U.S. Pork Exports Expected to Decline in 2022 and 2023

Author

Published

11/18/2022

U.S. Pork Exports: January to September 2022

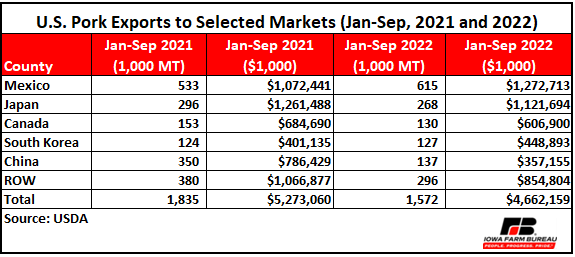

According to United States Department of Agriculture (USDA) latest data, Mexico has been the leading market for U.S. pork muscle cut exports[1] during January to September 2022. The data indicates, U.S. pork exports to Mexico were up 15.5% to 615,133 Metric Ton (MT) (see Table 1). In addition, exports to South Korea expanded 2.5% to 126,629 MT during the first three quarters of 2022. In contrast, exports to other key markets were below the levels achieved during the same period last year. The largest decline in shipments corresponded to China. From January to September 2022, U.S. exports to China (137,074 MT) fell 60.8% from the volume exported during the same time last year (349,924 MT). Note that exports to China in September 2022 were the second largest of the year at 17,365 MT (up 4% from last September). According to USDA, Chinese Government price data for mid-September indicated higher prices for live pigs (up 74%), piglets (up 46%), and pork prices (up 54) than year-earlier prices, which may have resulted from a decline in China’s sow herd earlier this year in response to low producer returns. China is expected to experience some moderate expansion in foreign pork demand during the last months of this year and possible into the early months of next year.

U.S. pork exports to Japan, Canada, and rest of the world (ROW) during the first nine months of 2022 declined 9.7%, 14.8%, and 22.2%, respectively.

Table 1. U.S. Pork Exports to Selected Markets (Jan-Sep, 2021 and 2022)

Compared with the previous nine months, the unit value ($/MT exported) for all U.S. pork muscle cut commodities increased in 2022, except for pork preparations/preserved (not canned), which fell 8.2% (to $4,250/MT). The unit value of fresh/chilled/frozen pork, which from January to September 2022 made up about 89% of U.S. pork exports compared with 92% in 2021, increased 2.1% to $2,797/MT from the same period in 2021 ($2,740/MT). The pork category with the largest increase in unit value was pork hams/shoulders, up 21.4% to $5,089/MT year-over-year. The weighted average unit value across products increased 3.2% to $2,965/MT from $2,873/MT during January to September 2021.

Overall, the volume of U.S pork exports from January to September 2022 dropped 14.3% to 1.572 million MT compared with to the first nine months of last year (1.835 million MT). U.S. pork exports during the first nine months of the year were valued at $4.662 billion, down 11.6% from the estimate in 2021 (January-September, $5.273 billion).

Iowa Pork Exports

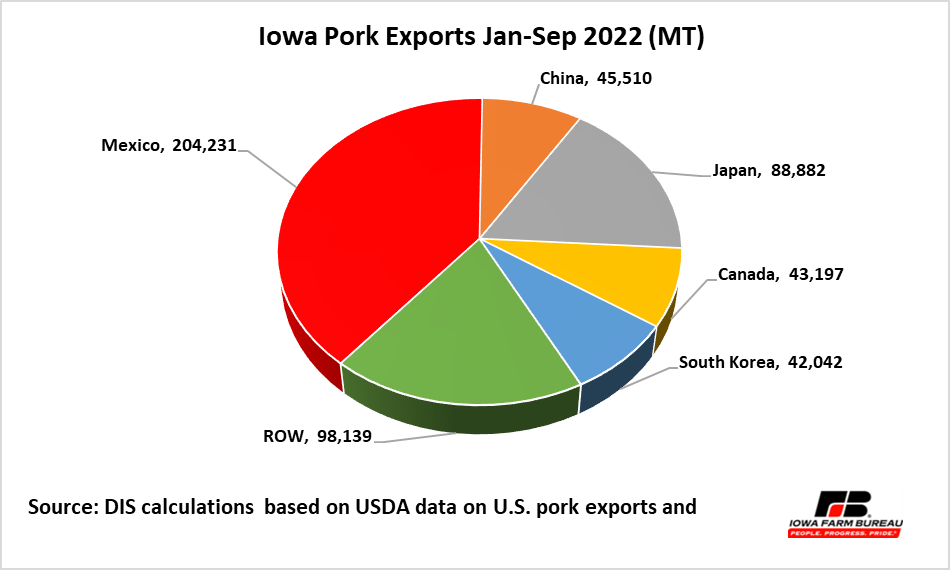

Since there is no published data at the state level, Iowa’s pork exports to main destination during the first nine months of 2022 were estimated by multiplying the average state’s share of national hog production during the last three years (2019-2021) times national export data for the corresponding period and markets.

Total Iowa hog exports were estimated at 522,002 MT during the first three quarters of 2022 and accounted for 33.2% of total U.S. exports during this period (1.572 million MT). Shipments to the top five markets, Mexico, Japan, China, Canada, and South Korea represented about 81.2% of total exports during the first nine months of this year (see Figure 1).

Figure 1. Iowa Pork Exports January-September 2022 (MT)

U.S. Export Outlook

USDA’s November 2022 projection indicates the volume of U.S. pork exports in 2022 will decline 8.8% to 6,409 million pounds, carcass weight equivalent (CWE), from the previous year (7,026 million pounds, CWE). This indicates that 23.6% of U.S. pork production would be exported in 2022.

Moreover, as indicated by USDA, slower global growth and appreciated U.S. dollar, may reduce demand for U.S. pork in leading destinations in 2023. USDA projects U.S. pork exports would fall 2% to 6,280 million pounds, CWE, in 2023 compared with 2022. If realized the U.S. would export 23.0% of the expected pork production in 2023 (27,345 million pounds, CWE).

[1] U.S pork muscle cut exports have a share of about 80% of total U.S. pork exports. The other 20% of U.S. pork exports are in the form of variety meats.

Economic analysis provided by Patricia Batres-Marquez, Senior Research Analyst, Decision Innovation Solutions on behalf of Iowa Farm Bureau.