Relative Value of Beef Cuts

Author

Published

9/21/2022

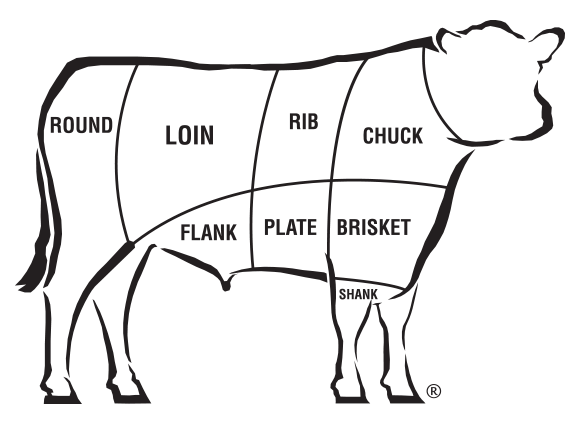

This article touches on the relative value of cuts of beef. The primal cuts discussed are outlined in Figure 1. A detailed overview of specific retail cuts from these primal cuts can be found on a link at the National Cattlemen’s Association website.

Figure 1. Primal Beef Cuts Diagram, Sourced from Certified Angus Beef

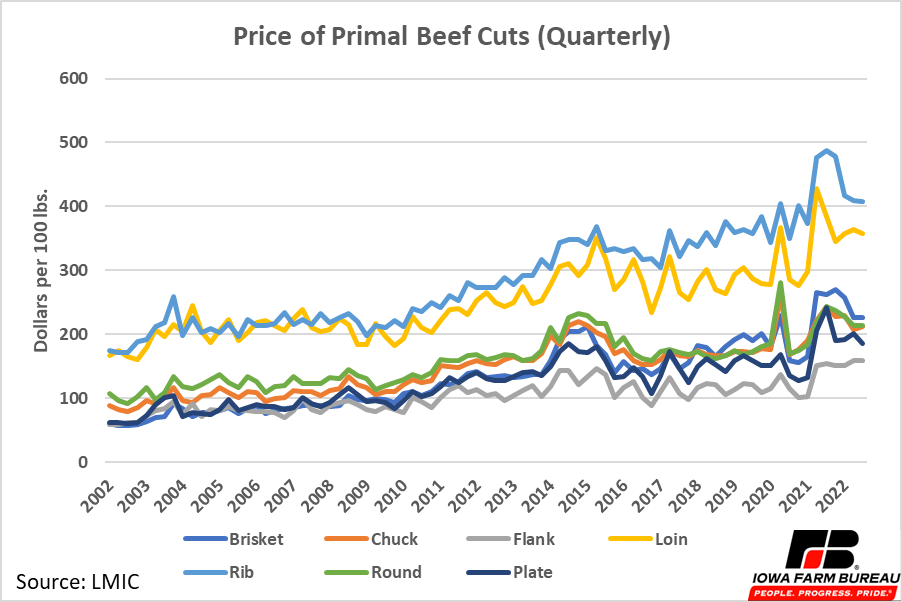

The price of each primal cut is given in Figure 2. Prices of all primal cuts have increased over time. The rib and loin have historically been the most valuable cuts on a per pound basis. High value retail cuts including ribeye steaks and T-bone steaks come from these areas making them more. valuable. Since around 2010, the spread between the ribeye and loin per-pound prices have increased, making the rib primal the most valued primal cut on a per-pound basis.

Figure 2. Value of Primal Beef Cuts (Quarterly)

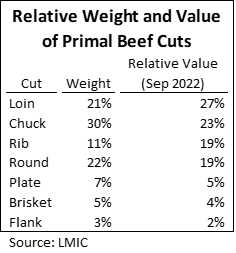

The percent of each primal cut of the total cutout weight is shown in Table 1. This weight along with the relative price of each cut is used to calculate the relative value of each cut presented in the third column of the table.

