Soybean Storage, Will it Pay This Year?

Author

Published

9/15/2022

As the soybean harvest season moves closer it becomes time to decide whether to sell soybeans this fall, or store soybeans for sale later in year, either through private or commercial storage. Over the past two marketing years we have seen large increases in the price of soybeans throughout the year, leading to opportunities to profit from storing soybeans. But profiting from storage does is not always possible.

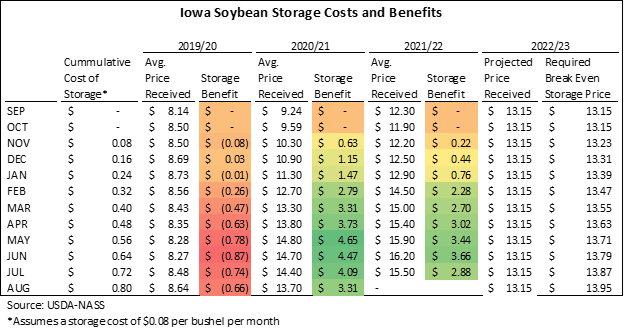

The average benefits from storing soybeans in 2019/20, 2020/21, and 2021/22 are also shown in Table 1 assuming a storage rate of $0.08 per bushel per month for soybeans. These calculations use average cash prices received by farmers across Iowa. Prices could vary to some degree across Iowa making storage slightly more or less profitable in some regions. The large increases in soybean prices throughout the past two years allowed for opportunities to profit from storing soybeans in both 2020/21 and 2022/23. However, as is evident from looking at 2019/20, gains are not always possible from storing soybeans. Decreases in prices, or prices that increase slower than the cost of storage led to losses from storing soybeans. The final two columns in Table 1 show average estimated fall soybean price and breakeven cash prices required to cover the cost of storage.

Table 1. U.S. Soybean Storage Costs and Benefits

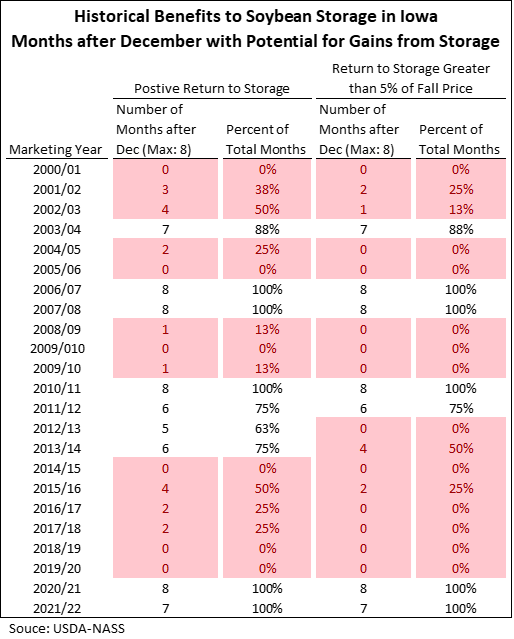

Historically, in most years there has not been a large, consistent upside to storing soybeans. Table 2 outlines previous years that have been profitable years to store soybeans. The first two columns show the number of months after December, (January to August of each marketing year), that the average monthly price was enough to cover all storage costs accumulated up to that point. For example, in every month in 2020/21 the average monthly price exceeded the cost to store soybeans until that month, so in Table 2, 8 months (January to August) are listed next to 2020/21. Years that have four or fewer of the eight possible months with opportunities to profit from storing grain are highlighted in red. Even though some months offer opportunities to profit from storage, less than half do, and producers would have to correctly time their sales to profit from storage. Opportunities to profit from storing soybeans in more than half of the storage months occurred in only 9 of the 23 marketing years reported in Table 2. Additionally, 5 of the 23 marketing years had no opportunities to profit from storing soybeans. Outside of the two most recent years, there was one other time in the 23 marketing years where profits from storage were possible in all storage months in two consecutive marketing years, which was 2006/07-2007/08. Those years were followed by a year where profits from storage were possible in four out of eight eligible storage months.

