Crop marketing objectives shift after harvest

Author

Published

8/1/2020

Marketing the 2020 corn and soybean crop certainly has been a challenge and added to the already stressful farming situation. With all the factors influencing 2020 prices, the opportunities to market above cost of production for normal yields have been few – especially during the growing season.

Estimated costs of production and a margin above those costs are normally important factors in pre-harvest marketing plans. Certainly, the market does not care about any farmer’s production costs, but it makes a good foundation for a pre-harvest marketing plan.

As the combines roll, many farmers will look to high yields again to rescue a profit margin for Iowa crop farms. That has been the case in past years of little pre-harvest margin and would give welcome relief. The shift in activity that happens at harvest means that the marketing objective may need to shift also.

After the bin site is used for harvest efficiency, the decision to store the crop past harvest time is the decision that price and/or basis are not at acceptable levels. That harvest price is the key starting value for post-harvest marketing decisions.

For a short 25 minute recorded webcast that covers these topics and more, please click here.

Storing for price appreciation

Harvest is the time when margin management shifts from margin versus costs of production to margin versus cost of ownership. Like cost of production, the market doesn’t care about your cost of ownership, however the market carry sometimes offers the ability to help pay for those costs.

Cost of ownership is unique to each farm operation. Often with on-farm storage, the costs to own the bushels into the future can be easily overlooked. The most obvious costs are any storage costs (bin costs, maintenance, extra shrink/dry) and interest costs (the opportunity costs of the stored crop value not offsetting farm loans or earning interest).

Any decision to store crops must consider the cost of ownership – on or off farm. Farmers should estimate and project these costs for their own situation. Once bushels are committed to storage, price is not necessarily the objective. In fact, the points on the cost of ownership line are equal to the starting harvest price. We can become so focused on price that real returns slip out of our hands. The real objective should be a margin above costs of ownership.

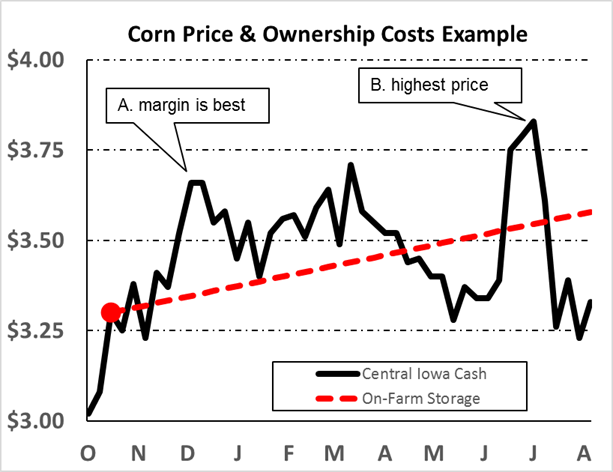

Margin after harvest moves with price and the mounting costs of ownership. For example, the above graph depicts a central Iowa cash corn price from a historical crop marketing year. This example is selected to illustrate that the highest price is not necessarily the best return. The costs of ownership (dashed red line) represent 5% interest plus 1.5 cents per month storage. At point A (December) the margin above costs of ownership is 32 cents per bushel. At point B (July), price is at the highest in the time period shown, yet margin is less per bushel than was offered in December. This simple example shows that the highest price is not necessarily the best margin. Stored bushels should have a margin goal, not a price goal! In addition, consider all the additional price risk experienced between point A and B.

