April WASDE Report Brings Bearish Surprise

Author

Published

4/11/2024

Report

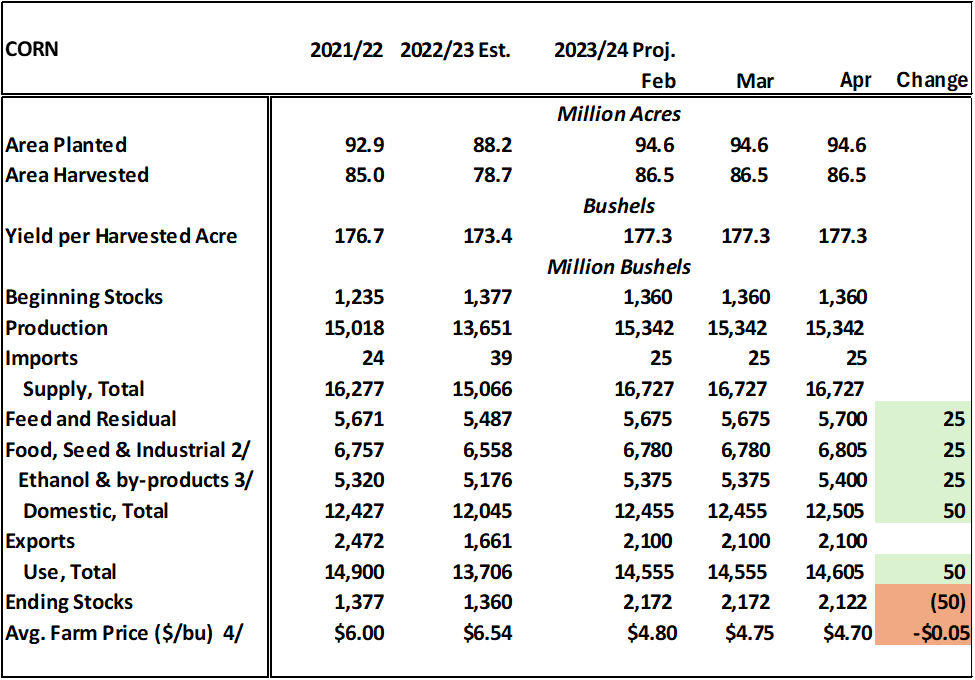

USDA released its updated WASDE report on April 11, 2024. This report brought mixed news to the corn market with a slight increase in U.S. corn usage for feed and for ethanol production which resulted in a 50-million-bushel adjustment to total usage and bringing total use to 14.605 billion bushels. However, even though ending stocks were reduced by 50 million bushels to 2.122 billion bushels, the season-average price was reduced by 5 cents per bushel to $4.70. U.S. corn ending stocks were slightly higher than the average of pre-report trade expectations but still near the middle of the range of expectations.

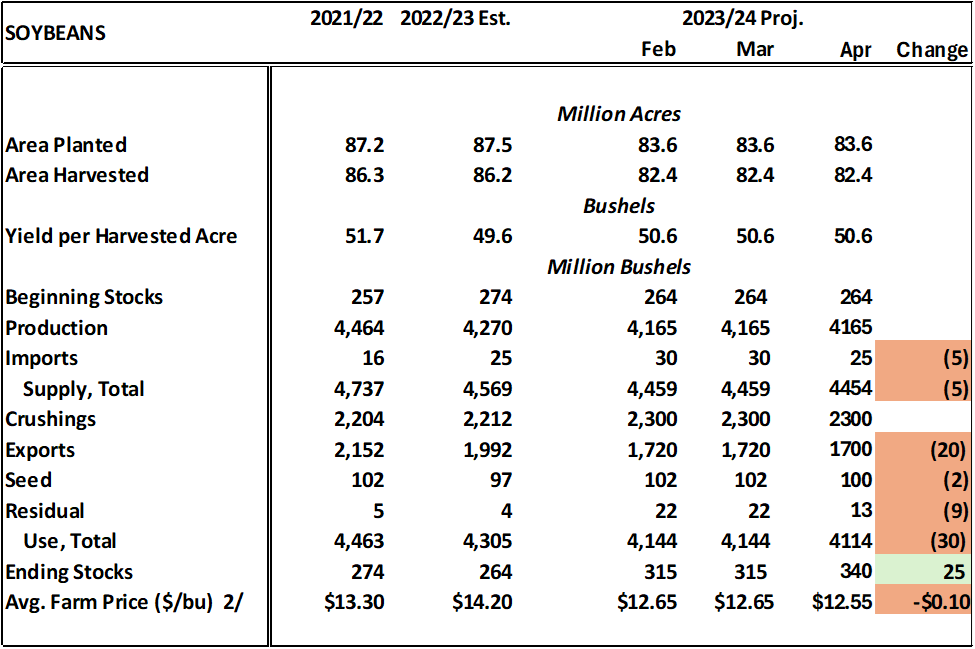

The report lowered soybean imports by 5 million bushels, but lowered exports by 20 million bushels, seed use by 2 million bushels, and the residual category by 9 million bushels which resulted in a net increase of 25 million bushels in ending stocks. The U.S. season-average farm price was lowered 10 cents per bushel to $12.55. U.S. soybean ending stocks were above pre-report trade expectations and at the high end of the range of expectations.

