HPAI Continues, but Egg Prices Drop Following Holiday Demand Spike

Author

Published

3/13/2023

HPAI Continues, but Egg Prices Drop Following Holiday Demand Spike

Introduction

If you have been to the grocery store lately, you likely have noticed eggs prices are high. In 2022, egg prices increased 60%. You may have also noticed a decrease in egg prices over the past few weeks. Unfortunately, this decrease is not likely to last much longer. Highly pathogenic avian influence (HPAI) and seasonal demand moved egg prices to extreme highs in November and December. While seasonal demand has faded, HPAI continues to impact the US flock.

HPAI Cases

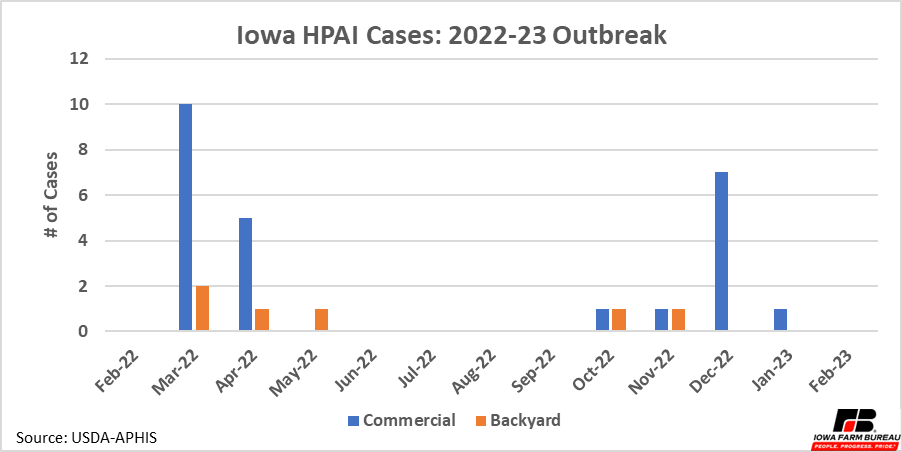

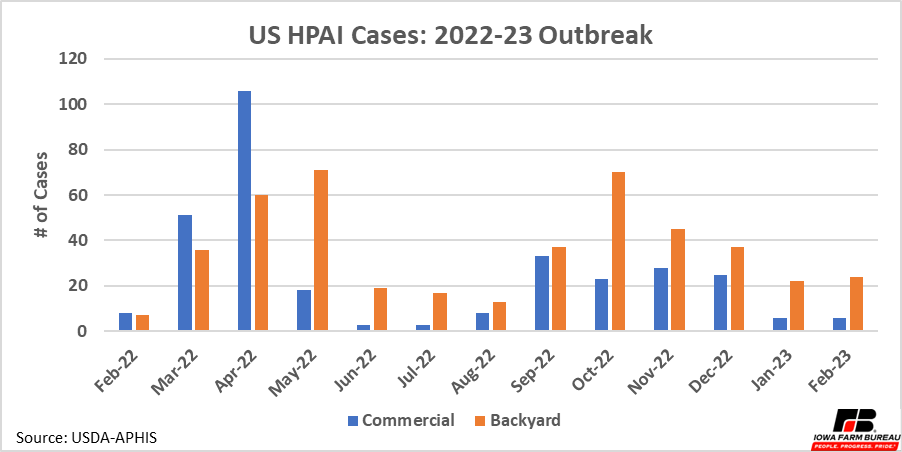

HPAI has continued to effect flocks in Iowa and the US (Figure 1 & Figure 2). Cases did slow down over the last summer, with Iowa have no reported cases from June to September, but cases picked up again in the fall and are still being identified across the US. At least 15 states have reported cases over the past month.

Of the domestic birds infected over the past year, 76% -- nearly 44.5 million birds -- have been in egg-laying operations. Turkeys account for about 9.8 million infected or culled birds. The impact on broiler operations has been less, involving a little more than 3 million birds. Other recent cases have involved commercial game birds or ducks[1].

The 2014-15 HPAI outbreak lasted 7 months from December 2014 to June 2015. The current outbreak has now lasted over a year. As of February 28, 2023, 58.5 million birds in 47 states have been affected by the 2022-23 HPAI outbreak. In Iowa, 15.9 million birds have been affected since the start of the outbreak. This means that about 27% of all birds affected have been in Iowa.

