Iowa Ethanol Production (03/31/2017)

Author

Published

4/4/2017

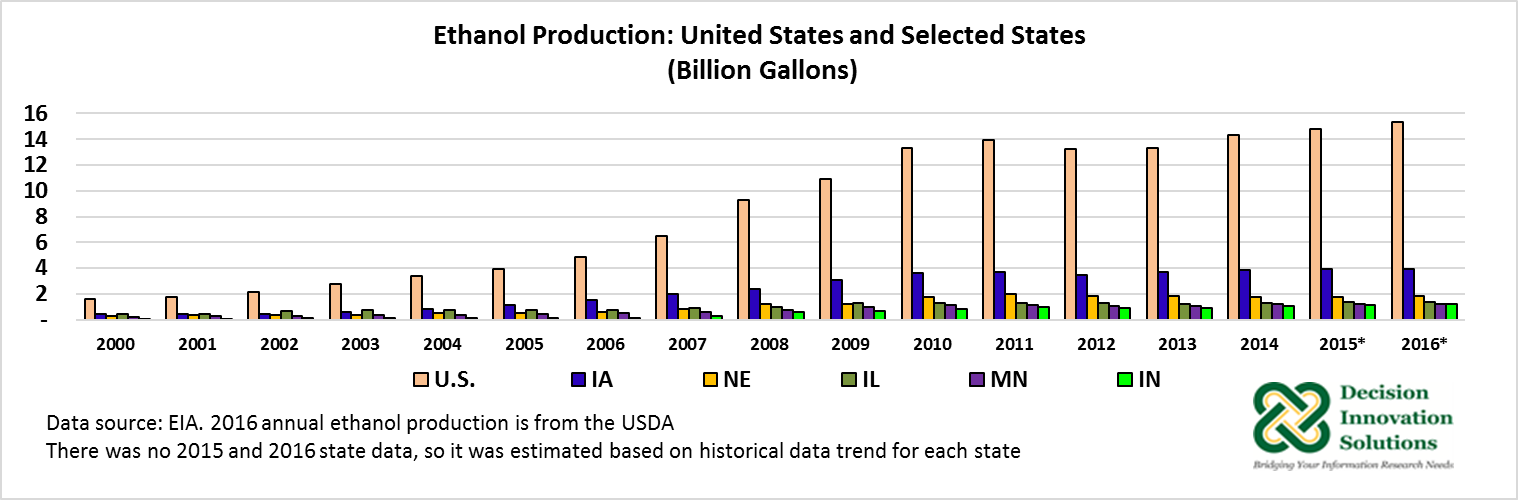

U.S. ethanol production increased 3.5% to 15.329 billion gallons in 2016 compared with 2015 (14.807 billion gallons) reaching a new record high (see Figure 1). The latest state ethanol production data available from the U.S. Energy Information Administration (EIA) is current to 2014, so for the states included in this report, 2015 and 2016 ethanol production was estimated based on each state historical data trend. The estimates indicate that Iowa continued as the largest ethanol producer in the United States in 2016, reaching a volume of 3.9 billion gallons and representing 25.5% of total 2016 U.S. production. Other large ethanol producers in the United States are Nebraska, Illinois, Minnesota, and Indiana. The estimated 2016 ethanol production of Nebraska and Illinois made up 11.9% (1.83 billion gallons) and 9% (1.38 billion gallons), respectively, of total U.S. ethanol production, whereas Minnesota and Indiana ethanol production made up 7.9% (1.21 billion gallons) each. Ethanol production of Iowa along with these four states made up 62.2% of 2016 U.S. ethanol production. Overall, since 2010, Iowa’s ethanol production has accounted for 27% of the U.S. fuel ethanol production (see Figure 1).