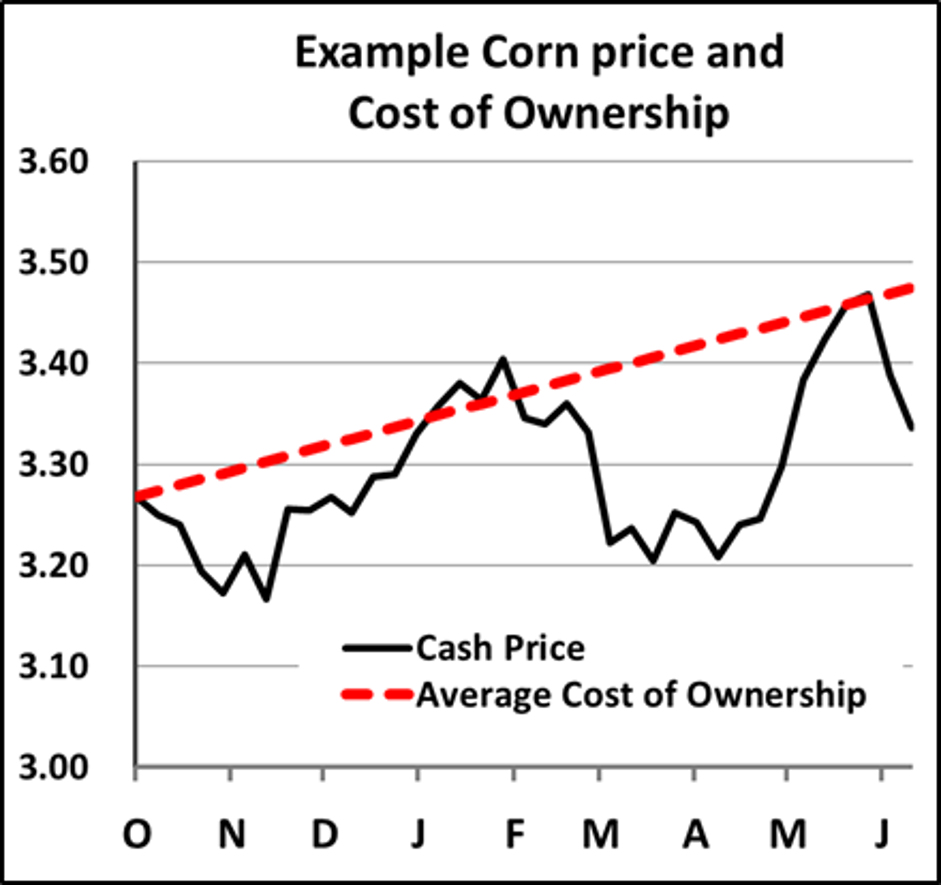

Just like any pricing objective, the margin above cost of ownership is not guaranteed. In fact, on average, opportunities are scarce. The graph below shows the average of last five crop years (2015-19) of central Iowa cash corn price and the average cost of ownership for that same period. This illustrates the importance of having a margin above cost of ownership goal in mind to sell at that pre-determined margin.

