Market Update May 8, 2023 - Fund Liquidation Higher than Anticipated

Author

Published

5/8/2023

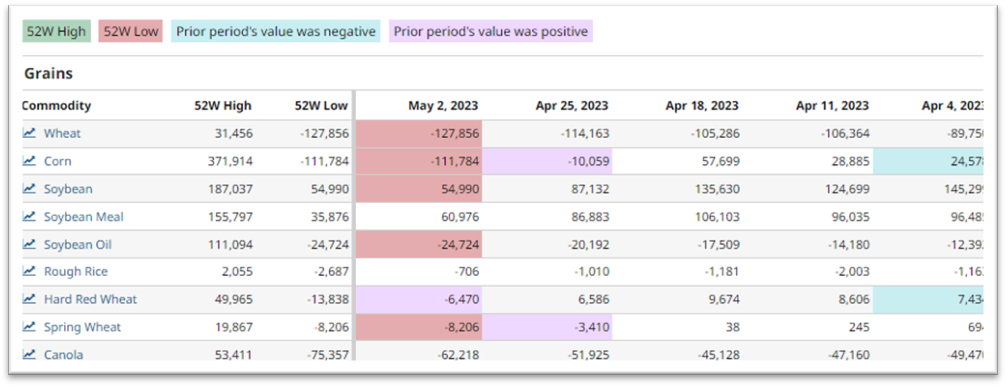

Funds continued their aggressive liquidation of corn, soybean, and wheat contracts highlighted in the most recent release of the Commitments Of Traders (COT) report released Friday 5/5/23 for Tuesday 5/2/23. Corn, Soybeans, and Wheat all achieved 52-week lows (Figure 1). Speculators still hold a net long position in soybeans at 54,900 contracts while wheat and corn add to significant short positions. Liquidation in the corn market gets the most attention as managed money traders sold over 100,000 contracts!

Figure 1 Disaggregated Commitments of Traders Net Positions (Managed Money)

The market did find support in the latter half of the week after Dec 23 corn touched 5.12½ on May 3rd, its lowest level since January of 2022 finishing the week more than 20 cents higher at 5.34¼ as oversold markets found buyers and the Black Sea Grain Deal continues to look less likely to be extended following drone attacks on the Kremlin.

Forward

The focus now shifts to planting progress with the USDA’s updates being released today at 4pm Eastern time with significant progress anticipated across the country. Many producers across the state have finished planting both corn and soybeans as a recent stretch of ideal weather kept planters rolling. Weekend rains and forecasted temperatures in the 70’s and 80’s support healthy gemination in the week ahead.

Next up is the May WASDE report which will be released Friday, May 12th at 12:00 ET. which will give the market its first look at the new crop balance sheet. Initial expectations are for the report to support increased production and carryout, limiting any bullish upside expectations stemming from the report.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!