May 2023 Supply and Demand Update

Author

Published

5/15/2023

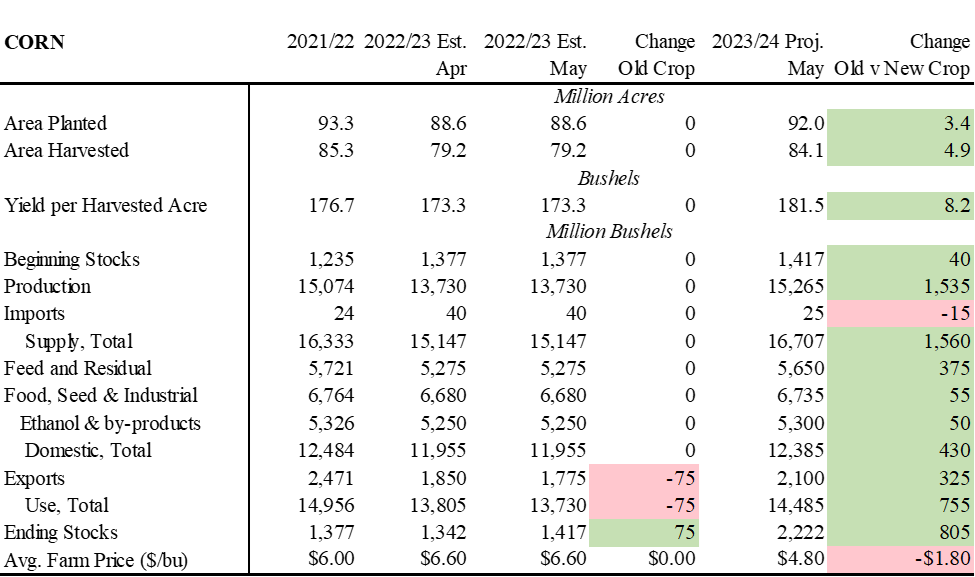

Corn

There was only one change to old crop corn estimates. Expected exports were lowered 75 million bushels to 1,775 million bushels. This left ending stocks 75 million bushels higher. The decrease was warranted and anticipated as corn exports have been slow all year. It would have been an uphill battle to reach the previous USDA estimates and the new one may come down even more by August as well, particularly if exports from the Black Sea region and from Brazil remain very price competitive.

New crop corn is forecast to have record production of 15.3 billion bushels. This uses a weather adjusted trend yield and that all the 92 million acres of corn USDA forecast in the March prospective plantings report will be planted to corn and the normal percentage of corn-for-grain will be harvested. The prospective plantings report forecast increases corn acreage in most major corn states. Notably North Dakota was forecast to have a large increase. North Dakota has just started to plant corn and has time to get acres in if weather cooperates. It will be a state to watch for lower-than-expected corn acres. Corn acres in Iowa are being planted at a near-record pace and it appears that corn plantings in other Midwestern states are at or ahead of normal planting percentages for mid-May.

On the demand side, every major category is expected to use more corn next year. This does not mean demand is increasing, only that the quantity consumed is increasing. The key difference is the quantity consumed changes if the price of corn changes, while increased demand means the market wants more corn and will pay more for it on a relative basis.

With supply expected to be higher in the coming marketing year, prices are expected to be lower, which will increase the quantity of corn consumed, but does not mean that “demand” is increasing. Most of the increases in domestic use are expected to come from feed and residual use. Lower prices lead to more corn included in rations and typically results in increased use per grain-consuming-animal-unit (GCAU). Ethanol use is expected to have a modest gain. Exports are expected to be higher, though they are extremely low this year as mentioned above. Again, it is lower prices that are expected to increase foreign quantity demanded.

Total production is expected to increase more than total use, leaving stocks higher. As a result, lower prices are expected. The average farm price received is expected to fall almost $2.00 compared to this past year’s season average price.

Table 1. WASDE Corn Estimates – May 2023

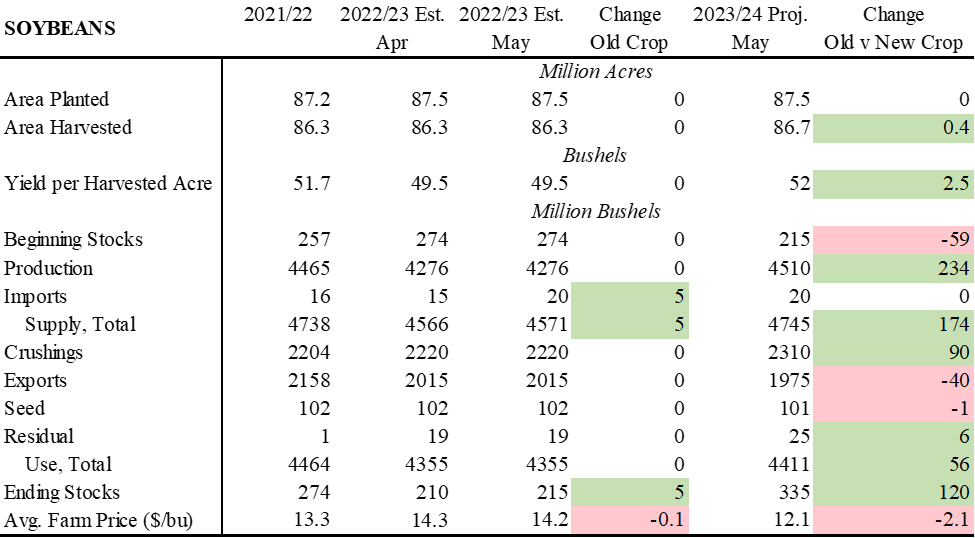

Soybeans

Like corn, old crop soybeans saw only one change. Imports were increased by 5 million bushels, increasing ending stocks by the same amount.

New crop soybean production is forecast to be 4.5 billion bushels, up over 230 million bushels from last year. As reported in the prospective plantings report, acreage is expected to be up marginally compared to last year, but not enough to see in the rounded figures in the Table 2. Yield is expected higher on a trend-forecasted yield.

Soybean use is expected to increase overall, but changes are mixed between categories. Favorable crush margins and expansion of domestic crush fueled by interest in the renewable fuels sector contribute to the increase in domestic crush. Competition for soybeans from domestic crush and from South America lead to lower expected soybean exports next year. Brazil just had a record soybean crop this past year and USDA forecasts next year’s crop to be even larger. Argentina on the other hand had poor soybean yields last year but is expected to have a big bounce back in the coming year. Paraguay, another major South American exporter is also expected to have a large crop. Weather will be a factor but large crops from these three countries would give US soybean exports significant competition.

Like in the corn market, use is expected to increase, but this does not mean soybean demand will be improving as lower prices are also expected. Farm prices are expected to fall about $2 per bushel to $12.10 per bushel.

Table 2. WASDE Soybean Estimates – May 2023

Final Comments

Gains in production are expected to outpace increases in use, leaving expected ending stocks higher for both corn and soybeans. As a result, prices are expected to be lower.

The expected 2023/24 farm price of corn is $4.80 per bushel, which is about equal to Iowa State’s current estimate for the breakeven price for corn following soybeans in 2023. Iowa State’s most recent estimate of breakeven soybean price is $11.82 per bushel for 59 bushel per acre beans, which is still below the expected farm average price for soybeans.

Costs vary significantly from farm to farm and risk management strategies can help lock in prices above the expected farm average price next year. Overall, margins are expected to be less than the past two years, and managing margins will be especially important this upcoming year.

Furthermore, unknowns like weather and final acreage still can change market conditions in a hurry if yields are higher or lower than current forecasts.Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!