South American Soybean Situation Update

Author

Published

6/7/2023

Soybeans

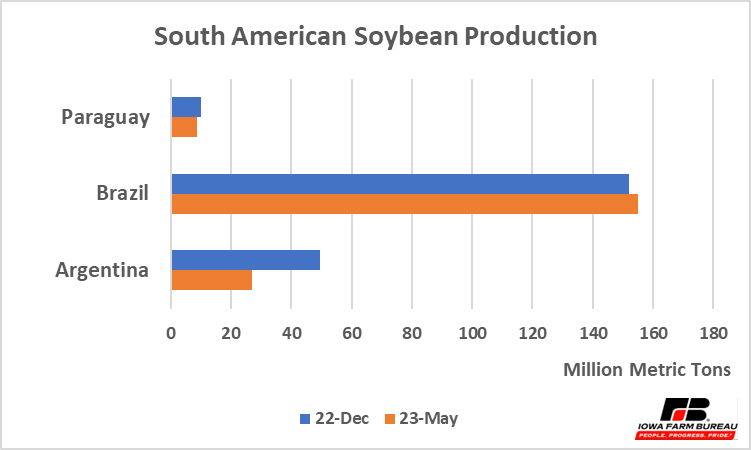

Soybean production in South America has been a tale of the haves and the have nots. Looking back to prospects in December 2022, South America was projected to produce 211.5 million metric tons of soybeans with Argentina producing 49.5 MMT, Brazil producing 152 MMT, and Paraguay producing 10 MMT. Fast forward to the latest USDA report on South American production and it shows that soybean production from South America is now 190.8 MMT, down 9.8% with production in Argentina declining by 45% to just 27 MMT; production in Paraguay declining by 12% to 8.8 MMT; but soybean production in Brazil increasing by 2% to 155 MMT.

The reduction in soybean production in Argentina has significantly reduced Argentina’s soybean crush. In December it was thought that they would crush 39.75 MMT of soybeans, but with the reduced production, they are now expected to only crush 31.5 MMT of soybeans, a 21% reduction in the amount of soybean meal in Argentina. Argentina is one of the primary exporters of soybean meal to the world market and this shortfall in soybean meal crush in Argentina has been a factor in stronger soybean meal prices over the past 6 months.

Brazil, on the other hand, is a major whole soybean exporter and with plentiful production in Brazil, their exports of soybeans have increased by 4%, rising from an expected 89.5 MMT to 93 MMT.

For the 2023 – 2024 marketing year, South American soybean production is expected to rebound with Argentinian production rebounding to 48 MMT, Brazil rising to 163 MMT and Paraguay rebounding to 10 MMT. The three-country total in South America would be a whopping 221 MMT. Soybean exports from these South American countries are expected to rise to 107 MMT in the coming year. At the same time, soybean crush in the three South American countries is expected to rebound to more than 95 MMT with increased soybean crush expected out of all three countries.

The latest outlook for U.S. soybean production for the 2023-24 marketing year has production expectations increasing compared to the prior year by 6.25 MMT, domestic soybean crush increasing by 2.4 MMT, but exports declining by 1.09 MMT. U.S. soybean ending stocks are expected to increase by 3.25 MMT while world ending stocks in the 2023-34 marketing year are expected to increase by 21.5 MMT.

If these projections hold, the increased production and increased ending stocks will likely pressure soybean prices in the 2023-24 marketing year compared to the 2022-23 marketing year. The latest WASDE estimates project a $14.20 season average price for U.S. soybeans in 2022-23 and $12.10 per bushel for the 2023-24 marketing year.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!