Dollar Index Drops

Author

Published

11/23/2022

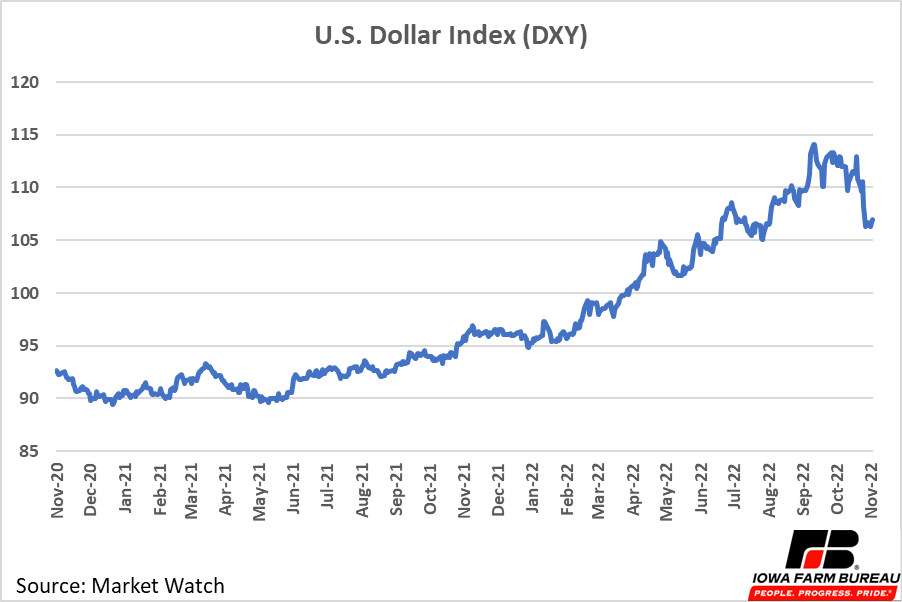

The U.S dollar index began rising in January 2022 as the world entered an uncertain economic time, the U.S. dollar rose in value as a safe-haven currency. Federal funds interest rate hikes have also supported the dollar’s rise. After rising to relatively high levels throughout most of 2022, the U.S. dollar has begun to cool off. The index dropped 4% the week of November 7 and has moved sideways since (Figure 1).

Figure 1. U.S. Dollar Index (DXY)

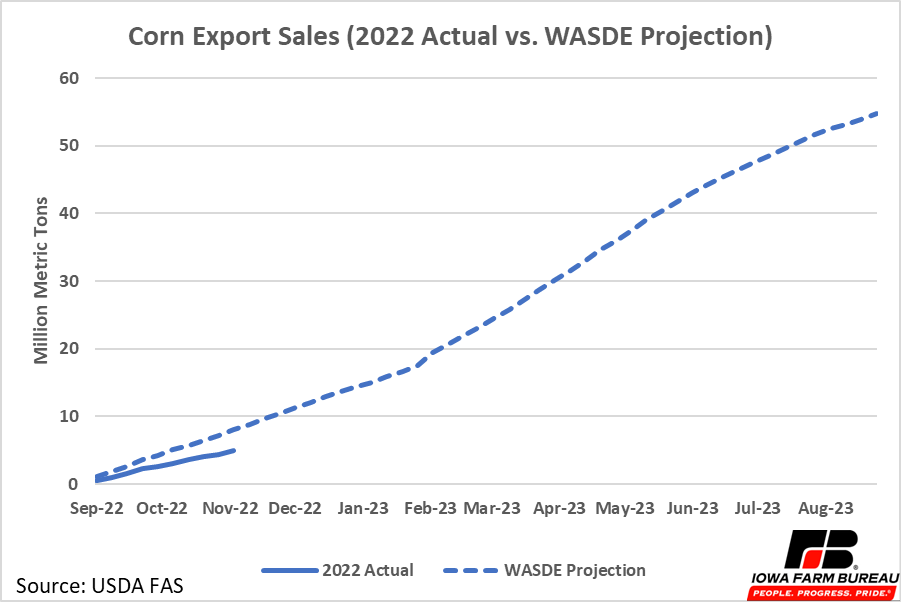

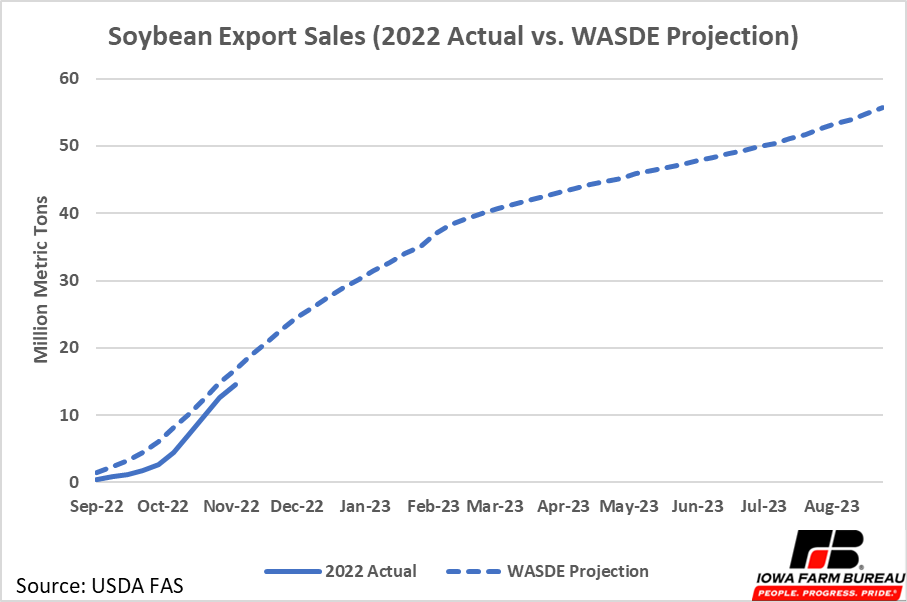

The decrease in the U.S. dollar index will make imports more expensive for U.S. consumers, but will make U.S. goods, including agricultural commodities relatively less expensive for other countries to purchase. A weakening dollar may help move some U.S. exports, particularly corn and soybeans, both of which remain behind the WASDE projected export targets for this year (Figure 2 and Figure 3). As of November 10, 5.0 million metric tons of U.S. corn has been sold for export, behind the WASDE target of 8.0 million. Soybeans export sales are also slower than expected with 14.6 million metric tons sold, behind the WASDE target of 16.8 million.

Figure 2. Corn Export Sales (2022 Actual vs. WASDE Projection)

Figure 3. Soybean Export Sales (2022 Actual vs. WASDE Projection)

Economic analysis provided by Aaron Gerdts, Research Analyst, Decision Innovation Solutions on behalf of Iowa Farm Bureau.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!