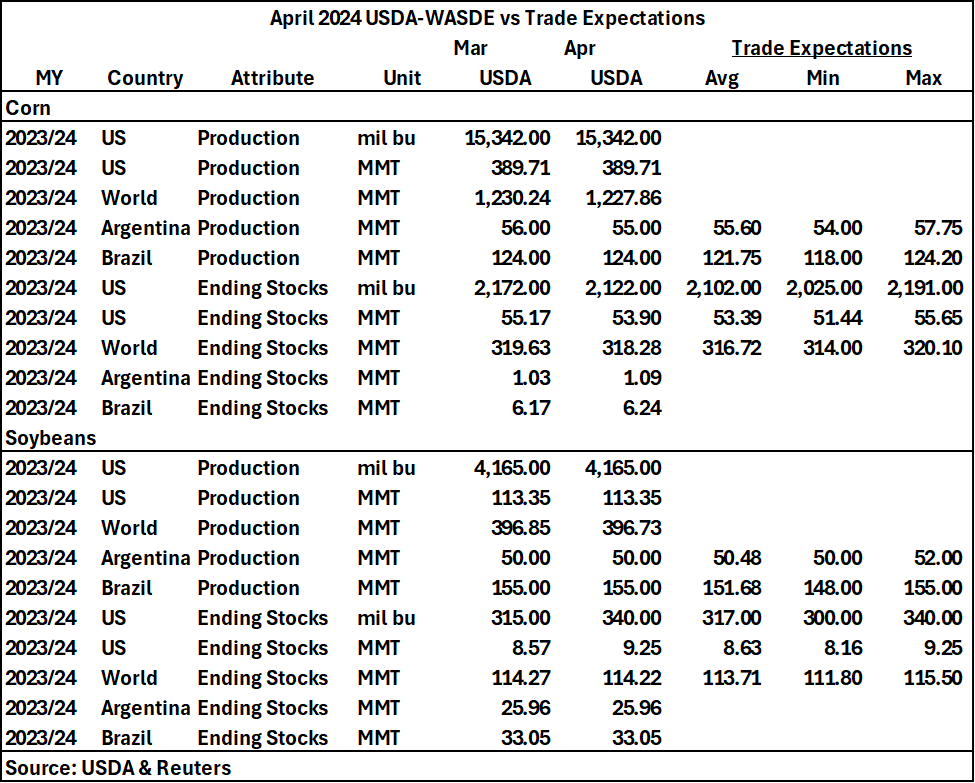

Table 1. April 2024 USDA WASDE vs Market Expectations

South American corn production was reduced slightly by USDA, dropping 1 MMT in Argentina, but holding Brazil steady with the production estimate in March. The drop in Argentinian corn production matched pre-report trade expectations, but USDA’s Brazilian corn production number was 2.25 MMT higher than the trade pre-report estimate and at the top of the range. The higher Brazilian corn production number by USDA also led to world ending stocks for corn than the trade expected.

For soybeans, USDA held production estimates for Argentina and Brazil at the same levels as reported in March. The market was expecting an increase for Argentina but a 3 to 7 MMT decrease for Brazil. The USDA estimate of 155 MMT of soybean production for Brazil was at the upper end of the range of pre-report expectations and world soybean ending stocks also were higher than trade expectations. Unrelated to today’s WASDE report, but relevant to the market’s expectations, the Brazilian crop agency, CONAB, reduced their estimates of Brazilian corn and soybean production to 110.9 MMT of corn, and 146.5 MMT of soybeans. There is now an 8.5 MMT gap between CONAB’s estimate of the size of the Brazilian crop and USDA’s estimate of the Brazilian crop. This is the largest gap ever between the estimates of the two agencies.

Initial Market Reaction

The immediate market reaction to the USDA reports was negative for both corn and soybeans. Corn was trading 2 to 3 cents lower before the report and traded as much as 6 cents lower on the day in the first hour after the report. Soybeans and soybean oil were lower on the day ahead of the report with soybean meal being a dollar or so higher on the day. After the report, soybeans dropped as much as 16 cents lower but then began to recover as soybean meal prices edged higher.

Changes to Domestic Balance Sheets

This section summarizes changes to the corn and soybean balance sheets in more detail.

Table 3. April 2024 WASDE Corn Balance Sheet

USDA raised domestic use of corn by 50 million bushels with 25 million bushel increases for both feed use and ethanol grind. These increases in usage fell through to the ending stocks line where USDA reduced ending stocks by 50 million bushels but still lowered season-average price by 5 cents per bushel to $4.70 per bushel.

Table 4. April 2024 WASDE Soybean Balance Sheet

For soybeans, USDA lowered supply by 5 million bushels on lowered import expectations, and lowered use by 30 million bushels with a 20-million-bushel reduction in exports and a net 10- million-bushel (after rounding) reduction in seed and residual. The season-average price for soybeans was reduced 10 cents per bushel to $12.55.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!