South American Soybean Production Update

Author

Published

4/12/2023

In conjunction with the April World Agricultural Supply and Demand Estimates (WASDE), USDA provided an update on soybean production in South America. USDA estimates that Brazil will produce 154 million metric tons of soybeans during the 2022/2023 crop production period, up 23.5 million metric tons from the prior year’s production and up 1 million metric tons from the March 2023 estimate.

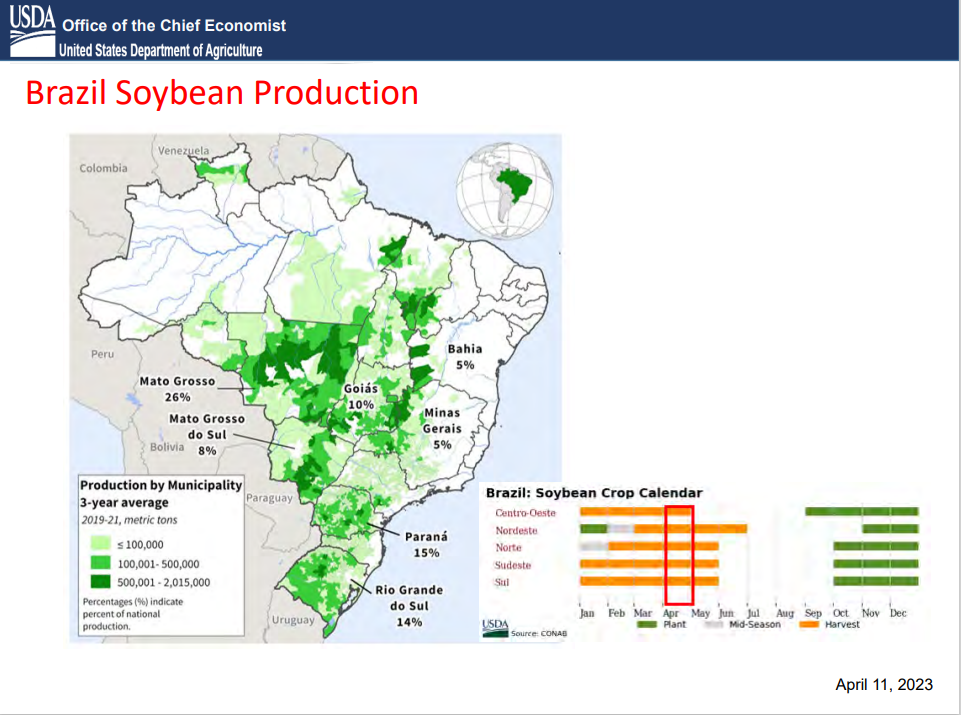

Figure 1 shows the major Brazilian soybean production areas and the relative levels of soybeans that come from each region. Mato Grasso is the leading soybean producing area with a 3-year average of 26% of Brazil’s production. This is followed by Parana’ at 15% of production and Rio Grande do Sul with 14% of production.

Soybeans are harvested somewhere in Brazil from January through June. Planting begins in September and can last until late January, early February. Moisture has been favorable across Brazil with the exception of Rio Grande do Sul which as been quite dry.

