Key Updates, Trends, and Insights on the Turkey Industry as We Approach Thanksgiving

Author

Published

11/20/2024

Production

Iowa’s poultry industry has faced significant challenges driven by biosecurity concerns due to Highly Pathogenic Avian Influenza (HPAI) and financial distress for an overwhelming part of the last three years. This year, however, Iowa’s commercial turkey sector has largely remained unaffected by HPAI. While turkeys are most commonly associated as the main dish at Thanksgiving dinner, lingering concerns over grocery prices leave consumers wondering how much their Thanksgiving meal will cost. Even as trends reveal fewer consumers are serving up turkey for Thanksgiving, the turkey industry remains a vital part of Iowa and U.S. agriculture.

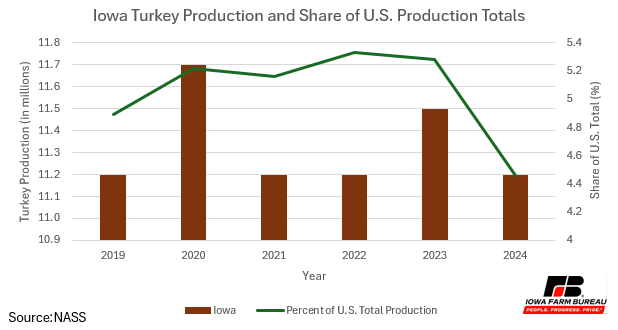

The USDA reports that Iowa’s turkey production remains steady at less than 12 million head annually. This year’s production levels of 11.2 million head come in slightly behind last year’s production of 11.5 million head. Iowa’s turkey production has consistently accounted for well over 4% of the total U.S. production, this year coming in at 4.5%. Iowa currently ranks seventh in the nation for turkey production trailing top producing states Minnesota and North Carolina who collectively produce just over 30% of all turkeys in the United States. The USDA projects this year’s total national production to come in at around 205 million head, a nearly 6% drop from 2023 production.

Prices

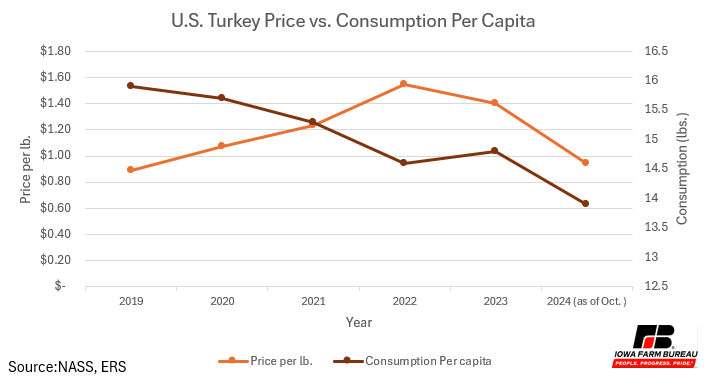

Consumers can anticipate favorable prices as they head to the grocery store this holiday season to purchase their turkeys. USDA price data reports the price for a frozen whole turkey hen at $0.94/lb. This is a significant decline from previous years, likely due in part to the decreasing demand from consumers. U.S. domestic consumption trends have experienced a persistent decline from 5.26 billion lbs. in 2019 to 4.96 billion lbs. to date in the current year (Figure 2). This decline comes as no surprise given the increased competition facing the turkey industry from pork and beef.

Recent years have demonstrated that despite the favorable and downward trend of prices, turkey consumption per capita in the U.S. is on the decline. While the demand for whole frozen turkeys typically spikes around the holiday season, consumer demand and interest in turkey remains a challenge for producers competing with other meat industries even around the holiday season.

Figure 2: Turkey Prices vs. Consumption

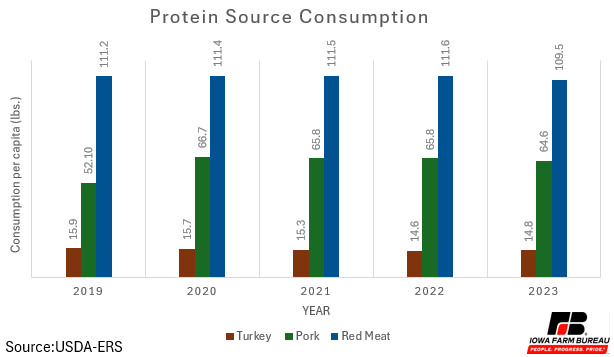

Trends show that consumers are taking full advantage of the variety of protein sources when it comes to Thanksgiving meal planning. Along with the downward trend of turkey consumption, the supply of turkey throughout the U.S. is also on the decline. The downturn in prices that consumers are paying is likely due in part to the decline in demand from changing consumer preferences and higher production costs for producers. USDA data reveals a decline in total birds and hatchlings for the year indicating fewer birds available for the holiday season than in previous years, but still plenty in stock for those who go with the traditional turkey dinner.

Figure 3: Comparison of Protein Source Consumption Per capita Over Time

Exports

Figure 4: Turkey Exports Over Time

The USDA projects a positive shift in U.S. turkey meat exports, expecting to rise nearly 3% from 2023 and nearly 24% from 2022 levels, reaching 504 million pounds (RTC). The United States remains one of the leading exporters in poultry, including turkeys, despite the setbacks during peak years of HPAI outbreaks, a major cause of a sharp decline in exports back in 2022. Commercial operations in other top exporting nations, like Brazil, remain free from HPAI allowing their industry to surpass the United States in producing to export numbers.

While commercial turkey production in the United States has experienced minimal impact from diseases this year, the recovery of trade and turkey exports is ongoing. Since 2022, export numbers have been significantly lower but slowly recovering over time. Still, the competitive nature of the global turkey industry will remain given that countries like Brazil have capitalized off of minimal disease outbreak threats and lower feed and inputs costs.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!