December 2025 WASDE Recap

Author

Introduction

The USDA released its updated WASDE report on December 9th, 2025.

(Current) 2025/26 Marketing Year

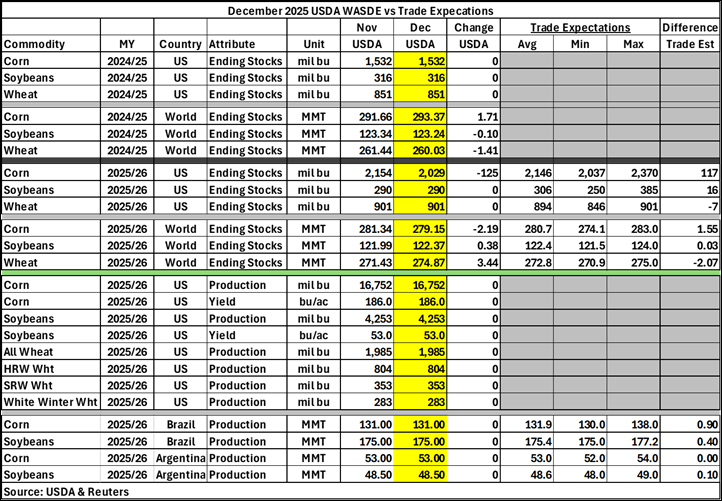

U.S. corn ending stocks decreased by 125 million bushels (mb) to 2,029 mb. Corn ending stocks fell 117 mb short of industry expert expectations and soybean ending stocks were 16 mb less than expected. Wheat ending stocks outperformed average expectations by 7 mb.

World ending corn ending stocks decreased slightly by 2.19 MMT to 279.15 MMT, while also falling short of trade expectations by 1.55 MMT. World soybean ending stocks increased marginally by 0.38 MMT to 122.37 MMT, while generally meeting average trade expectations of 122.40 MMT. World wheat ending stocks rose by 3.44 MMT to 274.87 MMT, outperforming expectations by 2.07 MMT.

(Prior) 2024/25 Marketing Year

U.S. corn, soybean, and wheat ending stocks remain unchanged from November to December for the 2024/25 marketing year.

World corn ending stocks increased by 1.71 million metric tons (MMT) to 293.37 MMT. World soybean ending stocks decreased marginally by 0.10 MMT to 123.24 MMT and world wheat ending stocks fell by 1.41 MMT to 260.03 MMT.

Foreign Markets

The USDA’s Brazil and Argentina corn and soybean production estimates remain unchanged for the 2025/26 marketing years, while all are relatively close to meeting average trade expectations.

Table 1shows some key report estimates for both U.S. and World production.

Table 1. December 2025 USDA WASDE

Initial Market Reaction

December corn futures rose from $4.35 to $4.39 just before the WASDE released. December corn futures initially fell by 1 cent before recovering to $4.41. March corn futures increased by 2 cents to $4.46 before the report released and initially rose to $4.48 before fluctuating and closing at $4.48. May corn futures rose by 3 cents to $4.54 before the report released and dropped a cent before fluctuating and closing at $4.55.

January soybean futures were trending downward reaching a low of $10.86 before the WASDE released but rose to $10.88 shortly after the report released. Futures fluctuated, falling to $10.84 before closing at $10.87. March soybean futures followed a similar trend, falling 5-6 cents prior to the report releasing. March futures fell 4 cents to $10.96 initially before closing at $10.98. May soybean futures initially fell by 3 cents to $11.08 before closing at $11.09.

December soybean meal futures decreased slightly from $300/ton to $299/ton. January soybean meal futures initially fell by $1.2/ton to $301.2 before continuing its downward trajectory and closing at $301.4/ton. March soybean futures followed a similar trend, initially falling by $1.2/ton to $307.3/ton. The downward trend continued before closing at $306.9/ton.

January soybean oil futures initially fell slightly from 50.98 cents per pound to $50.91 cents per pound before rising back to 50.99 cents per pound. March soybean oil futures followed a similar trend, decreasing from 51.50 cents per pound to 51.41 cents per pound, before recovering back to 51.50 cents per pound.

December wheat futures opened at $5.34 rose to $5.35. March wheat futures initially increased by 3 cents to $5.34 and fluctuated before closing at $5.34. May wheat futures also rose by 3 cents to $5.41 before fluctuating and closing at $5.42.