While the rib is the most expensive primal cut on a per pound basis, it does not produce as many pounds of product as other cuts like the chuck, round, and loin. The primal cut that creates the most overall value from the carcass is typically the loin, followed by the chuck. Both are large cuts relative to the total cutout of the animal. However, the loin has more high valued cuts than the chuck.

Table 1. Relative Weight and of Primal Beef Cuts

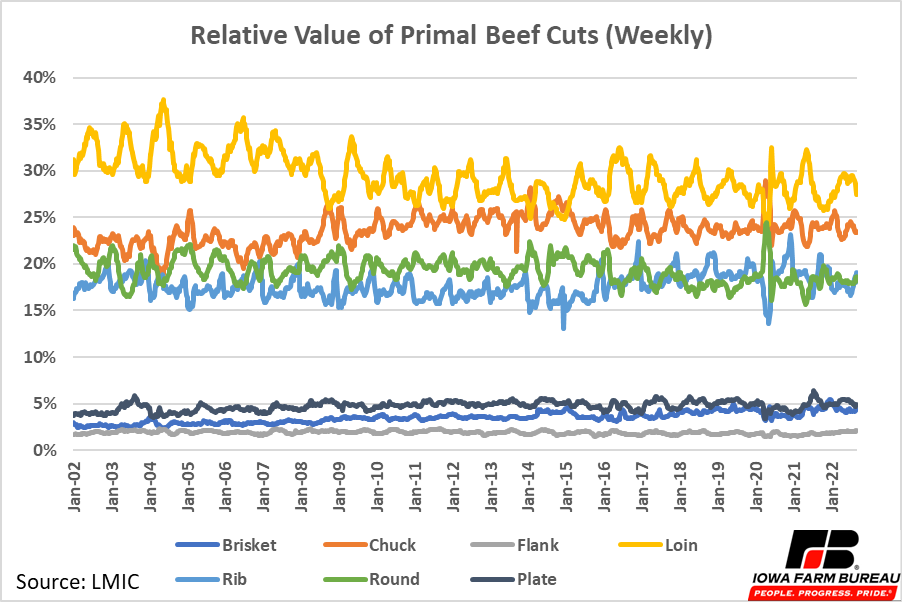

Historical relative values of each cut are shown in Figure 3. A few notable trends are evident in Figure 3.

The first is the strongly cyclical nature of the price of beef loins within each year. The loin’s value typically peaks in the late spring and early summer months and is at its lowest value in the fall. Summer cookouts have an effect of the value of beef loins. Chucks, rounds and ribs have some variation within each year, but are not nearly as cyclical as is the price of loins. The lower-valued primal cuts (plate, brisket, and flank) carry a relatively stable value throughout the year.

Second, the loin has become relatively less valuable compared to the other primal beef cuts. In the early 2000’s loin made up 30-35% of the value of the beef cutout but now it moves between 25-30%. The chuck appears to have gained the most value relative value from the loin’s loss, increasing from around 20% to near 25% of the value of the total beef cutout.

Third, the rib has been becoming relatively more valuable, especially in the last five years. The price of rib has increased faster than other cuts. The relative value of the rib has frequently surpassed the round in recent years, even though the round has about twice the retail pounds as the rib. In the early 2000’s there were a few periods of time when the rib created more value than the round, but this has not occurred very often since that time. The large increases in rib prices mentioned earlier have led to the change in this relationship.

Finally, the relative value of primal cuts appears to change during times of higher beef prices. In 2008, 2011-15, and 2020 the chuck briefly surpassed the loin to become the most valuable part of the animal. The round also became relatively more valuable during these periods while the ribs relative value decreased. During all these periods, the retail beef price rose. In 2008, higher feed prices pushed cattle prices and retail beef prices higher. From 2011-15, cattle inventories were falling to record lows while higher commodity prices increased feed costs. Reduced cattle numbers and increased costs increased the price of cattle at various times during this period, pushing retail beef prices higher. And in 2020, the beginning of the COVID pandemic brought supply chain issues to packers, wholesalers, restaurants and institutional meal providers changing the marketing channels for beef, temporarily reducing the overall supplies of beef for consumers, concentrating the demand for beef at retail, and driving retail beef prices higher.

