Cattle Inventory Report - January 2026

Author

Published

2/3/2026

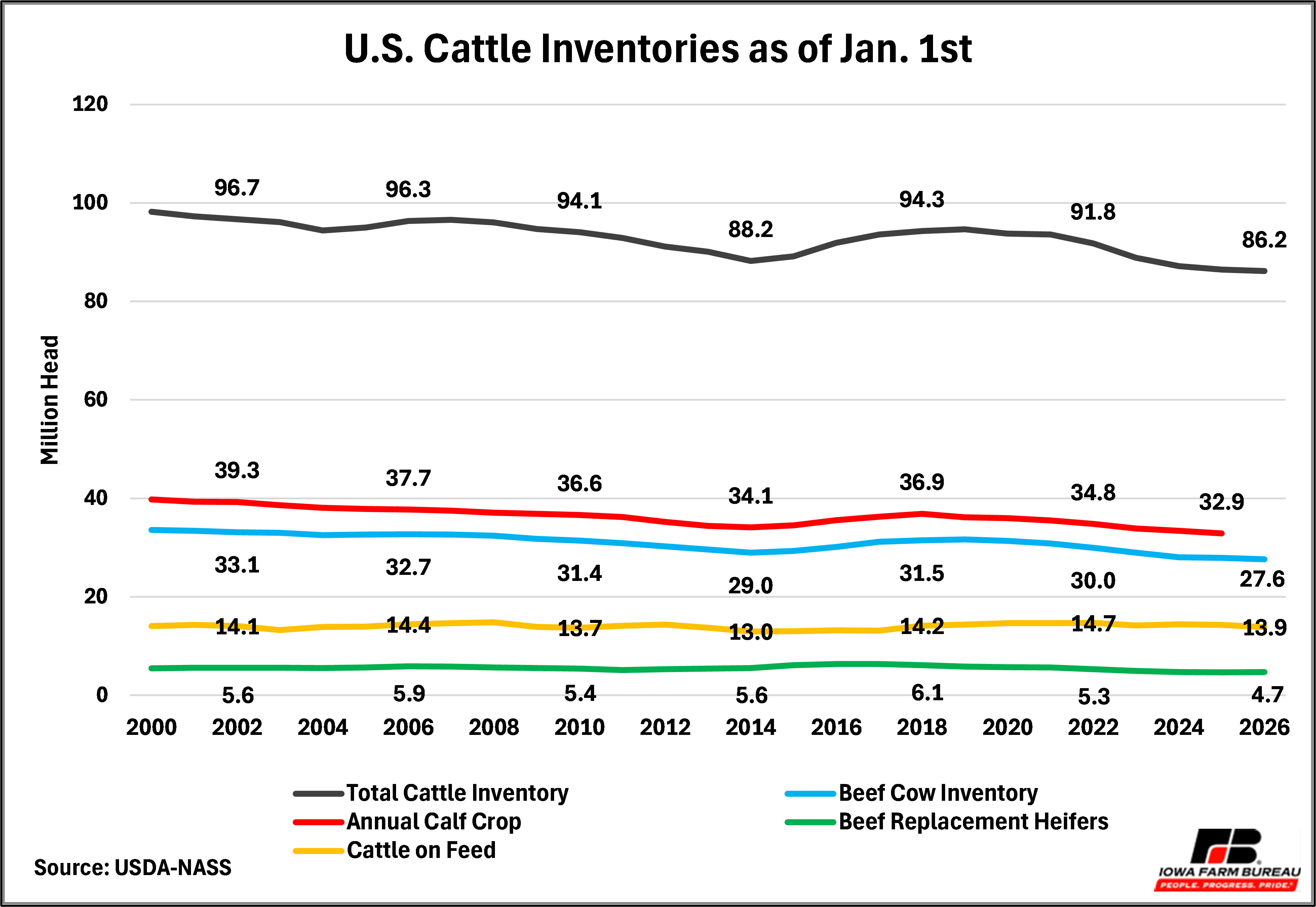

U.S. cattle inventories decreased amongst most major categories. The total inventory of all cattle and calves in the U.S. decreased slightly from 86.5 million to 86.2 million in 2025 (Figure 1). The U.S. cattle herd continues to contract, but this marks the smallest decline since 2019 (93.8 million) to 2020 (93.6 million). Beef cows fell by 1.0% to 27.6 million heads. Beef replacement heifers increased by 0.9% to 4.7 million heads with nearly 3 million expected to calve in 2026 which is a 1.4% increase from the previous year. All cattle on feed fell by 3.0% to 13.9 million heads. Additionally, milk cows increased by nearly 2.0% to 9.6 million heads.

The 2025 calf crop declined by 1.6% to nearly 32.9 million calves (Figure 1). Of the total annual calf crop, 73.6% were calved in the first half of the year and the remaining 26.4% were calved in the second half of the year.

The increase in heifers kept for beef cow replacement and those expected to calve signals the early stages of herd rebuilding, but this progress is tempered by the continued decline of the calf crop.

Figure 1. U.S. January Cattle Inventories

Iowa’s inventory of all cattle and calves is down 1.4% to 3.45 million heads from 3.50 million heads in 2025 (Figure 2). Beef cows totaled 815,000 heads, down 1.2% from 2025. Beef replacement heifers stayed constant at 110,000 heads in 2025. Cattle on feed in Iowa fell by 2.5% to 1.18 million heads. Iowa’s 2025 calf crop totaled 1.00 million heads, down 2% from 2024. Additionally, milk cows stayed constant at 245,000 heads.

Figure 2. Iowa January Cattle Inventory

Cattle on Feed

U.S. cattle on feed inventory of all cattle and calves fell by 3.0% to 13.9 million and Iowa’s cattle on feed inventory fell by 2.5% to 1.18 million. The decline in cattle on feed inventories is partially due to feeder cattle placements seen in figures 3 and 4. U.S. placements peaked at 2.04 million in October and sales for slaughter peaked in 1.87 million in January. Iowa’s placements peaked at 115,000 in January and sales for slaughter peaked in December at 100,000.

Figure 5 shows feeder cattle placements by size.

Figure 3. U.S. Cattle on Feed Stats

Figure 4. Iowa Cattle on Feed Stats

Figure 5. U.S. Cattle on Feed Placements by Size Group

Screwworm Risk

Cattle herds may be moved to northern states as a strategic response to rising New World screwworm risk, which is currently concentrated near the U.S.–Mexico border and expanding north through Mexico. Recent detections just 70 miles from Texas highlight how close the parasite is to entering southern U.S. cattle regions, prompting concern among producers and agencies. Because screwworm larvae infest open wounds and cause severe, sometimes fatal tissue damage, producers in high-risk southern areas like Texas, Oklahoma, and Arizona face greater vulnerability. Moving herds to northern states puts more distance between the cattle and the presence of screwworm.

Cattle on feed fell by nearly 10% in Arizona, Oklahoma, and Texas, while Nebraska’s cattle on feed increased by 4% in 2025.

Figure 6. Cattle on Feed for Notable States

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!