Changes to Domestic Balance Sheets

This section summarizes changes to the corn and soybean balance sheets in more detail.

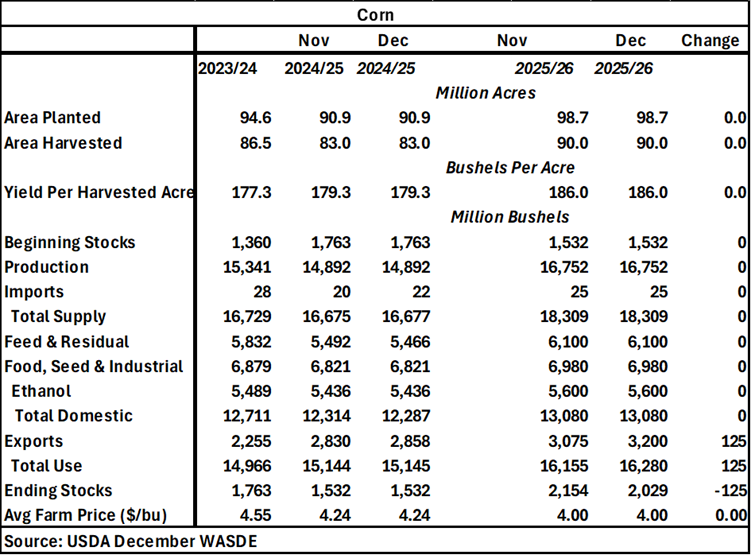

For corn in the (prior) 2024/25 marketing year, imports increased by 2 mb to 22 mb, leading to total supply also increasing to 16,677 mb. Feed and residual fell by 26 mb to 5,466 mb, resulting in total domestic also falling to 12,287 mb. Exports increased by 28 mb to 2,858 mb, which when combined with the 27 mb in total domestic, causes total use to increase by 1 mb to 15,145 mb. Ending stocks and expected average farm price per bushel remained the same at 1,532 mb and $4.24 per bushel respectively.

For the (current) 2025/26 marketing year, exports increased by 125 mb to 3,200 mb, leading total use to also increase by 125 mb to 16,280 mb and ending stocks to decrease by 125 mb to 2,029 mb (Table 2).

Table 2. December 2025 WASDE Corn Balance Sheet[DM1]

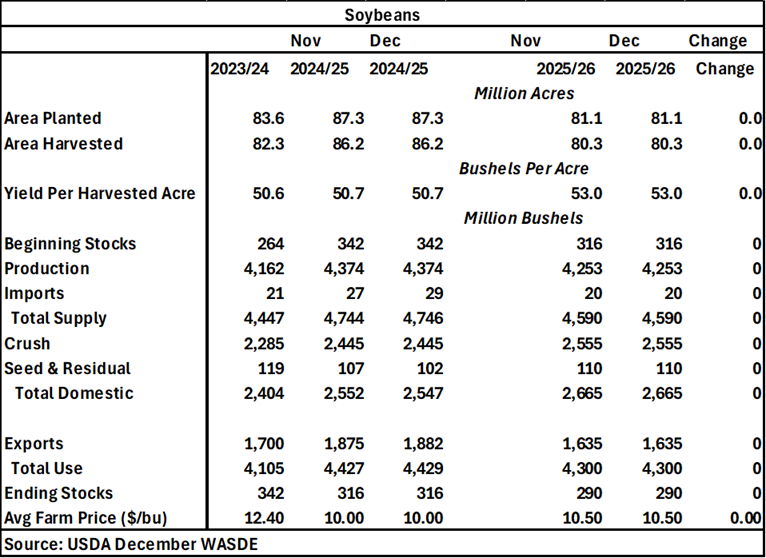

For soybeans in the (prior) 2024/25 marketing year, imports increased by 2 mb to 29 mb leading total supply to also increase by 2 mb to 4,746 mb. Seed and residual decreased by 5 mb to 102 mb, resulting in total domestic also decreasing by 5 mb to 2,547 mb. Exports rose by 7 mb to 1,882 mb. Total use increased by 2 mb to 4,429 mb. Ending stocks and expected average farm price remain unchanged at 316 mb and $10.00 per bushel respectively.

There were no changes to the (current) 2025/26 marketing year soybean balance sheet (Table 3).

Table 3. December 2025 WASDE Soybean Balance Sheet

[DM1]In table 2, Need to change 2025/26 corn ending stocks for December to 2,029 I already changed the text

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!