The second two columns provide context on the relative value of gains from storage. These columns only count months in which large gains from storage are possible. A 5% gain over the October cash price is used as a cut off for large gains. This means if October beans are $8 per bushel, a gain of over $0.40 per bushel plus the cost of storage would be needed to be counted in these columns and if October beans are $10 per bushel a gain of $0.50 per bushel plus the cost of storage is needed to be counted. In many cases the number in these columns is less than the number in the previous two columns as some months have been dropped due to lower, but still positive, gains from storage. Notably all months over the last two marketing years and in 2006/07-2007/08 had large gains from storage.

Table 2. Historical Benefits to Iowa Soybean Storage

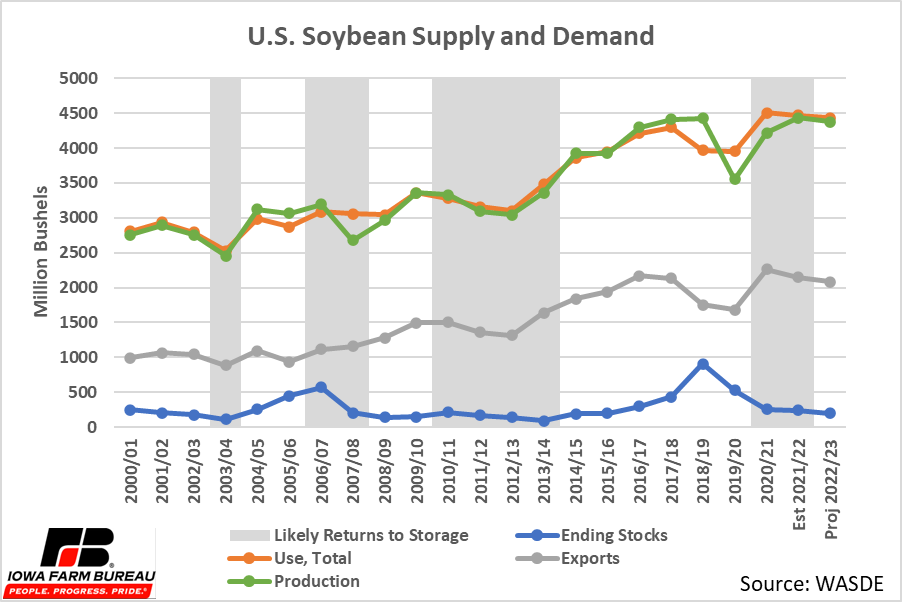

Supply and demand fundamentals determine the price received by producers, and as a result effect the profitability of storing soybeans. Figure 1 shows the total production, total use, exports (part of total use, and ending stocks for ach marketing year. Years with positive returns to storage in over half of possible months are shaded in gray. Years with tight ending stocks relative to prior years tend to be years to store soybeans.

Figure 1. U.S. Soybean Supply and Demand

The current outlook for soybean prices is mixed. One hand, current projections for demand are not as strong as last year. Some level of demand destruction is underway due to the higher prices of the past 18 months or so. The September 2022 WASDE report forecasts both exports and total use to be slightly lower next year. The rising value of the dollar against other major currencies has made U.S. soybean exports less attractive to foreign buyers. The dollar will likely continue to rise if the Fed continues to raise interest rates making U.S. soybeans even less attractive to foreign buyers.

On the other hand, other central banks have also begun to raise their interest rates on their currencies. If this continues this could slow the rise in the value of the dollar and might even lead to downward pressure on the dollar and potentially make U.S. exports more competitive.

Another wildcard is supply. Because of lower production forecasts in the September 2022 WASDE report the forecasted soybean ending stocks were lowered to 200 million bushels. This is lower than the last two years, and if realized would be the lowest since the 2015/16 marketing year. Tight ending stocks led to premiums to store soybeans during the last two years. If the October and subsequent reports see lower production estimates (and this is quite possible since the current yield estimates imply record high pod weights), then ending stocks could be lowered further unless there is even more demand destruction. Often, once supply is known, prices respond to that knowledge and then if demand declines higher ending stocks estimates could emerge as the year progresses.

Economic analysis provided by Aaron Gerdts, Research Analyst, Decision Innovation Solutions on behalf of Iowa Farm Bureau.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!