Storing for basis appreciation

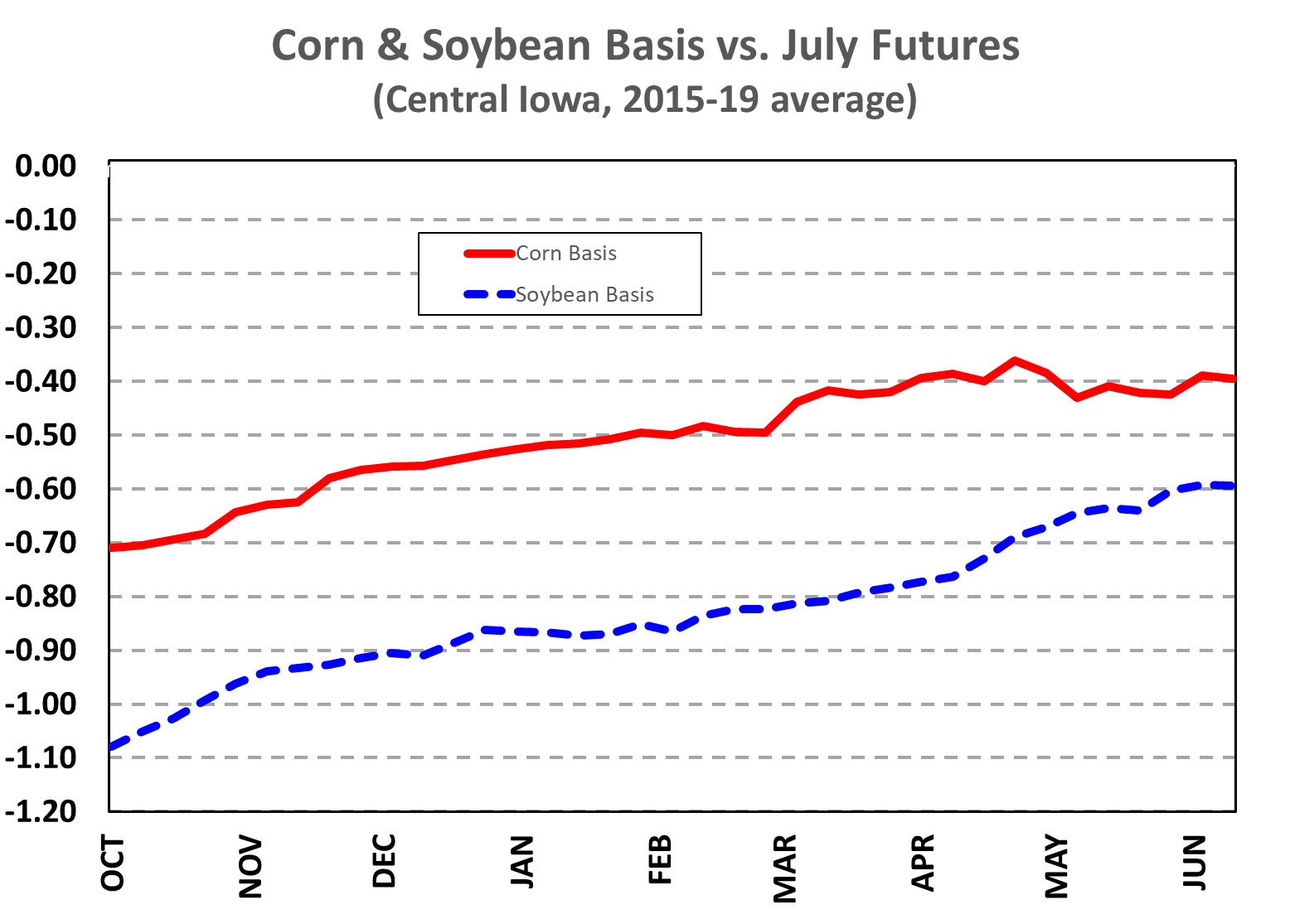

Hedged bushels can be stored also and the goal then becomes basis appreciation to a pre-determined goal. Historically, on average basis does improve for both stored corn and soybeans, yet the plan should include the basis goal. Just as in storing unpriced bushels, the farmer should be aware of the ongoing and mounting cost of ownership.

The graph above is a review of an example central Iowa 5-year corn and soybean basis history vs. July futures. The steepness of the average basis strength would say that on average basis does generally appreciate enough to pay for the cost of ownership.

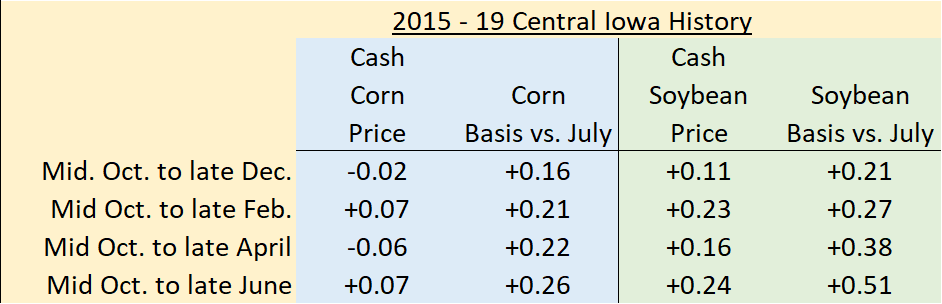

In fact, basis appreciation is much more common than price appreciation. The following table reviews the past five years for 4 time periods throughout the crop marketing year.

Of course, this is a look at averages, but it does show that basis gain is more consistent than price gain.

If your 2020 crop marketing strategy includes storing any portion of the crop for price or basis gain, it is important to have a plan that reflects your goals. Historically, storage can pay, but there are certainly no guarantees that the decision to store past harvest will be positive. Also, having a time deadline that considers seasonal price patterns and a margin plan that will trigger a marketing tool can give the storage portion of the plan much needed discipline.

To practice using goals and time deadlines with real markets, participate in the 2020-21 Iowa Commodity Challenge crop market simulation. Learn at home or office with the simulation that is open now and has a harvest date of October 21. For the sheet on how to get started, click on the grey box at the right top of this educational webpage.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!