It appears during the early times of reduced supply it is the lesser-valued cuts that gain the most value. If all beef prices rise, consumers switch to lower beef cuts in the short term, making the price difference between high-value cuts and lower-value cuts smaller. However, as time allows for consumers to adjust, price relationships tend to adjust back toward “normal”. It also can be partially attributed to a rise in demand for lean and very lean ground beef that generally comes from the lower-valued cuts and relatively less demand for steak.

Figure 3. Relative Value of Primal Beef Cuts (Weekly)

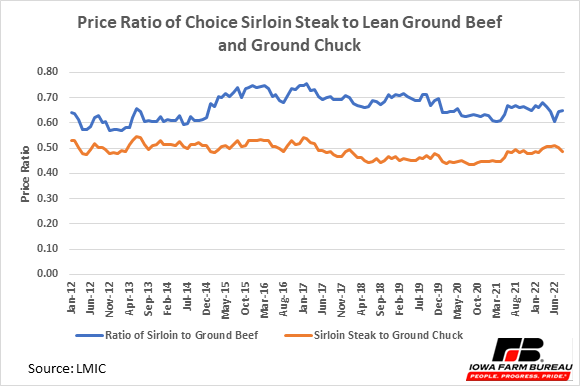

Figure 4 shows the relationship of the price of choice sirloin steak to the prices of lean ground beef and ground chuck. From late 2014 through 2019, lean ground beef was relatively strong compared to choice sirloin steak, but has lost some of the strength in more recent months. Conversely, ground chuck was somewhat weak relative to sirloin steak from 2017 through mid-2021 and has strengthened somewhat in more recent months.

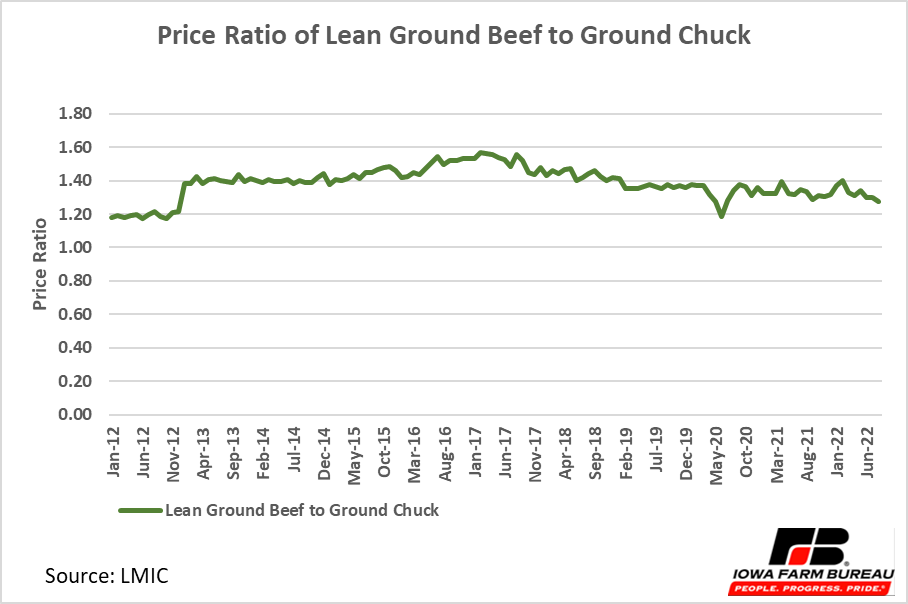

Figure 5 shows the price ratio of lean ground beef to ground chuck. Lean ground beef trades at a premium to ground chuck, but since mod-2017 has been losing some of that premium.

Figure 4. Price Ratio of Choice Sirloin Steak to Lean Ground Beef and Ground Chuck

Figure 5. Price Ratio of Lean Ground Beef to Ground Chuck

Economic analysis provided by David Miller, Consulting Chief Economist, Decision Innovation Solutions on behalf of Iowa Farm Bureau.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!