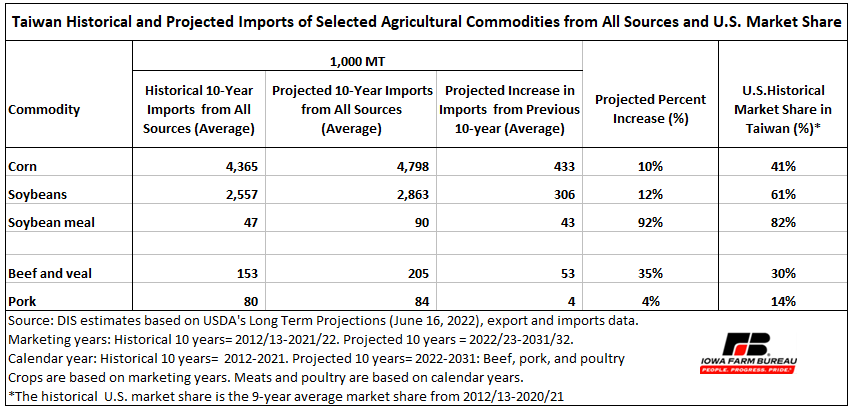

Taiwan’s reliance on agricultural product imports is expected to continue to increase due to the country’s limited arable land and small agricultural sector. Based on the latest data from USDA’s long-term projections, Taiwan is projected to import (from all sources) about 4.8 million MT (189 million bushels) of corn annually during the next ten years (2022/23 to 2030/32), on average, which would be up 10% from the average volume imported during the previous ten years (Table 2). Taiwan’s projected imports of soybean (from all sources) would increase 12% to 2,863 MT (105.19 million bushels) annually over the next ten years, on average, compared with the annual imported volume during the previous ten years (2,557 MT or 93.96 million bushels, on average). Taiwan imports of soybean meal are expected to expand by 43,000 MT per year to 90,000 MT annually during the next 10 years, on average, compared with the previous decade. Taiwan’s beef imports (from all sources) are projected to increase by 53,000 MT (35%) per year (on average) to 205,000 MT annually compared with 153,000 MT during 2012-2021. In addition, Taiwan’s pork imports (from all sources) are projected at 84,000 MT annually, on average, from 2022 to 2031, which would be up 4% from the previous ten years (80,000 annually, on average).

Table 2.Taiwan Historical and Projected Imports of Selected Agricultural Commodities from All Source and U.S. Market Share

Recent news report indicates Taiwan’s trade delegates signed a letter of intent to buy between 96 million to 107 million bushels of U.S. soybeans and 59 million bushels of U.S. corn between 2023 and 2024. If realized, U.S. soybean producers would benefit the most as U.S. soybean exports to Taiwan would increase between 44.4 million and 55.4 million bushels compared with the volume exported during the 2021 calendar (51.6 million bushels). For U.S. corn producers, exports to Taiwan between 2023 and 2024 (59 million bushels) would remain about the same as in 2021 calendar year (59.6 million bushels).

Economic analysis provided by Patricia Batres-Marquez, Senior Research Analyst, Decision Innovation Solutions on behalf of Iowa Farm Bureau.

[1] Taiwan Issues New COOL Regulations Affecting US Pork and Beef (https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Taiwan%20Issues%20New%20COOL%20Regulations%20Affecting%20US%20Pork%20and%20Beef_Taipei_Taiwan_09-16-2020)

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!