Figure 1.Ethanol Production: United States and Selected States (Billion Gallons)

Based on data from the Iowa Department of Revenue published in the Motor Fuel Monthly Report, Figure 2 indicates that in 2002, ethanol-blended gasoline (E10) taxable sales were about 55% of total fuel taxable sales in Iowa, with gasoline-only taxable sales representing the remaining 45%. As Figure 2 shows, the number of gallons of taxable ethanol-blended gasoline has varied throughout the years, but overall, gallons of taxable ethanol-blended gasoline have increased from 879 million gallons in 2002 to 1.129 billion gallons in 2016, indicating a larger demand for ethanol-blended gasoline in Iowa compared with gasoline without ethanol. In 2016, ethanol blended gasoline accounted for an annual average of 64% of taxable gallons of motor fuel. Starting in 2015, the average percentage of taxable gallons reported as ethanol blended gasoline decline to 64%. As indicated by the Iowa Department of Revenue, this was the result of a change in the way the types of taxable gallons are reported by suppliers.

Figure 2. Iowa Annual Taxable Gasoline, Ethanol Blended Gasoline, and Percent Ethanol Blended Gasoline of Total Taxable Fuel

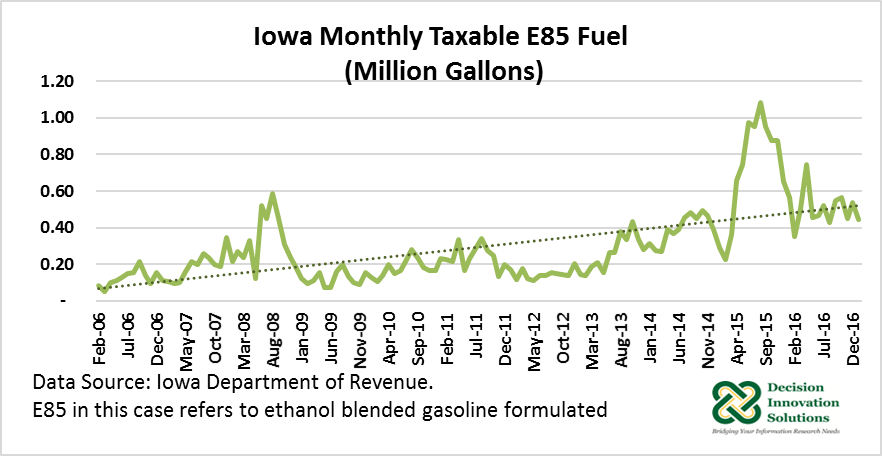

Most gasoline in the United States remains at a 10% blend, as the domestic market growth for E15 blends (15% ethanol blend) is limited by infrastructural and regulatory constraints. Higher levels of blends such as E85 (70% to 85% ethanol) can be used only in flex-fuel vehicles (FFV). The Iowa Department of Revenue in the Motor Fuel Monthly Report also publishes data on taxable gallons of E85, which in this case refers to ethanol blended gasoline formulated with a percentage of between 70% and 85% by volume of ethanol. The gallon amounts published in the Motor Fuel Monthly Report are not from the retail level but from the supplier/terminal or rack level.

There may be additional blending of products throughout the fuel distribution chain. This happen for most E85 gallons, therefore the gallons reported for this fuel type are far below the actual number of retail gallons sold in Iowa. Based on the data reported by the Iowa Department of Revenue (see Figure 3), Iowa taxable gallons of E85 have increased from 1.4 million gallons in 2006 to 6.1 million in 2016. Overall, sales of E85% fuel remain low compared with E10, representing only 0.4%, on average, of Iowa taxable gallons of motor fuel in 2016. According to the Iowa Renewable Fuels Association, there are currently 226 fuel retailers throughout the state of Iowa offering E85 fuel and nearly 300,000 FFVs owned by Iowa motorists. Iowa retail stations supplying gasoline fuel blends of 70% to 85% ethanol for use in motor vehicles may be eligible for a tax credit in the amount of $0.16/gallon. This tax credit will expire after December 31, 2024.

Figure 3.Iowa Monthly Taxable E85 Fuel (Million Gallons)

The USDA’s Biofuel Infrastructure Partnership (BIP) is expected to help fund the installation of about 5,000 blender and dedicated pumps at approximately 1,400 gas stations across 21 states. BIP awarded Iowa $5.0 million to install an estimated 187 blender pumps to increase the availability of renewable fuels in the state. As indicated by the Renewable Fuel Association (RFA) in its 2017 Ethanol Industry Outlook report, funding from the BIP program and the industry-led Prime the Pump program, have contributed to the adoption of blender pumps to a number of new retail stations.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!