Figure 1. Iowa HPAI Cases: 2022-23 Outbreak

Figure 2. US HPAI Cases: 2022-23 Outbreak

Egg Industry Statistics

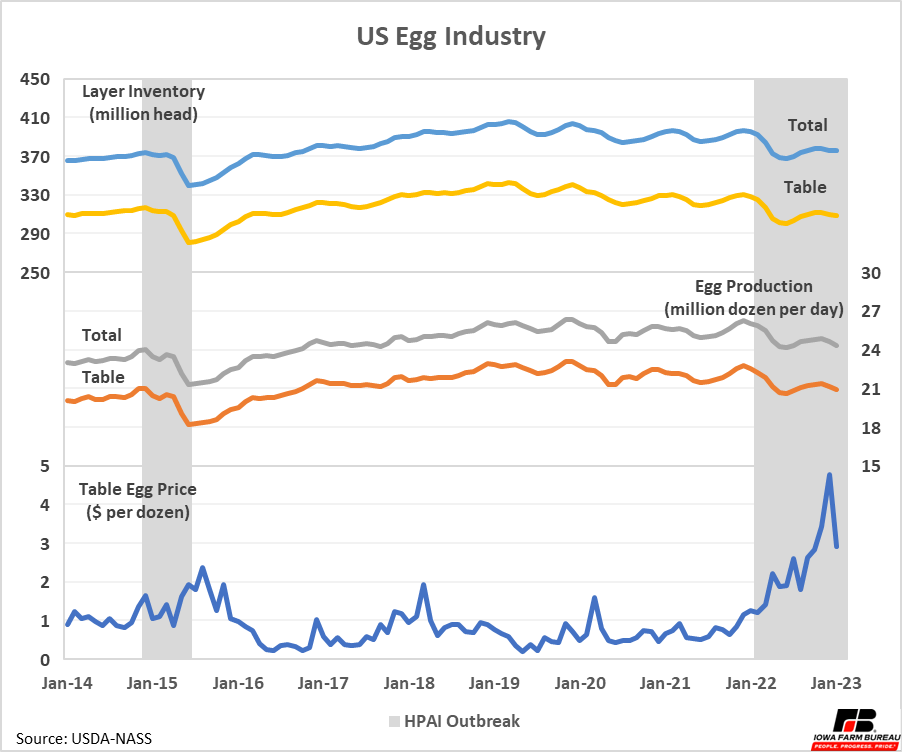

As HPAI cases have persisted, the recovery of layer inventory and egg production to pre-outbreak levels has slowed as well. Figure 3 shows statistics for the US Egg industry including layer inventories, egg production, and egg prices received by producers. HPAI outbreaks are also shaded. In the graph, “table” indicates eggs or layers who lay eggs for human consumption only, while “total” includes both table eggs and eggs to be hatched.

Layer inventories rapidly declined in February 2022 at the onset of the outbreak and hit their bottom in June 2022. Reported inventories rose slightly over the summer and early fall of 2022, but the resurgence of cases in the late fall of 2022 stalled gains inventory. Egg production mirrors layer inventory and has also seen recovery growth stall. In fact, production has decreased slightly on a per day basis over the last few months.

Despite stalled growth in layer inventories and production, egg prices have come down from the record highs in November and December. Egg demand typically increases around the holidays as demand for things like baked goods increases and 2022 was not an exception. Constrained egg supply coupled with this large seasonal demand pushed the prices producers received for eggs to $3.43 per dozen in November and $4.77 per dozen in December. Prices have fallen back considerably following the holidays but are still relatively high at $2.92 per dozen.

Figure 3. US Egg Industry

Looking Ahead

The 2022-23 HPAI outbreak has lasted much longer than the previous outbreak and still has not shown signs of slowing down. Layer inventories and egg production showed brief signs of recovery in the late summer of 2022 but a resurgence of cases in the fall of 2022 has stalled recovery. Meanwhile, egg prices have come down from record highs caused by seasonal demand, but still remain relatively high due to the continued HPAI outbreak.

With the seasonal demand shock now mostly past, how HPAI continues to impact the US flock will be important to monitor. Egg prices are likely to remain at these levels until the flock can recover to higher inventory and production levels.

If the outbreak does end, the industry showed after the 2015 outbreak it can recover relatively quickly. After the 2015 outbreak, egg prices reached more normal levels roughly six months after the outbreak ended and layer inventories and production had completely recovered in only nine months.

[1] https://www.dtnpf.com/agriculture/web/ag/news/article/2023/02/27/expert-current-highly-pathogenic-flu

Economic analysis provided by Aaron Gerdts, Research Analyst, Decision Innovation Solutions on behalf of Iowa Farm Bureau.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!