Figure 1. Brazil Soybean Production

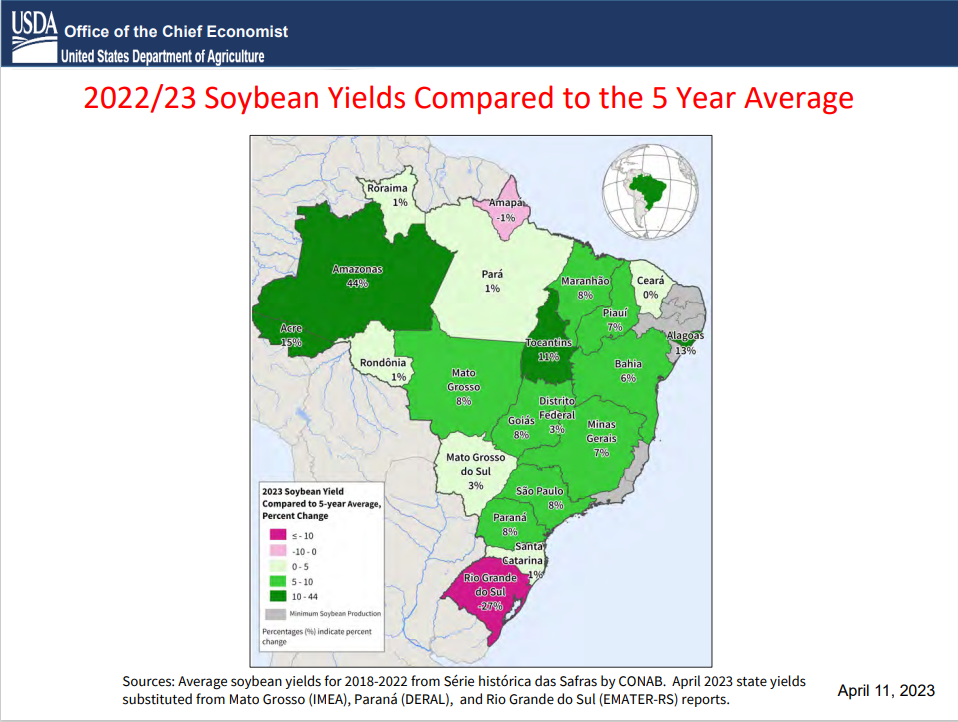

Soybean yields in Brazil this year are generally better than the 5-year average except in Rio Grande do Sul where the dryness has taken its toll on the crops in that region. Yields in Amazona are 44% better than the 5-year average, Tocantins yields are 11% above average, Mato Grosso yields are expected to be 8% better than average as well as in Goias, Parana’, Sao Paulo, and Maranhao. Yields in Piaui and Minas Gerais are 7% above average, Bahia 6% above average and Mato Grosso do Sul 3% above average. Other areas are very near average.

Figure 2. 2022/23 Soybean Yields Compared to the 5-year Average

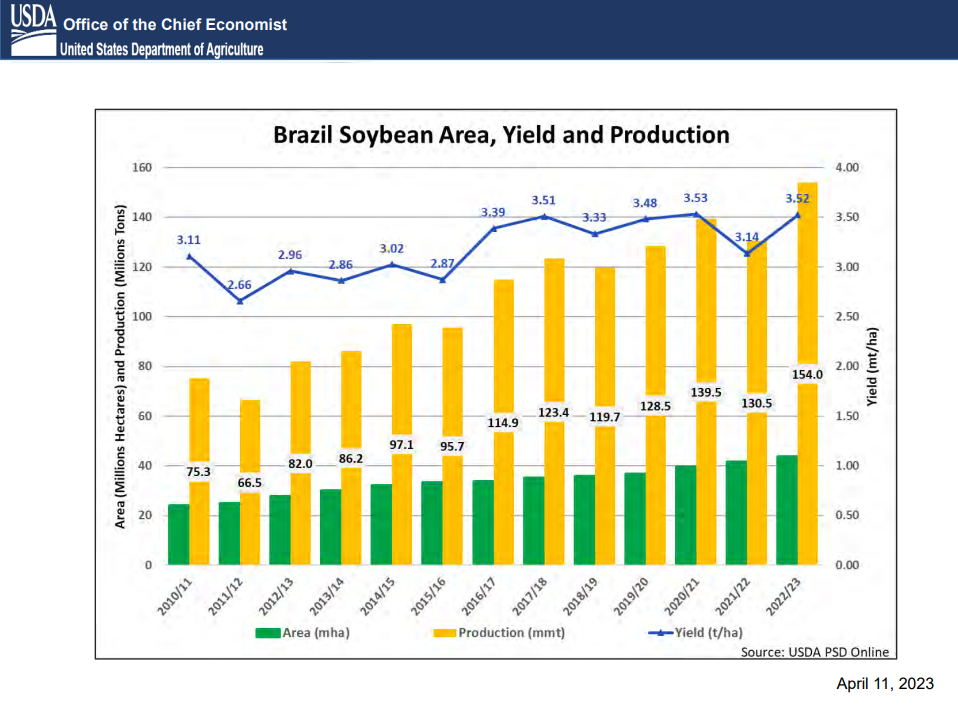

Brazilian soybean area, yield and production are all trending upward. Since 2010, the area planted to soybeans in Brazil has nearly doubled with a very steady increase in acreage nearly every year. Yields have been more variable, with yield dips seen in 2011/12, 2015/16, and 2021/22. If it were not for Rio Grande do Sul pulling down national yields this year, Brazil would likely have seen record yields and as it will see the second highest yield in their history.

Production also is climbing (Figure 3). To put this year’s 23.5 million metric ton (863 million bushels) increase in Brazilian soybean production in perspective, their increase is equal to all the soybean production in Iowa and Nebraska in 2022. Since 2010, Brazil’s soybean production has increased by an amount equal to all the soybean production in the U.S. from Ohio, Michigan, Indiana, Kentucky, Illinois, Wisconsin, Minnesota, Iowa, Missouri, Kansas and Nebraska.

Figure 3. Brazil Soybean Area, Yield and Production

Partially countering the increased soybean production in Brazil is the 16.9 million metric ton decline in soybean production in Argentina this year. Severely dry and hot weather in Argentina. Soybean production in Argentina is 38.5% less than the previous year. Argentina is a major exporter of soybean meal and the shortfall in production of soybean meal in Argentina has lent strength to soybean meal prices around the world.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!