March 31 Grain Stocks and Planting Intentions

Author

Published

3/31/2023

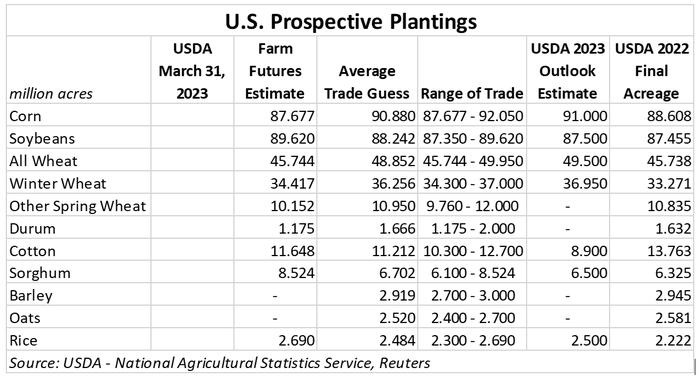

Acreage

At 11:00 a.m. CDT, The USDA released its Prospective Plantings and March 1 Grain Stocks report. The below table shows average trade estimates prior to the report release. The USDA pegged prospective corn acres at 91.99 million, which is roughly 1 million acres above the USDA outlook estimate of 91 million acres below and 4% above last year. The USDA pegged prospective bean acres at 87.51 million, slightly above the USDA outlook estimate of 87.5 million acres as well as slightly higher than last years final acreage numbers.

Quarterly Grain Stocks

Corn came in at 7.401 billion bushels, representing a nine year low.

Beans stocks at 1.69 billion bushels, representing a six year low.

Market Reaction:

Nearby May(K) corn futures responded positively to the stocks number, finishing the session 11 cents higher at 660-4.

New crop Dec(Z) futures struggled to maintain support given the acreage number after some choppy trade following the report release, closing half a cent lower for the day at 566-4.

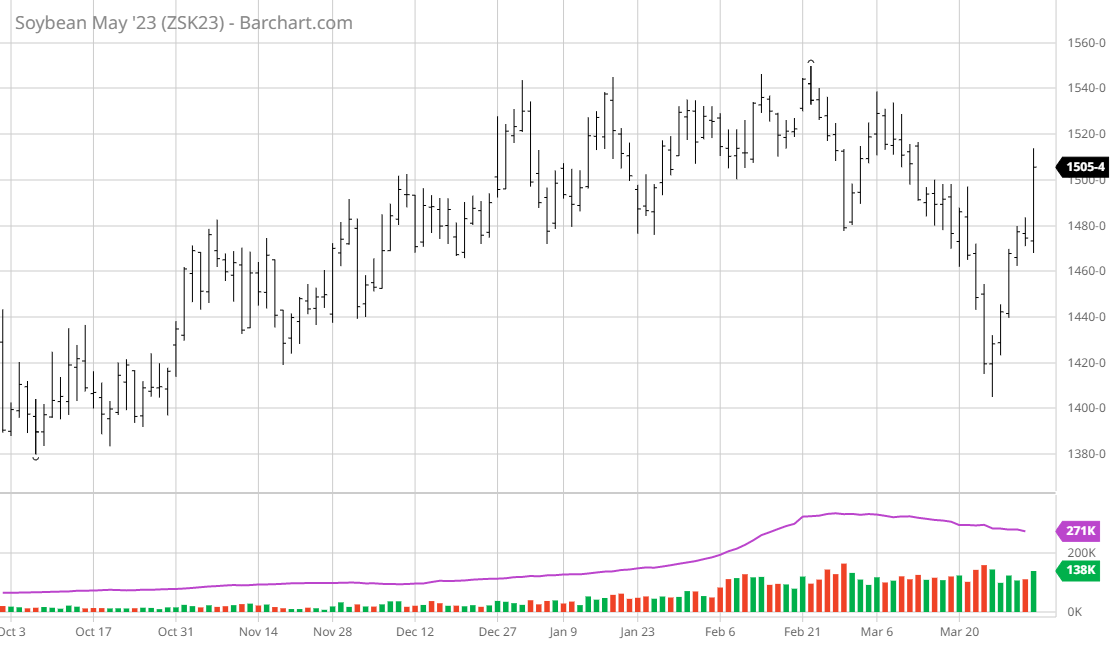

Nearby May(K) soybeans enjoyed a healthy rally on the lower than expected stocks number, finishing the day 31 cents higher at 1505-4. May soybeans have now rallied 86 cents in the last 6 sessions after closing at a nearly 5 month low of 1419-4 on March 23rd.

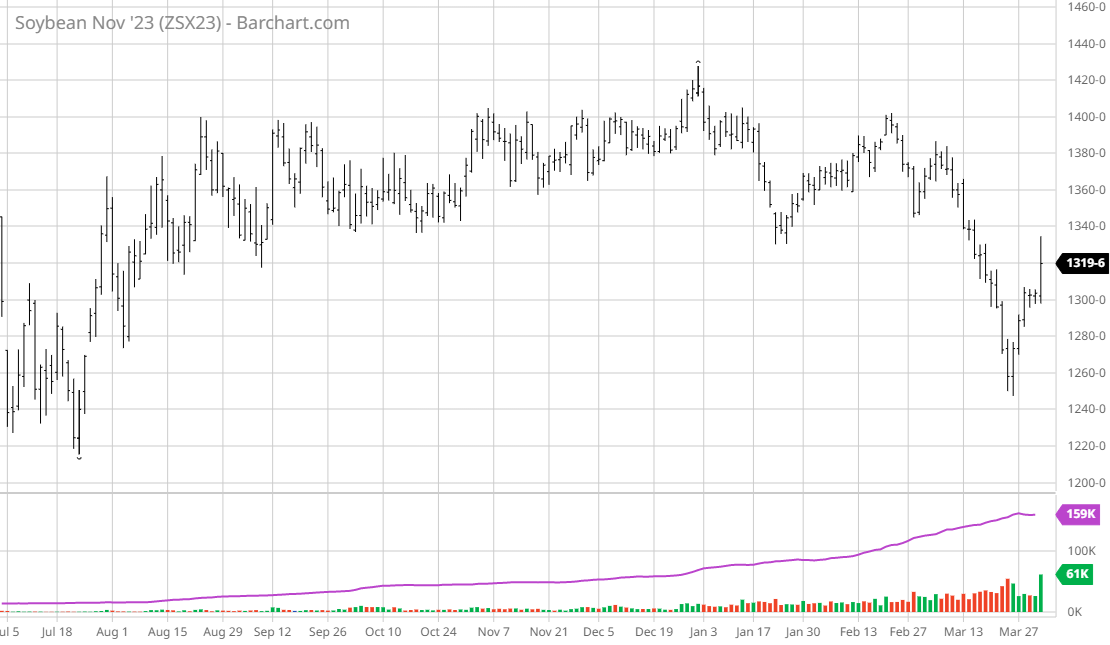

New crop Nov(X) beans also enjoyed a decent rally as they finished the session 16-2 higher at 1319-6, marking a 61-cent recovery from the roughly 8-month low of 1258 set March 23rd.

Please Join us Monday, April 3rd at 1:00p.m. for our Market Implications Webinar.

Commodity Risk Analyst, Karl Setzer will be taking a deeper look at the Planting Intentions and Stocks reports and what it might mean for commodity markets going forward.